Happy Monday, traders.

Jeff here.

I’ve said it before and I’ll say it again…

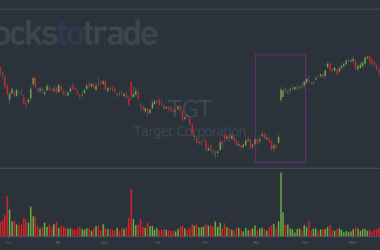

We’re in a very odd trading environment right now.

This is a mania-driven, euphoric market bubble — one that regularly shows dynamic and exaggerated moves.

Trading this market like a pro requires serious patience, discipline, and adaptability.

And while that may sound intimidating, there are still tons of excellent trading opportunities out there.

ALERT: Watch my Weekly Review video to see my complete thoughts on last week’s trades (and this week’s opportunities):

We had some amazing trades last week in the Burn Notice Alliance.

One setup in particular could’ve doubled your initial investment in just three days…

How I Nailed a 100% Trade on AMD

Last week, we had a 100% winner on Advanced Micro Devices Inc. (NASDAQ: AMD).

I alerted the AMD 03/01/2024 $170 calls towards the end of the trading day on February 20 when the contracts were trading around $4. AMD was down nearly 5% on the day.

On February 21, AMD gained a measly 0.98% and the calls didn’t move much. This required sitting on your hands and being patient — a major skill that every options trader needs to harness.

Then, on February 22, AMD blasted off, gaining as much as 12% on the day. I told subscribers to sell when the contracts were trading for $8 — a gain of 100% in three days.*

Although the same contracts eventually traded as high as $14, I’m not beating myself up about missing this ultimate top.

CAUTION: If you’re up over 100% on an options trade in just a few days, it’s always smart to take some profits. You never know what could happen, especially in a market like this one.

I’m sure you’re wondering how I identified this trade opportunity in AMD…

It all comes down to a “secret weapon” I use during earnings season…

Secret Weapon: The ‘Earnings Sympathy Play’

The secret weapon I’m referring to is something I call the ‘Earnings Sympathy Play.”

It involves trading correlated names on earnings rather than directly betting on the stock reporting.

I get much cheaper options and the stocks in the same sector can still move quite a bit.

For example: If I see a big earnings setup in, let’s say, a chipmaker like Nvidia Corporation (NASDAQ: NVDA) … but the contracts are too expensive, I might look to trade one of NVDA’s sector peers as a sympathy play.

This should sound familiar to you as this is exactly what I did last week — I traded Advanced Micro Devices, Inc. (NASDAQ: AMD) to piggyback off the momentum from NVDA.

Of course, the Earnings Sympathy Play isn’t a guarantee, but it works a lot of the time…

The upside or downside pressure from a sector leader can cause massive rallies or dips (respectively) in correlated names.

But the correlated names (e.g. AMD) will have lower implied volatility and premiums than the sector leader (e.g. NVDA) — making the positions cheaper to enter and providing you with more potential upside on your contracts.

(While I was paying $4 per contract on AMD, many other traders were paying upwards of $40 for NVDA contracts…)

Better yet, correlated stocks don’t only apply to earnings season…

My #1 Trading Loophole

When the market is as uncertain as it is now, I have a particular trading loophole I like to use.

Not just me — this loophole has been classified by the SEC as Wall Street’s #1 trading strategy across all markets.

You’ll never see it on a stock chart, a company’s 13F filing, or any public data source … But this invisible loophole is how I made over $1 million in a single trading day during one of the fastest crashes in stock market history.*

And I can almost guarantee you have no idea it even exists.

I’m talking about The Money Link — a loophole that uses correlated stocks to make potentially MASSIVE GAINS.

TOMORROW, February 27th at 8 p.m. Eastern … I’m hosting a LIVE, one-night-only event where I’ll reveal everything you need to know about The Money Link.

Don’t miss this once-in-a-lifetime chance to witness a proven, battle-tested strategy that has stood the test of time…

Click here to RESERVE YOUR SPOT BEFORE IT’S TOO LATE.

Until then…

Happy trading,

Jeff Zananiri

*Past performance does not indicate future results