Good morning, traders…

Ben here.

The thrill of making quick decisions, the rush of being in and out of positions within minutes, and the satisfaction of locking in gains multiple times a day make day trading an essential part of my trading.

Day trading allows me to drive the investment vehicle I want while avoiding the stress of holding positions overnight.

I can sleep better knowing that I’m not exposed to after-hours surprises that could erode my gains. It’s also about avoiding the dreaded ‘hold-and-hope’ mentality that can trap swing traders in losing positions for far too long.

But there’s more to it than just peace of mind. When done correctly, day trading can lead to big and fast gains, especially when trading weekly options.

However, this approach isn’t without its risks — how you day trade is critical (as even a slight misstep can lead to brutal losses).

Today, we’ll explore the key ingredients that go into a successful day trade. By understanding the recipe, you can increase your chances of making slam-dunk intraday trades…

Why I Love Day Trading

Day trading refers to when you buy and sell a stock or option in a single trading day.

While swing traders and long-term investors can hold stocks for weeks, months, or years … I’m usually in and out of my positions quickly.

Sometimes in minutes. And often multiple times per day.

I prefer day trading for a variety of reasons…

- I sleep better knowing I’m not holding positions overnight…

- I avoid getting trapped in ‘hold-and-hope’ swing trades…

- If I’m correct on the timing and direction of my trade, I can bag much more significant gains on weekly options than I can on monthly options (or common shares)…

However, everything in the stock market is a double-edged sword. And with great potential reward comes major risk as well…

WARNING: If your timing is off — even slightly — your weekly options contracts can drop 30%-50% in minutes!

So, how can you avoid your contracts taking a haircut like this?

First, there are two key areas to focus on…

How to Pick the Right Strike Price

When it comes to strike prices, you should avoid trading contracts that are too far out of the money (OTM).

If you buy a contract that’s far out of the money — and the underlying stock hits that number by your expiration date — you’ll make a bigger % gain than if you had bought at the money (ATM) contracts.

On the other hand, if you’re holding OTM contracts and you’re wrong about the direction — even for a few hours — your position could lose more than half of its value.

NOTE: I usually trade strikes that are very close to the money, but slightly out of it, which gives me a solid risk/reward on the trade.

Beyond strike prices, there’s another factor to consider…

How to Pick the Right Expiration Date

This is the real key to day trading options successfully — you’ve gotta pick the right expiration date.

If you have a strong conviction that the move will happen soon, you should press your edge and buy weekly options.

But for any trade where you have less than A+ confidence in an immediate move, you should buy longer-dated contracts.

I tend to avoid swing positions for the most part, although I do trade them occasionally (more on that later)…

My trading style usually involves buying short-dated contracts that are close to the money.

But these parameters depend on you. You’ve gotta figure out the risk/reward relationship that perfectly fits your personality and account size.

Bottom Line: By simply focusing on your choice of strike prices and expiration dates, you could potentially improve your entire day trading strategy…

3 More Ingredients for a Winning Options Trade

Beyond picking strikes and expirations, I want you to have solid trade ideas. Without actionable setups, success is impossible…

But how do you find a great trade idea?

The best options traders approach setups like a five-star chef prepares a main course. They have a great recipe, but they also measure the ingredients to utter perfection.

If you don’t consider the ingredients, your dish won’t taste very good (and it’ll cost a lot more than it should).

The same goes for cooking up an options trade. And typically, the best ideas have three key ingredients:

Ingredient #1: Momentum

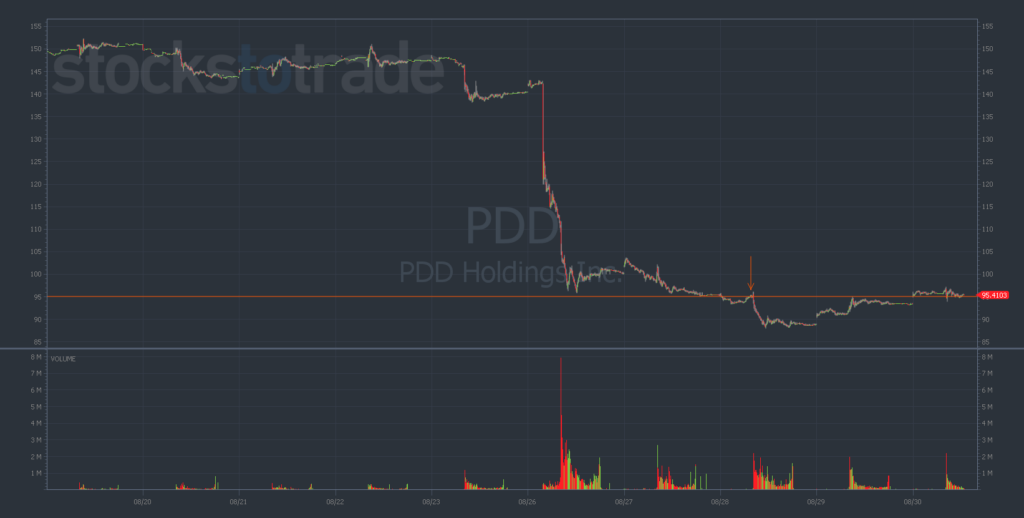

Last week, Jeff Zananiri floated the idea of buying puts on PDD Holdings Inc. (NASDAQ: PDD)

below $95:

Why would this trade work at that level?

This is a classic example of post-earnings momentum to the downside. PDD saw a nasty earnings drop, a brief attempt to recover, then another drop.

It’s a continual drift downward, where selling feeds more selling — negative momentum.

Jeff noticed PDD’s behavior after earnings — three instances of resistance around $93.75, forming a textbook 3x a Lady Pattern.

Look for names with strong breakouts or breakdowns, especially when they form this pattern in conjunction with…

Ingredient #2: Catalysts

CHWY was another trade we discussed last week — a catalyst trade.

The catalyst? A massive earnings beat, over 1000% above expectations.

Even better, there was a significant 11% post-earnings push to the upside, from $27 to $30+.

Earnings reports are some of the most consistently reliable catalysts, which is why I designed Operation: Master Calendar.

I want to take the guessing games out of picking earnings winners, as these are some of the juiciest catalysts in the market.

But other catalysts can move stocks as well, such as:

- Product Launches

- Mergers and Acquisitions

- Regulatory Approvals or Changes

- Economic Data Releases

- Analyst Upgrades/Downgrades

- Industry or Sector News

- Management Changes

- Dividends and Share Buybacks

- Geopolitical Events

- Short Squeezes

- And…

Ingredient #3: “Smart Money” Bets

I’ve always wanted a way to benefit from ‘smart money’ information without doing anything illegal.

And that’s exactly why I created my Spyder Scanner.

By looking at the biggest bets from Wall Street’s richest and most connected traders, I’m able to do exactly that.

I don’t need to make illegal trades to piggyback the ‘smart money’ … and neither do you.

All you have to do is be a Spyder member, pay close attention to the Spyder Scanner, and stay disciplined with your entries and exits.

And speaking of “smart money,” let’s look at…

💰The Biggest Smart-Money Bets of the Day💰

- $2.9 million bullish bet on WMT 09/20/2024 $75 calls @ $1.90 avg. (seen on 8/30)

- $2.5 million bullish bet on XBI 01/17/2025 $105 calls @ $5.00 avg. (seen on 8/30)

- $2.2 million bullish bet on FLR 01/17/2025 $50 calls @ $4.40 avg. (seen on 8/30)

Happy trading,

Ben Sturgill

P.S. Take a look at the first 4 trade results from my brand-new specialized system for trading earnings season — Operation: Master Calendar:

EQR 8/16/24 $70 calls @ ~ 2.30

20% move from ~$2.30 to $2.75*

FFIV 8/16/24 $185 calls @ ~3.60

456% move from ~$3.60 to $20*

HOLX 8/16/24 $85 calls @ ~0.75

69% move from ~$0.75 to $1.27*

WELL 8/16/24 $115 calls @ ~1.00

116% move from ~$1.00 to $2.16*

If you want access to this system — which can predict earnings moves like these before they happen — Click here now to join Operation: Master Calendar!

*Past performance does not indicate future results