Good morning, traders…

Ben here.

I think every great trader needs to harness three attributes: knowledge, execution, and lack of greed…

And a crucial part of the “knowledge component” is knowing your history.

This subject is close to my heart.

Before getting my master’s in teaching, I was a history major.

To me, having a grasp on history is one of the best ways to understand the current moment, market sentiment, and directional trends.

The options market is no exception. If you wanna be a master trader, you’ve gotta know where it all started.

A perfect example of this occurred with the recent resurgence of meme stocks…

On the one hand: If you were unaware of the recent history — 2021’s epic gamma squeezes in GameStop Corp. (NYSE: GME) and AMC Entertainment Holdings (NYSE: AMC) — you probably missed the move this time around.

On the other hand: If you knew the history of GME and AMC, you might’ve entered immediately on the first signs that meme stocks were curling back up.

With that in mind, let’s break down the complete history of options trading in two parts (today and tomorrow).

You won’t believe when (and where) it first started…

A Timeline of Major Events in Options Trading

Sixth Century B.C., Greece

Over 2,500 years ago, a Greek man named Thales of Miletus predicted a big olive harvest…

To make money, he reserved an olive press at a cheap price, paying a premium for the right to use it.

In other words, he “bought calls on olives.”

When the harvest was huge, he rented the presses at higher rates, and unknowingly invented the idea of options trading in the process.

This early example showed how options can allow you to secure profits by betting on future events.

1630, Holland

In the 1600s, the Dutch went crazy for tulips, making their prices skyrocket.

It was like the meme stock craze for flowers…

Early traders created the first simple options markets during this time.

Even though many people lost money when the tulip bubble burst, these traders made profits, accidentally setting the stage for modern options markets.

Tulip mania showed us two things:

- How speculation could both create and destroy fortunes…

- How traders could make money on both sides of the options market (contract buyers vs. market makers)…

1872, New York City

Businessman Russell Sage opened an options exchange in New York…

He first introduced the terms “puts” and “calls” to describe bearish and bullish contracts, respectively.

He also developed the first system for pricing options based on their underlying stocks.

This method would foreshadow the future Black-Scholes formula (but more on that later)…

Sage’s ideas made options trading more accessible and understandable for traders, trailblazing a path for every options trader today.

1920

Legendary trader Jesse Livermore became famous for using options in his trading strategies.

He used put options to bet against Union Pacific Railway before the 1906 San Francisco earthquake…

Later, he bet against the stock market before the 1929 crash, making a fortune on both trades.

Livermore’s use of options showed their potential for big profits during volatile periods in the stock market.

1929

In one of the most important years in the history of finance, the stock market crash of 1929 changed trading forever…

Millions of people were flushed out of the markets, a crash that eventually led to the Great Depression.

In response, the government increased the regulation of speculative trading, including options by introducing stricter rules to prevent similar crashes in the future.

This period marked the beginning of market regulation as we know it (which is crucial for the options market to function).

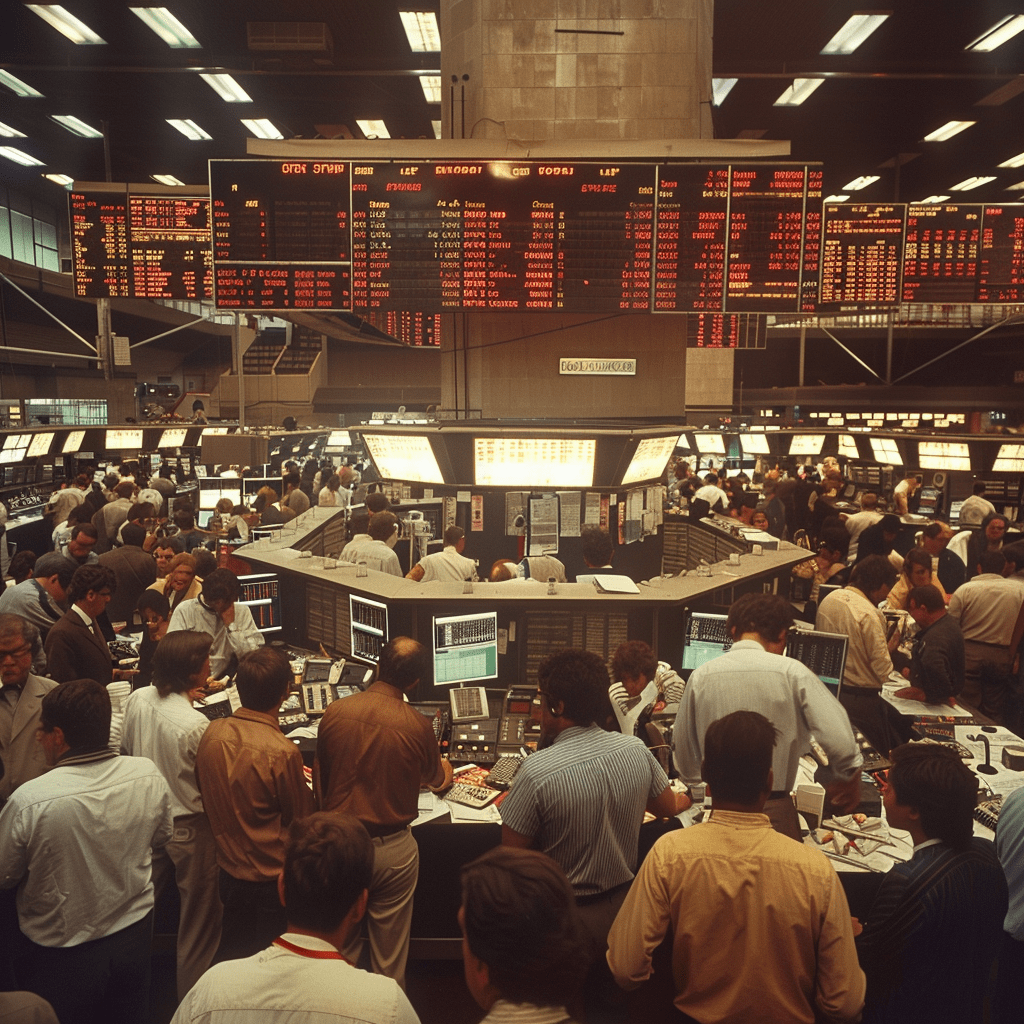

April 1973, Chicago

The Chicago Board Options Exchange (CBOE) opened, becoming the world’s largest options exchange…

The CBOE saw a lot of trading activity in the 70s and 80s, helping to develop the modern options market.

This exchange provided a central place for options trading, making it more transparent and liquid.

Plus, the exchange created the CBOE Volatility Index (VIX), one of the most critical indicators for options’ implied volatility (IV).

This started modern options trading as we know it today.

But you’ll have to tune in tomorrow to read part II and see how it all played out…

To be continued…

Now, before we go, let’s look at:

💰The Biggest Smart-Money Bets of the Day💰

- $5.65 million bearish bet on SBUX 07/19/2024 $75 puts @ $0.94 avg. (seen on 5/22)

- $2.59 million bullish bet on FCX 08/16/2024 $60 calls @ $1.18 avg. (seen on 5/22)

- $1.35 million bullish bet on GOOG 06/21/2024 $185 calls @ $1.69 avg. (seen on 5/22)

P.S. If you want access to more ‘smart money’ sweeps (like the one that led to my recent 250% win on KDP)…*

There’s no better place to start than in my Spyder Webinars.

TODAY, May 23 at 12:00 p.m. EST — I’m hosting an urgent LIVE WEBINAR where I’ll reveal the MOST PROMISING ‘smart money’ setups I’m seeing this week.

Don’t miss out — CLICK HERE NOW TO RESERVE YOUR SEAT.

*Past performance does not indicate future results