Happy Thursday, traders…

Jeff here.

I remember it like it was yesterday…

When I first started on Wall Street, I had a major problem: taking two steps forward and one step back.

After nailing a big win, I would feel overconfident, and then give the gains back to the market over the following few trades.

If you have this problem, listen up…

There are a variety of lessons, tips, and skills I’ve learned over the years that allowed me to put those problems behind me and become the trader I am today.

But a handful, in particular, stand out as complete game-changers — small nuggets of wisdom that I’ve carried with me throughout my career.

Now, you need to not only hear these things — you must drill them into your psyche.

In that spirit, today I’d like to share ten crucial tips that have helped me beat the market for over 25 years of professional trading.*

🕵️♂️ Identify Your Weaknesses

One of the major problems I see in students is that most traders aren’t identifying what they’re doing wrong.

This is especially true for newbie traders who tend to have a difficult time identifying weaknesses.

They like to focus on their strengths — but doing so will ensure that they never improve.

The sooner you can break out of this trap, the better.

One way to potentially do this is to…

✅ Check Yourself Before You Wreck Yourself

Go through your past trades meticulously.

Backtest different strategies, strikes, and expiration dates.

See if there are certain types of contracts (calls, puts, varying expiration dates) you consistently profit more from Or vice versa.

You should be constantly self-evaluating your performance and looking for ways to improve.

Here’s an easy way to track your trades…

📖 Keep a Trading Journal

Keeping a trading journal is the best way to track your trades.

After you’ve entered your trades consistently for a few months, you’ll be able to see trends in your successes … and your failures.

Over time you’ll get a better understanding of how different factors affect the ultimate outcomes of your trade decisions…

📈 📉 Play Both Sides of the Chart

The best traders can take opportunities both ways—long or short, puts or calls.

By being a perma-bull or perma-bear, you limit your ability to trade the wide variety of setups available in the options market.

A broken clock may be right twice a day, but it’s wrong for the other 23 hours and 58 minutes.

You should be flexible and willing to trade either side of volatile charts. By doing so, a whole world of new patterns will open up to you (that you might not have seen prior).

🛠️ Expand Your ‘Trading Tool Belt’

Like a handyman with a different gadget for each household problem, as a trader, you should have a potential strategy available for every possible setup.

In other words, the more tools you can master in your trader’s tool belt, the more opportunities you can potentially capitalize on.

The options market provides you with endless opportunities to tailor-make unique trades to your liking. Use this to your advantage.

Take me, for example…

I trade large-cap equities, ETFs, puts, calls, long, short — whatever the moment calls for!

🙅♂️ Examine the Risk/Reward

The vast majority of setups in the market are simply not tradeable.

Ask yourself: What’s the risk/reward of this play? Is there enough upside or downside in the chart to make it worth the risk?

If you get overzealous, trading mediocre every setup that comes across your screen, you’re gonna get smoked.

Success in trading is as much about knowing what not to do as it is about knowing what to do.

⚾ Singles Add Up

Always know the risk/reward of your trade before you enter.

Realize that the bigger the potential reward on a contract, the bigger the risk.

If you go for YOLO, 0DTE options trades, you’re trying to hit a grand slam. But you don’t even need to hit home runs to have extraordinary results.

Hitting singles will force you to build a consistent strategy that works over and over again.

And that’s priceless…

💸 Avoid Opportunity Cost

Have you ever tied up your capital in a subpar trade only to see a much better setup moments later?

Don’t overlook opportunity cost — the loss of a potential gain by being tied up in subpar trades.

This is especially true for small-account traders who can only afford to be in a few plays at a time…

Make them count!

👴 Trade Like You’re Retired

On the same token, if you think you need to make a trade every single day … you’re wrong.

Worse yet, you’re probably overtrading, which will eat up your capital before you know it.

The best traders I know possess a zen-like patience, waiting quietly for the perfect moment to slap on big size.

As my buddy Tim Sykes says, trade like you’re retired!

⏰ Time of Day Matters

Don’t overlook what time of day you’re executing your entries and exits.

The market behaves differently depending on the hour.

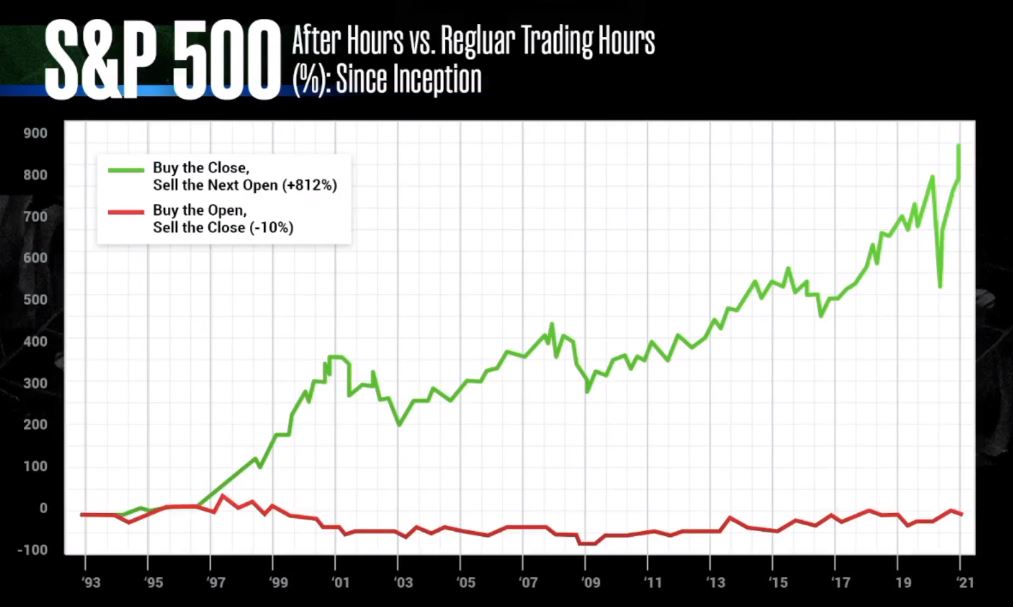

That’s why I’ve based my entire Burn Notice strategy on the following chart:

By entering trades at the end of the trading day (and selling the following morning), I discovered a way to beat the market consistently.*

These are the ten pieces of advice I wish I had known on day one.

Take these tips to heart and you’ll be a better trader for it.

Happy trading,

Jeff Zananiri

P.S. If I had to start back on day one, trading a few thousand bucks for my family’s livelihood…

I would exclusively trade my Burn Notice strategy.

I’m that confident in it.

So … If you aren’t signed up for my trade alerts, what are you waiting for?!

Burn Notice Members already have my latest play.

But I think the biggest trade idea yet is right around the corner…

SEE MY NEXT TRADE IDEA RIGHT HERE

*Past performance does not indicate future results