There’s a famous quotation that says, “Those who forget their history are doomed to repeat it.”

There’s a reason these lessons hold so much truth for traders: recent history is a critical factor in how the market moves forward.

Now that we’ve passed the midpoint of 2024, the stock market is in a fascinating spot.

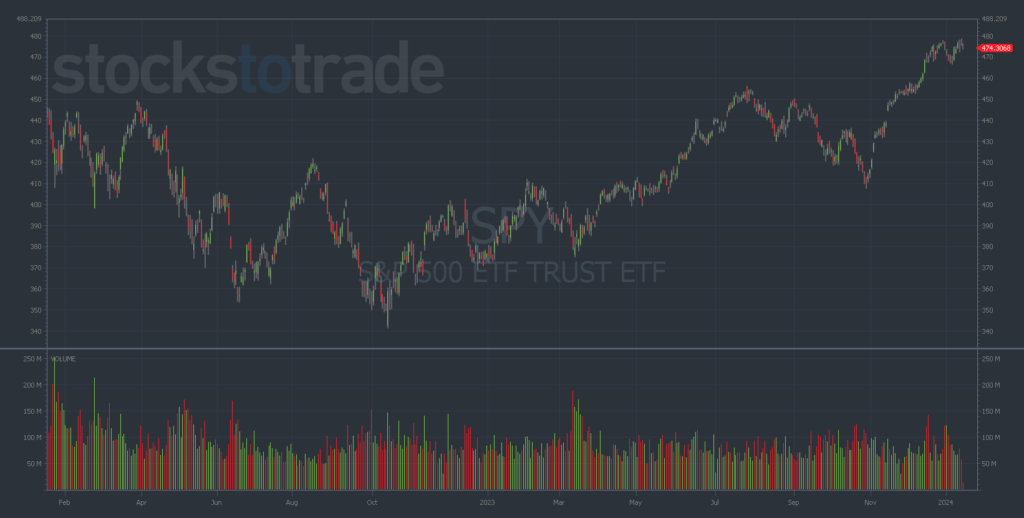

We went from a big downturn a few years ago to a huge, bubblelicious rally that’s sent the stock market to new all-time highs.

This year, major indexes have bounced back stronger than ever, making many traders wonder: “What’s next?”

Today, in our mid-year market review, I’ll try to answer that, plus:

- Look at the key events that have created this bullish momentum…

- Explore the strategies necessary for survival in the second half of the year…

- Unveil a brand-new trading tool that could change the game for the rest of 2024…

As we enter the second half of 2024, it’s time to reflect on the wild ride the stock market has taken us on over the past two years.

By doing so, we can make informed predictions about how to trade the rest of 2024…

From Ultra-Bearish to Ultra-Bullish

In 2022, we witnessed a bearish downturn that shook the foundations of many portfolios.

The year was characterized by continuous interest rate hikes from the Federal Reserve, which sent the major indexes into a relentless nosedive.

However, just when things looked the most grim, 2023 surprised us with a bullish rebound.

The market roared back to life — with the SPDR S&P 500 ETF Trust (NYSEARCA: SPY) gaining more than 25% — and some stocks surging by 100% to 200%.

And so far, 2024 has brought a continuation of the overall uptrend, with the index up another 16.6% YTD…

The stock market may seem unstoppable on the heels of AI euphoria … but don’t get hypnotized into a false sense of security.

This is where some traders make a huge mistake…

Don’t Get Complacent

An ultra-bullish run in stocks often leads to a dangerous mindset among traders — complacency.

There’s a tendency for traders to become cavalier, believing that the market is a magic bullet that will fix everything.

In these times, stock selection seems less important because it feels like everything is on an upward trajectory.

Sound familiar? (This is what’s been happening for the past 2.5 years.)

However, make no mistake — complacency is a mental trap that can lead to overconfidence and a false sense of security.

It’s easy to forget the fundamentals of your trading strategy and get swept up in the market’s overall momentum.

But as we move into the second half of the year, it’s time to get more selective…

The Season of the Stock Picker

Looking ahead to the back half of 2024, I think the landscape is set to change once more.

Before long, we’re likely to move away from a broad-trend-driven market. Instead, the focus will shift to a more discerning approach.

You’ll likely need to zoom in on specific sectors and individual stocks as the market won’t be about riding a giant wave anymore — it will be about skillful and tactful navigation.

In this environment, paying attention to Wall Street strategies becomes more important.

Active management will take center stage, where entering and exiting positions at the right time will be crucial.

Tactical management will also be vital, involving nuanced decision-making and a keen eye for market signals.

In other words, this will be the Season of the Stock Picker.

Furthermore, hedged positions and Money Link trades— where two correlated securities are simultaneously bought and sold — will probably gain prominence.

These strategies will come to the fore as savvy traders look for ways to buffer their portfolios against uncertainties, potentially helping them to manage risk and leverage market opportunities.

Do Your Homework

In such a landscape, depending on the market to compensate for a lack of strategy (or poor stock selection) is like walking a tightrope without a safety net.

Don’t find yourself in this situation.

My message for the rest of 2024 is simple: Do your homework.

Understanding the fundamentals of the companies you’re trading, staying updated with market trends, and having a defined strategy are non-negotiables.

Thorough research, a well-founded strategy, and a clear understanding of the risks involved should back every trade you make.

It’s also important to set realistic expectations and not get swayed by the allure of quick gains.

The 3 P’s will be key virtues in navigating the 2024 market.

In summary, the rest of 2024 will be about decision-making, strategic planning, and an active trading strategy.

The stock market is not a one-size-fits-all realm, and what worked in the past may not necessarily work in the future.

As we forge ahead, the successful trader will be the one who adapts to these changes, remains vigilant, and approaches the market with a blend of wisdom and caution.

The era of easy wins may be over, but for the astute and disciplined, 2024 holds immense potential for incredible trading opportunities.

And few tools can take advantage of this unique backdrop like my brand-new AI trading system, The Gamma Code…

The Gamma Code

Trading in 2024 is a whole new ballgame compared to just a year or two ago.

Many people fail to realize that up to 90% of trades are now executed by algorithms without any human intervention…

It’s no wonder major players like Goldman Sachs, Citigroup, and other big institutions are pouring $10 billion annually into technology for their algorithmic trading systems.

But here’s the exciting part — despite these sophisticated Wall Street algos and High-Frequency Trading systems making it tough for regular traders to keep up…

I’ve discovered a unique error that occurs daily in the red-hot options market due to the rapid pace of quotes and transactions.

To take advantage of this, I built my proprietary AI-powered Gamma system, which can detect these glitches in real-time with a 90% accuracy rate, leading to explosive gains like 216% on CHWY calls in 24 hours* and 200% on QCOM puts in 48 hours!*

And today, I’m giving you a special opportunity…

If you’re one of the first 500 people to claim your spot today, I’m offering an unbelievable 50% discount.

Plus, as part of today’s special offer, you’ll be able to test-drive everything my Gamma Code has to offer for your first 90 days.

Click here now to be one of the first 500 people to claim a GAMMA CODE membership.

Happy trading,

Jeff Zananiri

*Past performance does not indicate future results