Good morning, traders.

Jeff here.

You need to hear this…

Over the next week, I’m going to be breaking down the finer details of one of the BIGGEST LOOPHOLES in the stock market…

I used this loophole all the time on Wall Street. It helped me grow my former hedge fund from $5.1 million in seed money into more than $700 million in live, real-money earnings — a return of 13,625%.*

This strategy also led to me making $1 million in a single trading day* (but more on that later)…

SPOILER ALERT: There’s a good reason why it’s been classified by the SEC as Wall Street’s #1 trading strategy across all markets.

And in the current market landscape—increasingly dominated by algorithms and robots—knowing the ins and outs of this secret loophole is more critical than ever…

Meet the “Money Link”

The strategy I’m talking about is called The Money Link.

Before I dive into all the methods I use when looking for money links, let’s review the basics.

The Money Link is a market-neutral trading strategy involving matching a long position with a short one in two stocks with a high correlation.

The key idea is to capitalize on the divergence in the price movements of these two stocks.

If you’ve ever heard of a “long/short hedge fund,” this is exactly what those funds are doing.

Big institutional funds are never 100% long or 100% short. Usually, it’s much closer to 50%/50%.

On the contrary, many retail traders seem to think they must choose one side of the trade and stick to it — but this is a fallacy.

So, here’s how The Money Link works…

Choose two stocks that historically move in relationship to one another. They could generally trade inversely to each other, or maybe they follow each other.

These pairs are often in the same industry or sector, as they are likely to be influenced by similar economic factors.

The stocks should have a high correlation, meaning they exist in similar sectors/industries and/or move in tandem under similar market conditions.

Look for moments when the prices of the two stocks diverge unusually, indicating one stock is overperforming or underperforming the other.

One example would be buying (going long) the underperforming stock and selling (going short) the overperforming stock with the expectation that the underperforming stock will rise and the overperforming stock will fall, converging back to their historical mean averages.

On the other hand, you might make a Money Link trade betting on the continued direction of two stocks.

For instance, If Stock A was down 30% in 2023 and Stock B was up 30% — and they exist in the same sector — you might make a bet on those trends holding.

The goal is to amplify your gains when the long stock goes up while simultaneously making gains on the short stock going down.

However, when I look for Money Links, I’m not looking for two random stocks going in the opposite direction.

I’m looking for this…

How to Find the Perfect “Money Links”

When looking for Money Links, it’s important to identify two closely related stocks.

The stocks must have a strong correlation between them — that’s the secret sauce, the recipe doesn’t work without it.

Money Links make it more likely that the day one stock is going up, the other stock will fall — so they’re inversely correlated.

I can almost guarantee you’re already seeing some on the market right now, you just haven’t realized it yet.

We’ll have days on Wall Street where a technology stock is up, and then that same day you’ll see defensive stocks like pharmaceuticals are down.

However, when I’m looking for a Money Link with stocks in the same sector, I have to do things a bit differently…

For a specific example, let’s turn to the retail duo of Target Inc. (NYSE: TGT) and Walmart Inc. (NYSE: WMT)…

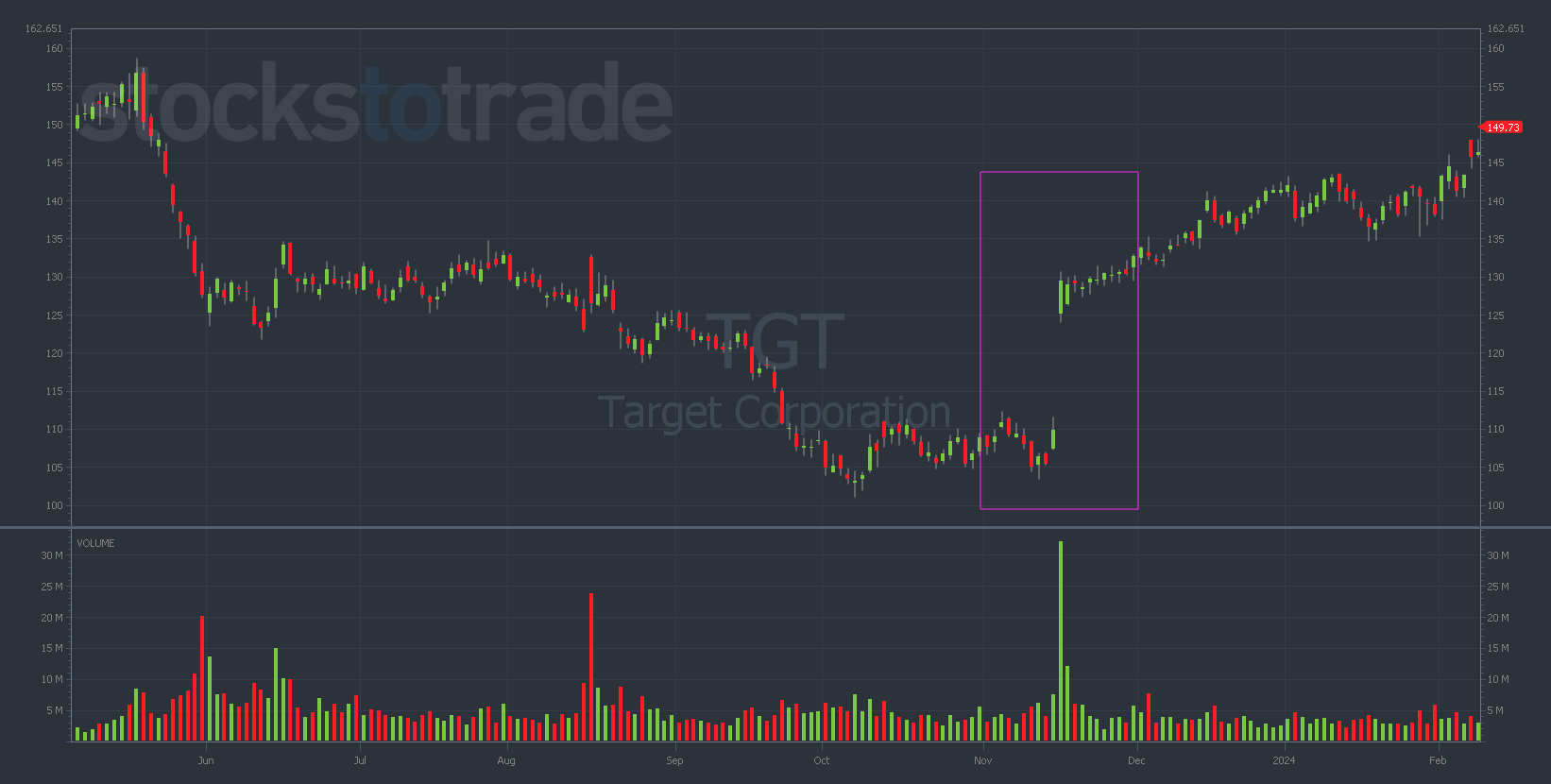

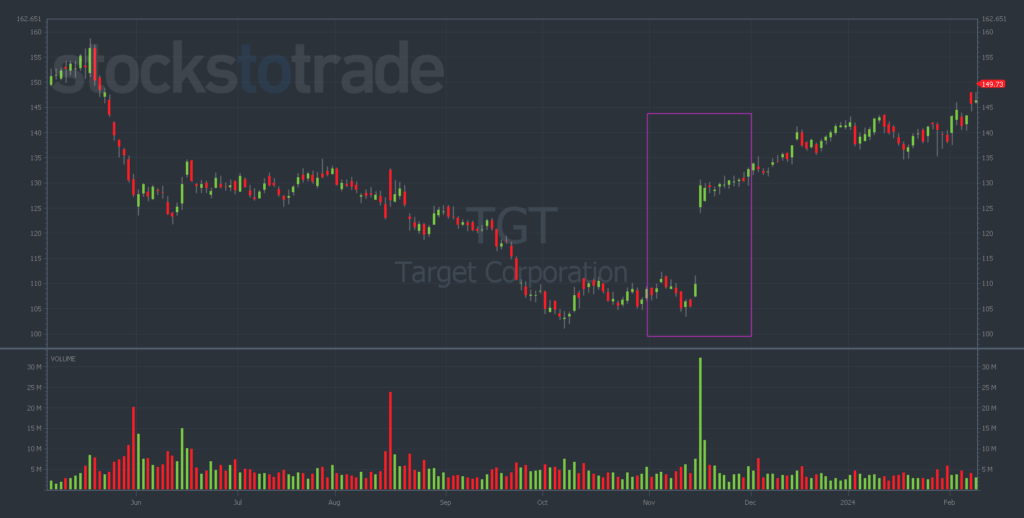

In early November 2023, I put a link trade on where I was long TGT and short WMT.

This came from the experience of watching these two stocks for decades.

When the news of major retail theft affecting stores crossed the wires, I had a feeling that TGT would be doing much better than WMT on that front.

Sure enough, I was right.

Look at what happened to the charts in mid-November…

TGT 1-year daily chart — courtesy of StocksToTrade.com

WMT 1-year daily chart — courtesy of StocksToTrade.com

TGT gained 16%+ following its November earnings report, while WMT dropped more than 8%.

I could’ve just shorted WMT or gone long TGT individually … but by making it a Money Link, I increased my profit potential by leaps and bounds.

I was able to secure a 91% return on my position*, while in the same period, the S&P 500 dropped 20%…

91% is great, but $1 million in a single trading day is even better.

Let’s roll the clock back for a moment…

On May 6, 2010 … something crazy happened.

I had put on a Money Link — long Japanese Nikkei futures and short over $20 million in S&P 500 futures.

The markets were buzzing along, and then – bam! Out of nowhere, the market takes a nosedive into the abyss.

Now, this wasn’t your garden-variety dip — this was the Dow Jones Industrial Average plummeting a whopping 1,000 points in minutes.

My S&P futures nosedived 7%, while my Nikkei futures, although hurting, dipped just 2.5%.

By the time the dust settled, I was flat, out of all positions, and I had profited more than $1 million in mere seconds* — all thanks to The Money Link I had set up.

The neutrality of The Money Link gave me the confidence to be in the trade in the first place.

You see, although I was leaning bearish that day, I wouldn’t have had the same conviction had I been 100% short.

Bottom Line: I needed The Money Link to make $1 million in a single trading day.*

That said, don’t expect to see these types of gains on every Money Link setup…

Most Money Links are lower-risk/lower-reward setups. Plus, there are no guarantees in the stock market.

Successful Money Links require extensive research and a deep understanding of the market dynamics.

The effectiveness of these examples would depend on the specific time frame and market conditions during which the trades were executed.

That said, The Money Link can be a great and effective way to make longer-term bets in a market-neutral way.

And now, for the first time ever, The Money Link is available to you…

Next Tuesday, February 27th at 8 p.m. Eastern … I’m hosting a LIVE, one-night-only event where I’ll reveal everything you need to know about The Money Link.

Don’t miss this once-in-a-lifetime chance to witness a proven, battle-tested strategy that has stood the test of time…

Click here to RESERVE YOUR SPOT BEFORE IT’S TOO LATE.

In the meantime…

Happy trading,

Jeff Zananiri

*Past performance does not indicate future results