Happy Friday, traders.

Jeff here.

Over my many years of teaching students how to trade options, I’ve noticed a particular tendency that plagues a lot of newbies.

When traders first come to the options market, they often want to make short-term, high-risk/high-reward trades.

And they often stick to trading one side of the options chain, usually calls.

They see all these goofballs on Reddit bragging about some ridiculous call option YOLO that made 500% overnight and want the same for their account.

If this sounds like you, it’s time to pay attention…

This mindset is a recipe for disaster. Short-term call options may be working in this mania-driven market bubble, but no setup lasts forever.

If you aren’t positioned for both bullish and bearish scenarios, you’re setting yourself up for failure…

Wall Street’s #1 Loophole … REVEALED

But there’s a simple way to fix this…

By employing a long/short strategy — the #1 method used by Wall Street’s most profitable hedge funds — you can potentially make enormous returns with considerably less up-front risk.

This is exactly how I use the “Money Link” loophole…

The return potential of “Money Links” can easily exceed moves of 100% or more in a matter of months … sometimes weeks … and in rare cases, days.

Better yet, these trades can do all of this without the hair-raising risk involved with weekly contracts.

Now, there’s nothing wrong with short-term trades. While I never day trade, my entire Burn Notice strategy revolves around overnight plays with massive profit potential.

That said, if you’re only trading weekly contracts, you’re probably taking too much risk — and endangering your account.

I use the “Money Link” loophole to solve this problem. It allows me to set my account up for huge gains without short timeframes and elevated risk profiles.

Unfortunately, Wall Street’s wealthy elite have made sure that this elusive phenomenon remains hidden in the shadows of Wall Street…

Until now…

How the “Money Link” Can Solve the Problem

One of the BIGGEST things I’ve learned throughout 25 years of professional trading is this:

Traders who always think the market will go up (perma-bulls) or always down (perma-bears) often end up losing.

Newbie traders often have blinders on, only looking to trade calls or puts, failing to see the opportunities on the other side of the options chain.

But these inherent biases will do you a major disservice as a trader. You’ll only consider half of the possible setups in the market.

To win long-term in the options market, you need to be adaptable, nimble, and flexible.

If you get too attached to one stock, setup, market view, or strategy — you’ll get caught flat-footed when the inevitable day comes that brings your house of cards tumbling down.

This is another reason why I love trading the “Money Link” loophole, it ensures that I never fall into this trap.

The Money Link is all about buying contracts with a little more time on them, yes … but it’s also about simultaneously buying both puts and calls on correlated stocks.

The Money Links That Led to 135% and 144% Moves

The Money Link is a market-neutral trading strategy involving matching a long position with a short one in two stocks with a high correlation.

If you’ve ever heard of a “long/short hedge fund,” this is exactly what those funds are doing.

The key idea is to capitalize on the divergence in the price movements of these two stocks that historically move in relationship to one another.

They could generally trade inversely to each other, or maybe they follow each other.

The stocks should have a high correlation, meaning they exist in similar sectors/industries and/or move in tandem under similar market conditions.

And when you find the right “Money Link,” the results can be extraordinary…

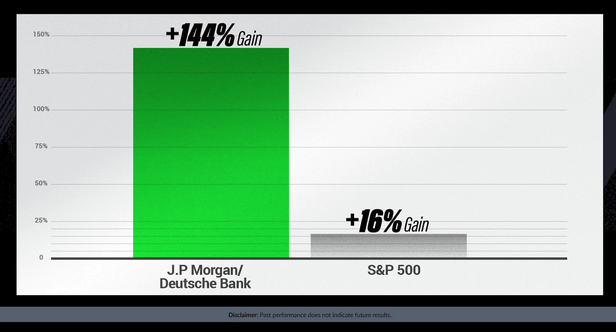

For example, when the S&P 500 was up 16% in 2022…

The value of the “Money Link” between J.P. Morgan and Deutsche Bank reached a peak 144% move.

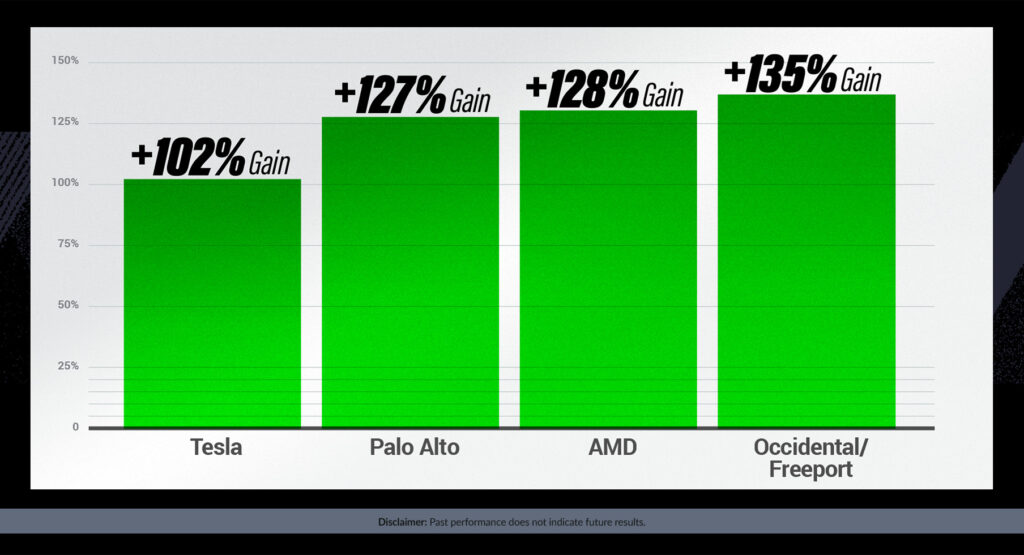

And even more recently, the “Money Link” between Occidental Petroleum and Freeport-McMoRan resulted in a massive 135% run.

However, these setups are completely invisible to the naked eye — meaning you won’t find any trace of them by pulling up charts, digging through analyst ratings, or even combing through dozens of financial statements.

And I’ve really only grazed the tip of the iceberg today.

If you want in on this loophole — access to everything you need to know about the Money Link — you can’t miss my Livestream next week.

During this EXCLUSIVE, one-time event, I’ll reveal:

- How you can identify Money Links forming in real time…

- How Money Links helped me earn a staggering $1 million in profit* during one of the most devastating crashes in Wall Street history…

- Real-world examples and case studies of money links that exploded to peak gains of 50%…68%…113%… and as high as 748%…

- The proprietary metric I use to verify the strength of a Money Link…

- And much more…

WARNING: Seats to this event are incredibly limited.

Don’t miss this once-in-a-lifetime chance to witness a proven, battle-tested strategy that has stood the test of time…

Click here to RESERVE YOUR SPOT BEFORE IT’S TOO LATE.

See you then,

Jeff Zananiri

*Past performance does not indicate future results