Happy Monday, traders…

Jeff here.

Considering the market is closed on Friday, this is setting up to be a rather muted week in the stock market…

You could already see the low-volume, exhausted signals in Monday’s trading — when the major indexes were bouncing around between 1/10 of a %.

The market doesn’t have any new catalysts, but it’s gone up extensively since Federal Reserve Chairman Jerome Powell turned dovish.

Trader sentiment wants to keep pushing prices higher, but stocks are seriously exhausted on the upside.

That said, nobody is inclined to sell either — short sellers have no power. Bears have had their faces ripped over over the past year and a half.

So, I think we need to wait for this four-day trading week to pass and then we’ll see some more tradeable price action.

There are plenty of catalysts on the horizon. We’re going to get some more earnings coming up in a couple of weeks, then critical March employment numbers.

The first week of April is gonna be massive. But right now, we’re in the calm before the storm.

A lot of big hedge fund portfolio managers go on vacation this week (like I’ll be doing tomorrow, headed to Orlando with my family).

When that happens, trading slows, and volume plummets. Sometimes, the market’s open, but it really isn’t (if you catch my drift).

Here’s how to play it…

Faster Time Decay

First off, you need to understand how time decay will be affected this week.

In the options market, time is not just a ticking clock — it’s money.

And during a four-day trading week, this time decay is sped up by 24 hours. This is especially important for options expiring this week.

Know that if you’re holding weekly options over the next four days, you’re racing against the clock even faster than usual.

Be incredibly careful about trading weekly options right now.

Lower Volume, Less Liquidity

Trading volume is often lower during a shortened week.

This lower volume can lead to less liquidity, meaning the bid-ask spreads between options contracts could be slightly wider than normal.

Lower liquidity can also lead to higher price volatility — which can either be a risk or an opportunity (depending on how you manage it)…

For me, lower volume and liquidity mean I’ll be more conservative with the trades I enter.

I’m not saying I won’t trade a perfect setup if it appears out of nowhere, but I’m primarily planning to sit on the sidelines.

Planning for the “Weekend Effect”

The “weekend effect” is a term used to describe the tendency for stock markets to experience a downturn on Mondays following a rise in prices on the previous trading day (usually Friday).

(My entire Burn Notice strategy is based around this unique market dynamic…)

However, in a four-day trading week, this dynamic can shift.

You need to consider how the short week (and long weekend) might influence market sentiment.

In practice, the short week places a larger importance on Thursday (which acts like Friday) followed by potentially exaggerated market moves on Tuesday (which acts like Monday).

Given these unique conditions, you might need to adjust your strategies.

As I mentioned earlier, if you usually trade weekly options — you may want to enter and exit them even more quickly than normal.

Or, you might focus on options with longer expiration dates to reduce the impact of time decay during this shortened week.

In a short trading week, risk management is paramount.

With less time to recover from any adverse market movements, you should be discerning with the setups you trade … and meticulous about setting stop-loss orders and/or “risk levels.”

The Psychological Aspect of a 4-Day Trading Week

Lastly, you can’t ignore the psychological aspect of this week.

The anticipation of a long weekend might make some traders more conservative, wanting to avoid holding risky positions over the extended break.

This is what I usually observe — short weeks lead to boring price action.

So, don’t think you have to trade every day. Sit on the sidelines and wait for the volatility to pick up again.

By understanding and adapting to these conditions — keeping an eye on time decay, being careful with weeklies, and managing risks effectively — you can come out of this week in better shape than the vast majority of aspiring traders.

Bottom Line: It’s likely to be a slow week, so don’t force it.

Happy trading,

Jeff Zananiri

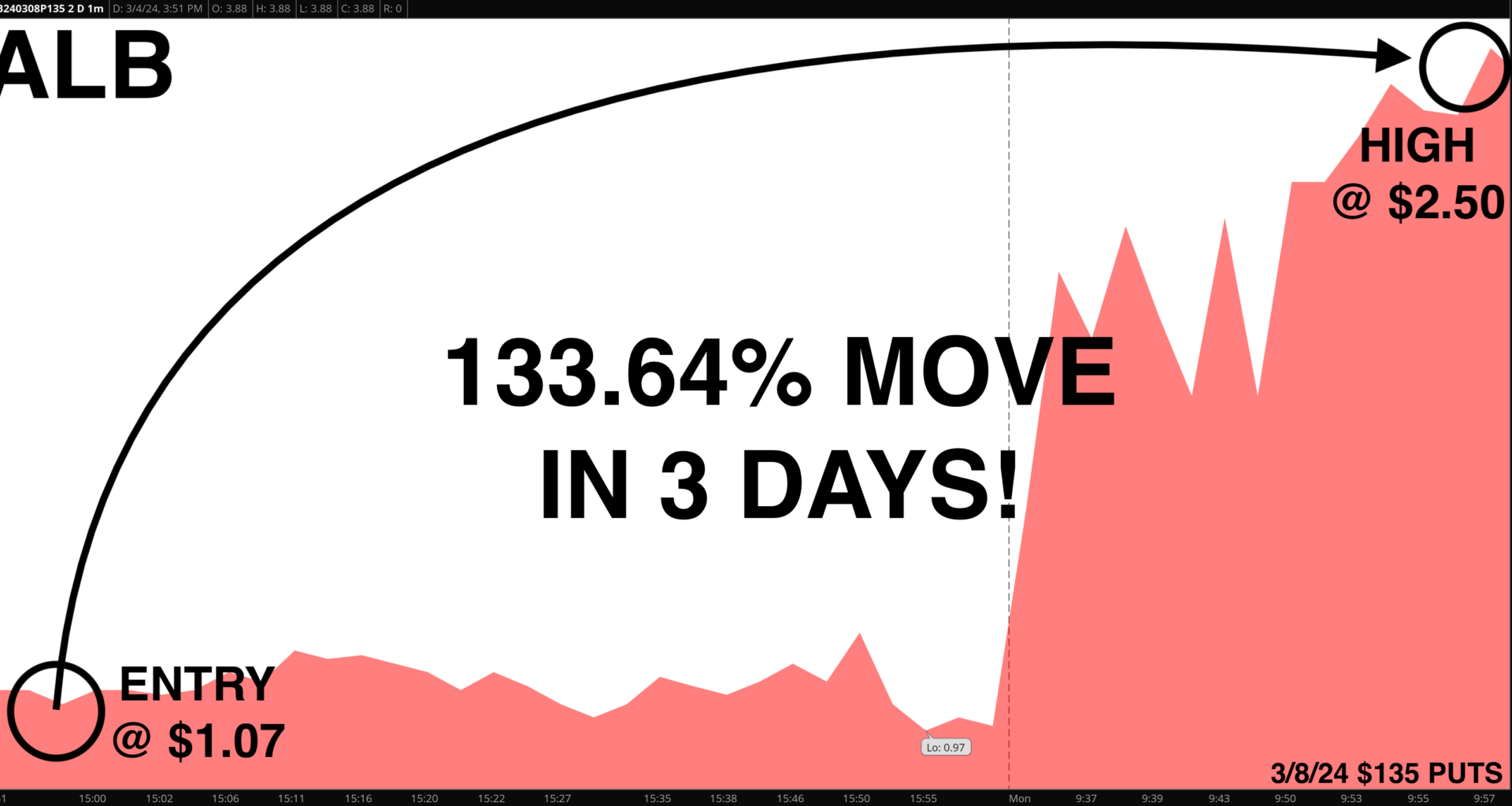

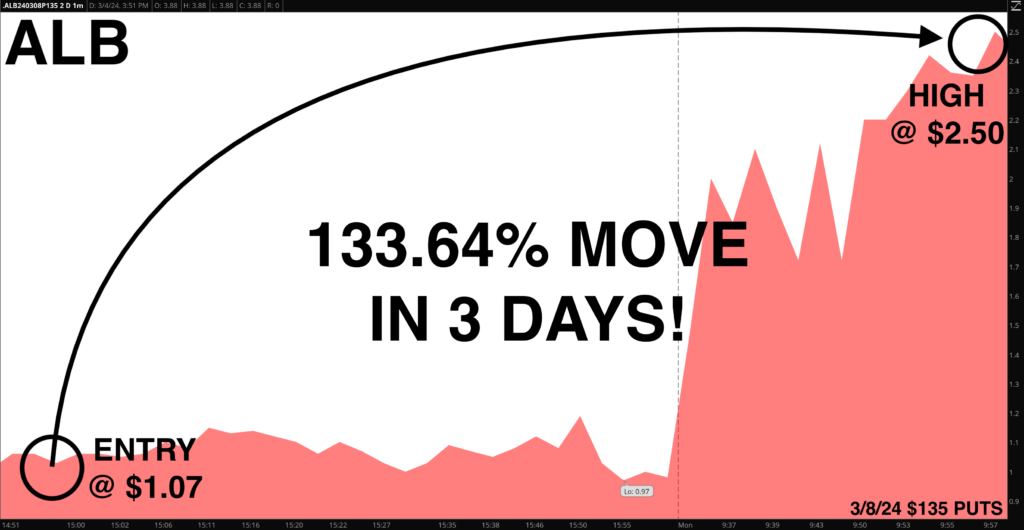

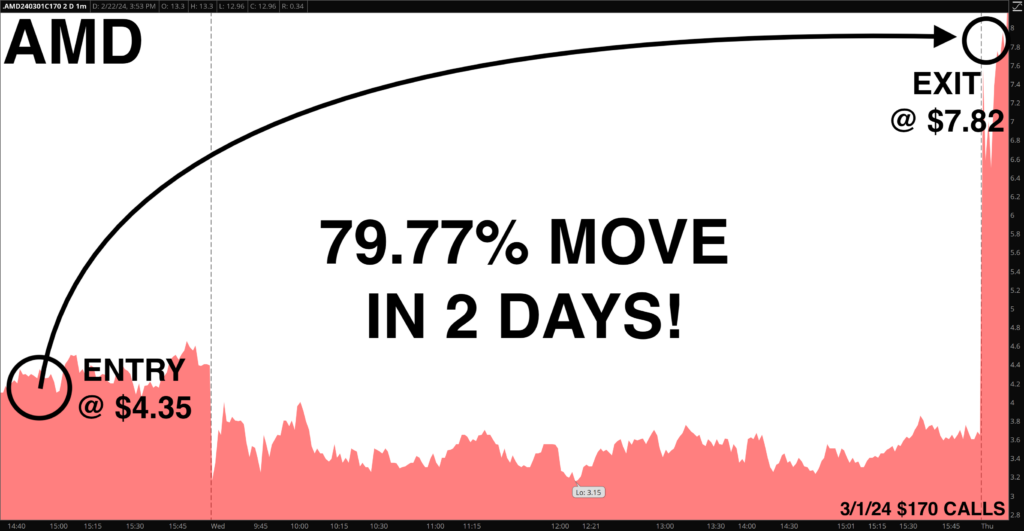

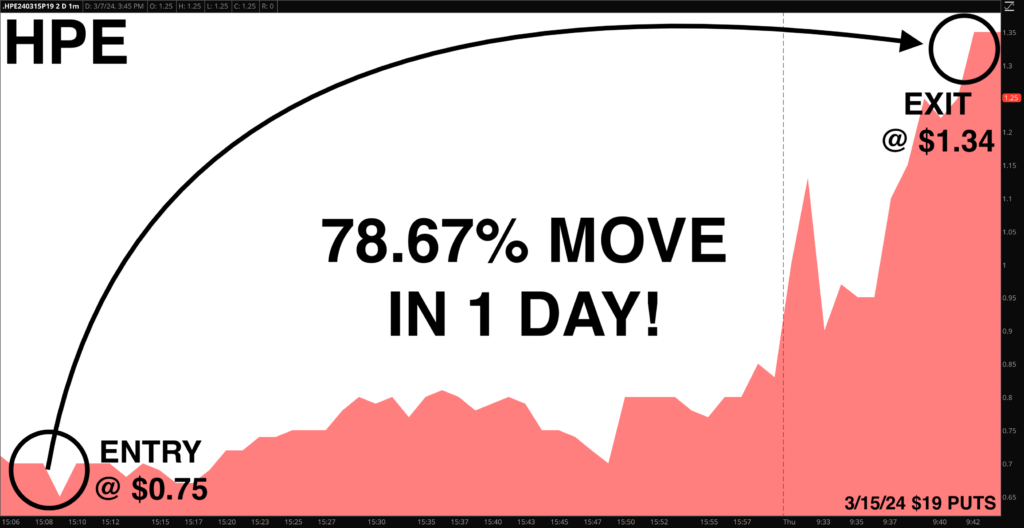

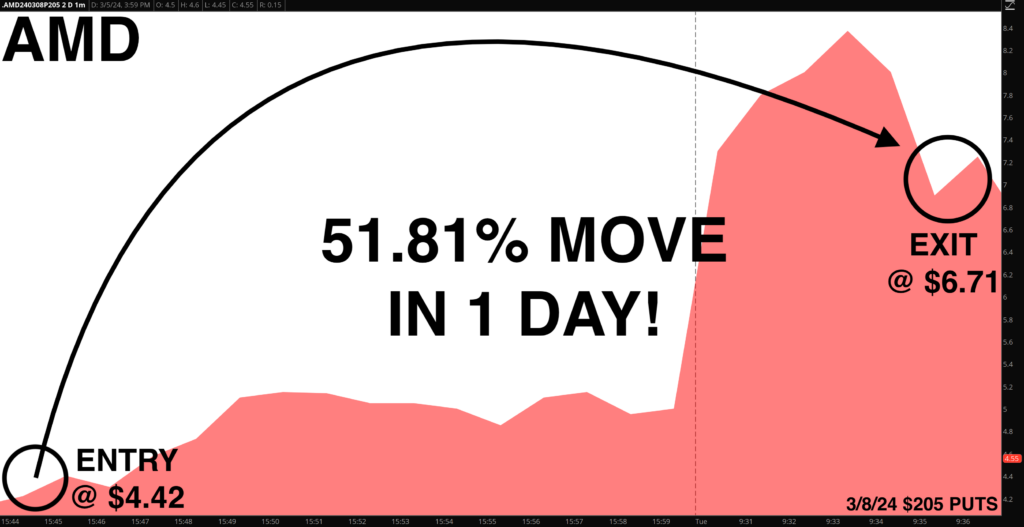

P.S. Take a look at these five monster winners I alerted recently*:

Every week, I share trade ideas (just like these) inside my flagship research trading service — the Burn Notice Alliance.

Here’s what you’ll get by signing up:

- 🔔 4 new trade alerts every week (like the five home runs I just mentioned)

- 👨🏫 Stock tickers and complete instructions for your options trade

- ⭐ My proprietary ranking system for position sizing

- 📖 Full trade analysis and follow-up game plan

But you can’t see ANY OF THIS if you don’t join NOW…

CLICK HERE TO JOIN THE BURN NOTICE ALLIANCE

Happy trading,

Jeff Zananiri

*Past performance does not indicate future results