Happy New Year, traders…

Jeff here.

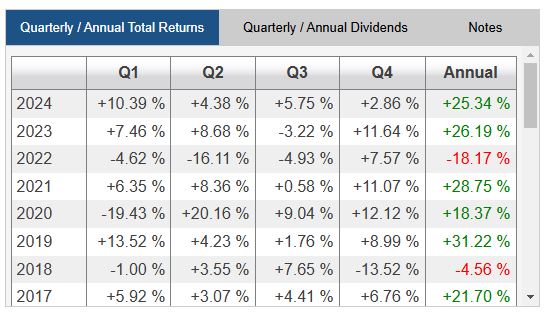

As we kick off 2025, I think it’s important to take a step back and look at how insane the market returns have been over the last two years…

The S&P 500 has soared more than 50% — that’s not just impressive, it’s over double the average historical return for that time frame:

But when markets deliver that kind of out-of-this-world performance, the question is: how long can this last?

Heading into 2025, I’m optimistic about some of the pro-business tailwinds we might see under the second Trump administration. His push to cut regulatory red tape could pave the way for stronger corporate profits, which lead to higher stock prices.

That said, I’m not sitting here expecting another 25% rally in the S&P 500. Is it possible? Sure. I’ve seen crazy things in my 25 years of trading — and anything can happen in the stock market.

Still, I’ve been consistent about my position that the market is in an AI-fueled bubble, and there’s still a lot of air in asset prices. Moreover, the past two weeks have shown us some pretty bearish price action, which could be foreshadowing more downside soon.

After a two-year run like this, it’s critical to evaluate a) the risks that could send the market lower and b) the catalysts that could keep it moving higher.

With that in mind, let’s break down the biggest threats (and positive catalysts) for the stock market in 2025…

The Risks

1. The Fed Stops Cutting

The market’s been enjoying some relief from falling interest rates for several months now.

But if inflation flares up again, the Fed could pause or even reverse those cuts, slamming the brakes on growth.

Markets don’t like that kind of uncertainty, and we could see a sharp reaction.

2. A Geopolitical Black Swan

Tensions are high globally with several geopolitical conflicts looming as potential black swans.

Whether it’s Israel and Palestine, Ukraine and Russia, or China and Taiwan, any major escalation could ripple through the markets, shaking investor confidence and creating sudden volatility.

This is why I’m bullish on volatility in the mid-term. Think about some VIX calls to hedge any long call positions.

3. Earnings Growth Slows

Earnings and revenue growth are the lifeblood of the stock market. Stocks cannot move higher without them.

If companies start reporting slower growth — or worse, declines — it could be a signal that the economy is cooling off faster than expected.

In 2024, earnings growth was incredibly strong. Now, we’ll have to see if 2025 can keep pace with the lofty built-in expectations.

4. Consumer Credit Card Defaults

On Monday, the Financial Times reported that credit card defaults have hit their highest level in 14 years as consumers “tap out” their credit limits.

Credit card lenders wrote off $46 billion in seriously delinquent loan balances in the first nine months of 2024, according to BankRegData.

This is a big risk, quietly lurking beneath the surface, that I don’t hear discussed much. If the U.S. consumer loses spending power, expect stocks to go lower.

The Catalysts

1. Trump’s Pro-Business Push

If the Trump administration’s policies kick in, we could see a surge in corporate profits thanks to deregulation and business-friendly initiatives. Lower costs and fewer obstacles for companies mean higher margins, and that’s music to Wall Street’s ears.

2. Interest Rates Are Still Coming Down (for Now)

The Fed is still in a cycle of monetary easing, which is positive for stocks. That said, Powell’s recent commentary about slowing the pace of rate cuts sent the market into a mild tailspin.

That’s why the interest rate/Fed situation is so crucial to track in 2025…

If inflation doesn’t rear its ugly head again, the Fed can continue cutting with more confidence, and that could be incredibly bullish for an already-surging stock market.

3. U.S. Energy Independence Gaining Steam

With domestic oil production set to skyrocket under Trump, the U.S. is becoming less reliant on foreign energy sources.

That could mean reduced geopolitical risk premiums and higher profit margins for companies reliant on stable energy prices.

4. Earnings Growth Remains Steady

This time last year, everyone and their grandma was predicting a recession. They were wrong.

Not only was there no recession, earnings growth was far beyond expectations, and it was a banner year for the stock market.

If tech earnings continue to defy expectations and grow at triple-digit year-over-year rates, stocks will likely trade higher next year.

If the Fed stops cutting, that could put a bump in the road. But unless we see a visibly negative effect on earnings growth, it remains the biggest catalyst to move the market higher.

How to Make 2025 Your Best Year Yet

2025 isn’t shaping up to be a “set-it-and-forget-it” year. This is a time to stay engaged and be aware of the risks out there. Watch the Fed closely, track global events, and stay laser-focused on earnings.

At the same time, don’t count out the potential upside. Pay attention to companies that stand to benefit from pro-business policies, lower rates, or a resurgence in domestic energy production and manufacturing.

Opportunities in options trading are everywhere, arguably even more so in a volatile market. You just need to know how to position yourself.

That’s where Burn Notice and GAMMA come in — to help you spot the trades that matter.

Let’s crush 2025 together and make it our most profitable year yet.

Happy New Year,

Jeff Zananiri

P.S. If you’re ready to capitalize on the gains my AI-powered GAMMA Code system has been delivering me every week — 145%, 235%, 630%, and even 900% — all in 24 hours or less* — then now is the time…

TOMORROW, January 2 at 10:00 a.m. EST, my buddy Danny Phee is hosting a SPECIAL LIVE WORKSHOP to show you how to start weaponizing GAMMA for huge overnight gains.

Seats are filling up quickly — Don’t miss your chance to join.

*Past performance does not indicate future results