When I worked on Wall Street, I watched countless traders enter the market with wide eyes and big dreams, only to then blow their accounts up and go back to their day jobs with their tails between their legs…

The truth is that professional trading isn’t easy. (If it was, everyone would do it.)

But I’m here to help you avoid becoming one of these unfortunate failures. (That’s my entire goal with building the Burn Notice Alliance.)

So, I’ve been thinking a lot about exactly what makes great traders great — and why the other 90% of traders lose money.

There are certain commonalities that I’ve noticed with the best traders I know.

I rather find that a few often-overlooked aspects of your personality have an enormous effect on your success (or lack thereof) as a trader.

With that in mind, keep reading and I’ll show you the three personality traits that all great traders have in common…

Discipline

More than anything, traders need discipline.

If you aren’t disciplined in the options market, you’ll lose. It’s that simple.

One of the biggest enemies of discipline is the fear of missing out (FOMO). I see FOMO leading to bad trades all the time…

It can be tempting to see someone else making a play, and then try to piggyback onto said play, regardless of whether it fits into their trading strategy or not.

But this is a critical error — one that I’ve seen ruin otherwise promising traders.

You see, FOMO can lead to traders taking on setups they aren’t ready for.

Even worse, it can spark a vicious cycle of overtrading, which can lead to huge losses.

So, if you’re alerted to a play that looks intriguing, don’t simply jump into it without discipline.

First, decide whether the setup fits your strategy and determine your game plan beforehand.

Then, work hard to execute your ideas with discipline, and I promise you’ll be a better trader for doing so.

Patience

The second trait that every trader needs is patience.

You see, on Wall Street, the impatient often get chewed up and spit back out before the opening bell rings.

But the same goes for retail traders employing their own capital…

And in the options market, the most important aspect of patience is how it affects the timing of your trades.

The truth is that promising trades are ruined by poor timing every single day.

You can be 100% right on a trade thesis, but if you enter the position too early (or too late) … you might as well be 100% WRONG.

This effect is even more exaggerated if you’re trading options.

If you’re trading stocks without leverage, you probably aren’t gonna lose more than 20-30% on your worst day (unless you’re scalping sketchy penny stocks).

But if you’re trading options and the underlying stock moves just a few percentage points in the wrong direction, your contracts could lose more than 50% of their value.

On the other hand, this is why nailing your timing can be so incredibly profitable.

In the options market, a few percentage points in the right direction could potentially yield you a small fortune.

So, if you wanna start timing your options trades like a pro, do the following:

1. Don’t Trade Strike Prices Too Far Out of the Money (OTM)

Never buy contracts that are too far OTM. It may seem like a tantalizing way to make money quickly, but in reality, if you pick a strike that’s too far OTM … you’re setting yourself up for failure.

2. Don’t Trade Expiration Dates Too Near in the Future

Just like a far-off strike price, a close-dated expiration can lead you to timing troubles. Don’t buy 0DTE contracts and expect to make 100%+ overnight. Give yourself more time on your contracts to realize your trade thesis.

3. Always Have an Entry and Exit Plan for Every Trade

Would you hike unfamiliar territory without a map? I’m guessing not. Well, the same principle applies to your trading strategy, and the way to map your trades is to create an entry and exit plan.

Passion

Finally, if you wanna have long-term success in the stock market, you’ve gotta be truly passionate about trading.

There are no shortcuts here…

If you only trade because you’re looking to make “easy money,” you’ll eventually get humbled by the market and lose all of it.

Take me, for example…

I could’ve retired comfortably years ago and sailed off into the Florida sunset, spending my days hanging out with my kids, playing poker, and watching Liverpool matches.

But I’ve never even considered that because I love to trade, I live to trade.

At this point, it’s clearly not about money for me … it’s about the love of the game. It’s about passion.

Harnessing these three personality traits isn’t a suggestion … it’s a requirement.

Find your passion for trading, exercise discipline, and whatever you do, stay patient.

By simply focusing on these three areas, you can potentially improve your trading by leaps and bounds.

Stay Street Smart,

Jeff Zananiri

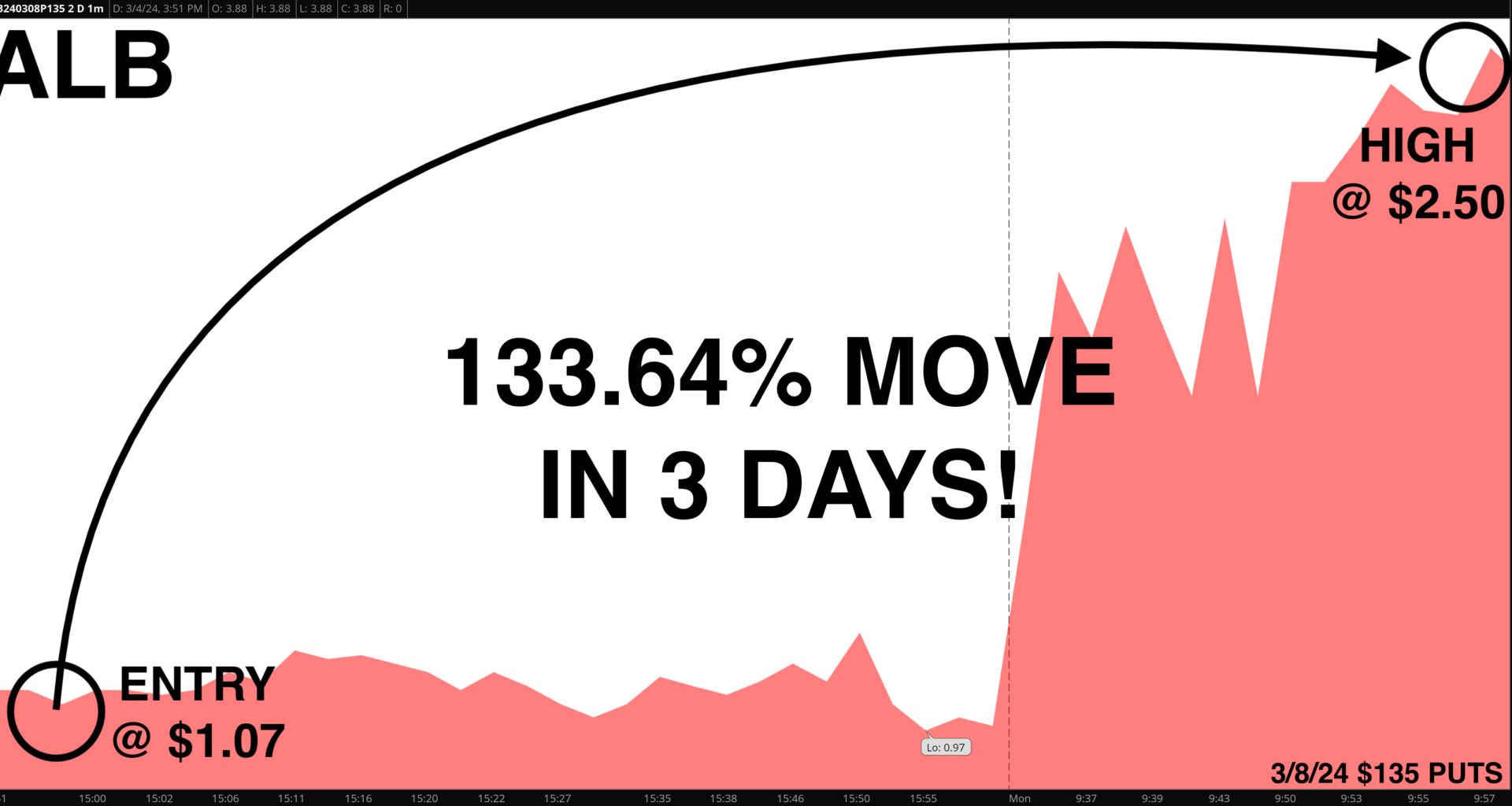

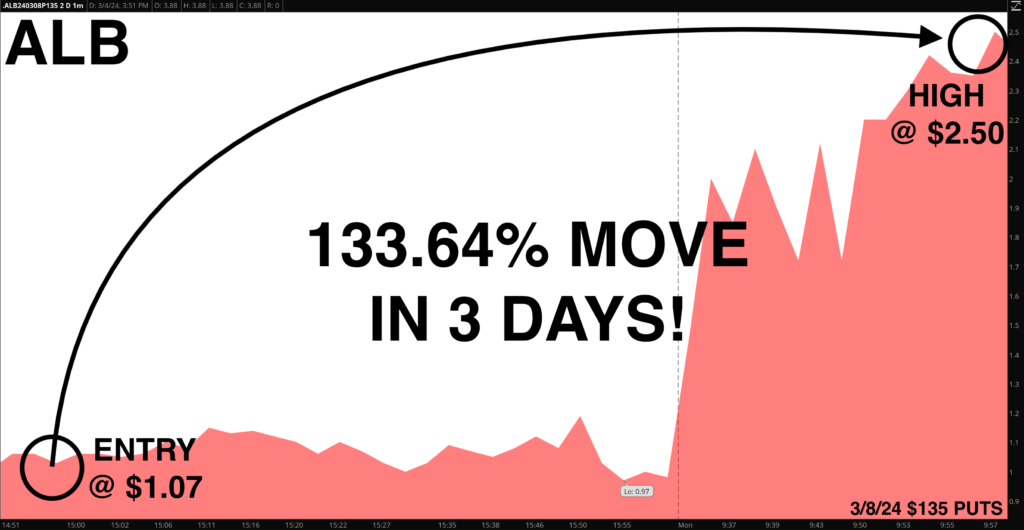

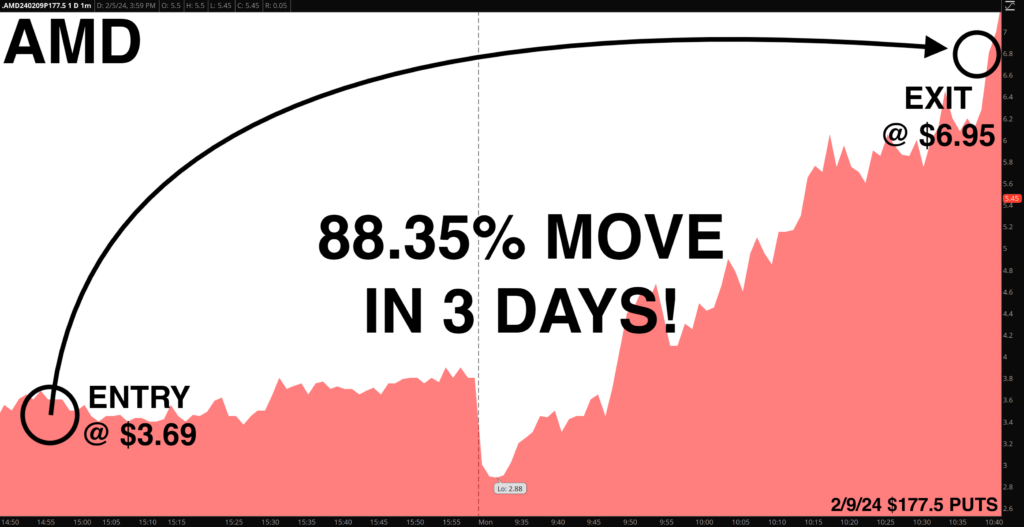

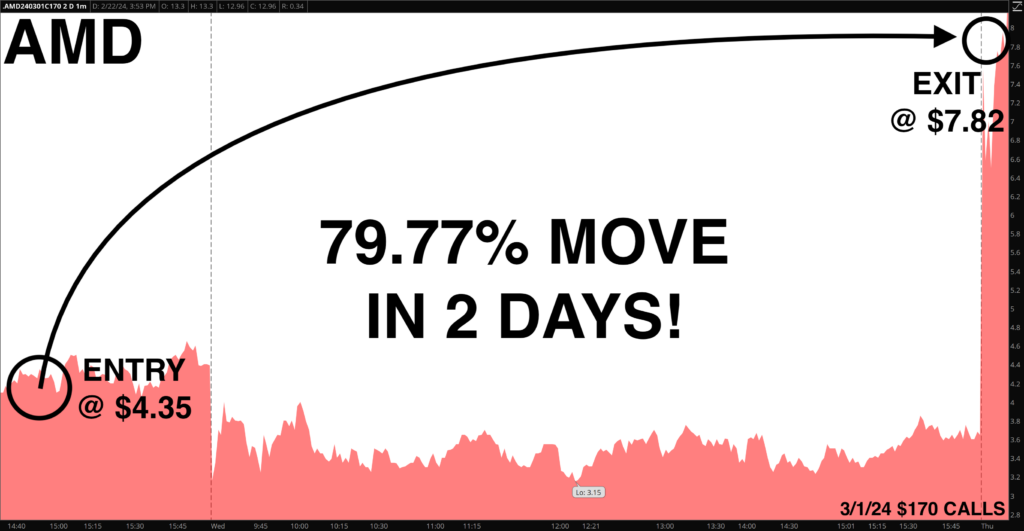

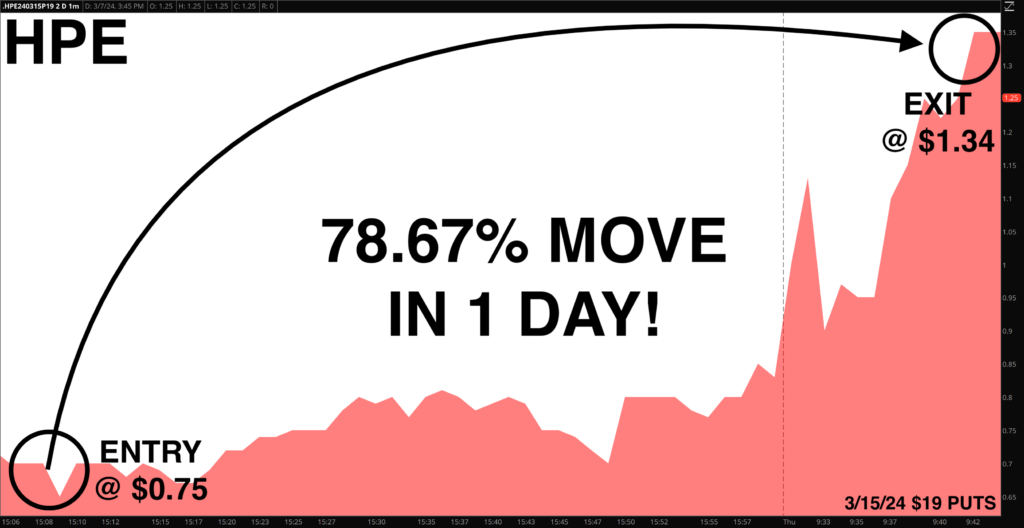

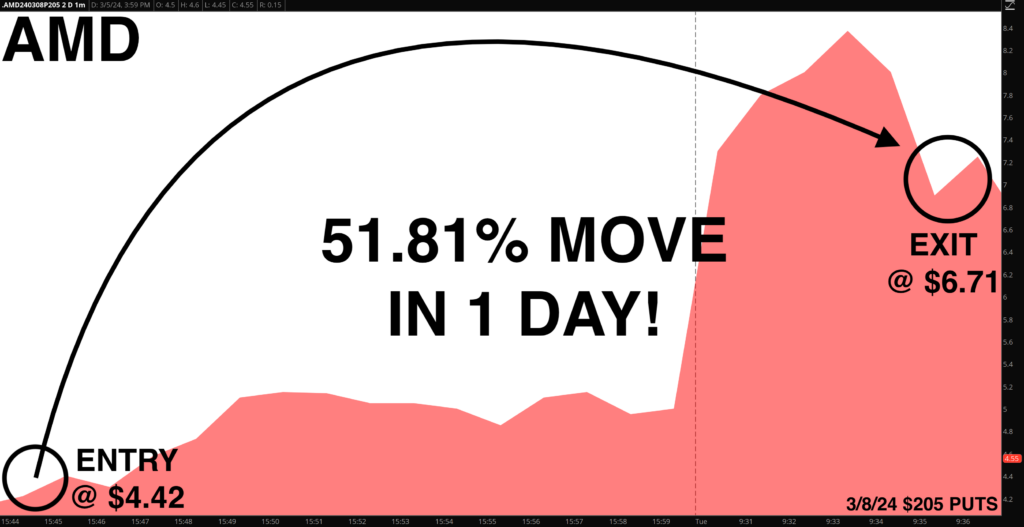

P.S. Take a look at these five monster winners I alerted recently*:

Every week, I share trade ideas (just like these) inside my flagship research trading service — the Burn Notice Alliance.

Here’s what you’ll get by signing up:

- 🔔 4 new trade alerts every week (like the five home runs I just mentioned)

- 👨🏫 Stock tickers and complete instructions for your options trade

- ⭐ My proprietary ranking system for position sizing

- 📖 Full trade analysis and follow-up game plan

But you can’t see ANY OF THIS if you don’t join NOW…

CLICK HERE TO JOIN THE ‘BURN NOTICE ALLIANCE’

Happy trading,

Jeff Zananiri

*Past performance does not indicate future results