Good morning, traders…

Ben here.

I think every great trader needs to harness three attributes: knowledge, execution, and lack of greed…

And a crucial part of the “knowledge component” is knowing your history.

Yesterday, I went through the first half of options trading history. If you missed it, you can read Part I right here.

Now that you’re caught up, let’s jump back in our time machine and break down Part II of the complete history of options trading…

A Timeline of Major Events in Options Trading

May 1973

When we left off yesterday, the Chicago Board Options Exchange (CBOE) had just opened.

Around the same time, mathematicians Fischer Black and Myron Scholes introduced the Black-Scholes Formula, which changed how stock options were priced forever…

Their formula considered the stock’s price, its volatility, the option’s exercise price, the option’s maturity, and the interest rate.

You may be dealing with the Black-Scholes Formula without even knowing it…

This formula still helps determine options prices today.

1982-1985

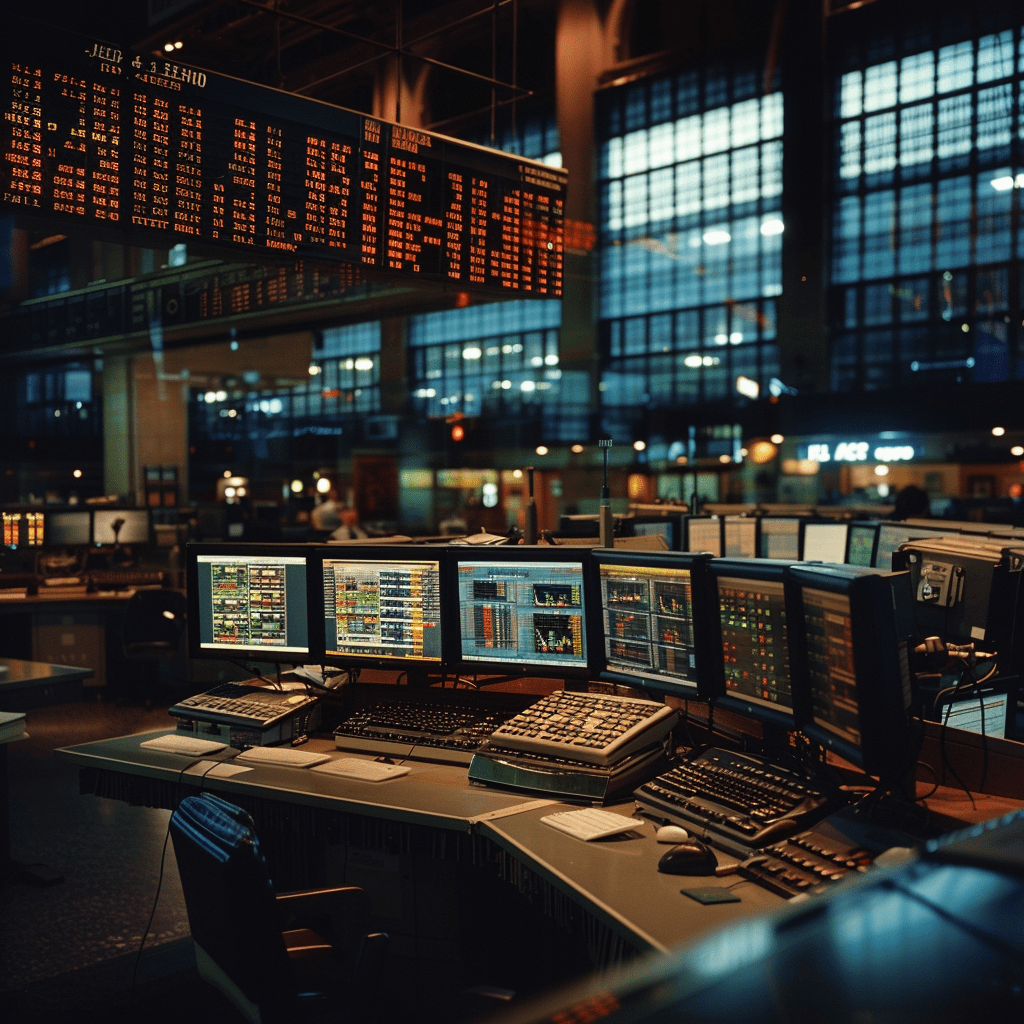

In 1982, the first online trading platform, NAICO-NET, was launched. But it was clunky and expensive…

In 1985, Trade*Plus emerged as the first user-friendly platform. This later became E-Trade, still a major player in the online trading world.

These platforms made trading more accessible to retail traders, increasing the number and speed of transactions.

Today, nearly every trade in the market is executed via online trading platforms.

1990s

The rise of the internet and better technology changed options trading even more…

Electronic trading platforms became more advanced, offering real-time data and analysis tools that helped traders execute complex strategies more effectively.

This made the market more efficient and led to new trading strategies.

The early internet also saw the beginning of online trading chat rooms, paving the way for the entire future of trading education.

Daily Strike Alliance wouldn’t be around if it wasn’t for what occurred online in the 1990s.

2008

The financial crisis of 2008 had a massive negative impact on the entire global economy, and options trading was affected as well…

The uncertainty during this time led to a surge in options trading as investors tried to protect themselves from risks.

In response, regulators introduced new rules to make markets more transparent and reduce risks.

This crisis highlighted the importance of risk management and the critical role of options in protecting against market downturns.

2020

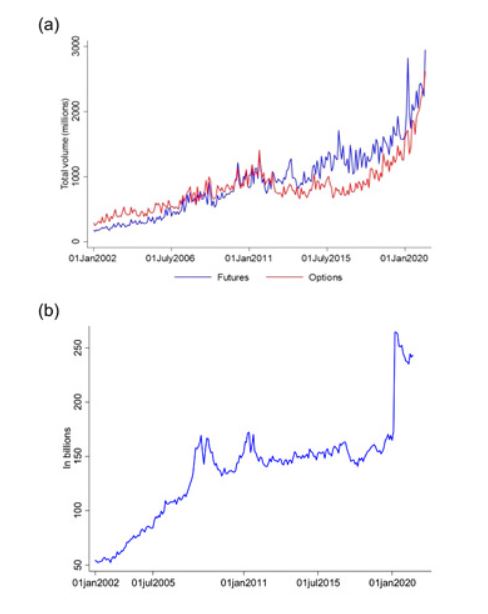

The COVID-19 pandemic shut the world inside, leading to a frenzy of people opening brokerage accounts.

Global options volume skyrocketed in 2020 as people got bored being quarantined at home and started trading options:

January 2021

As mentioned earlier, Reddit’s r/WallStreetBets forum caused a trading frenzy around GME.

Traders used call options to create a gamma squeeze, making the stock’s short squeeze even more intense via the use of call options.

For arguably the first time in history, retail traders beat Wall Street…

This event showed the power of options trading and changed how people view the market.

It also showed the influence of retail traders using social media, proving you don’t need to work on Wall Street to crush hedge funds.

Present Day

Options trading is more popular today than it ever has been before.

High-frequency trading, algorithmic trading, and artificial intelligence are shaping the future of options markets.

But most importantly, retail traders have access to data they’ve never had before…

More educational resources and tools have made options trading more accessible to everyone, opening the door for higher options trading volume than any other period in history.

I’ve said it before and I’ll say it again…

This is the best time in history to be an options trader.

Now, before we go, let’s look at:

💰The Biggest Smart-Money Bets of the Day💰

- $3.4 million bullish bet on AMD 07/19/2024 $185 calls @ $3.80 avg. (seen on 5/23)

- $3.13 million bullish bet on GLD 06/21/2024 $220 calls @ $3.10 avg. (seen on 5/23)

- $1.55 million bearish bet on UBER 07/19/2024 $60 puts @ $1.18 avg. (seen on 5/23)

P.S. If you want access to more ‘smart money’ sweeps (like the one that led to my recent 250% win on KDP)…*

There’s no better place to start than in our Spyder Webinars.

TODAY, May 24 at 12:00 p.m. EST — my colleague Danny Phee is hosting an urgent LIVE WEBINAR where he’ll reveal the MOST PROMISING ‘smart money’ setups we’re seeing this week.

Don’t miss out — CLICK HERE NOW TO RESERVE YOUR SEAT.

*Past performance does not indicate future results