Good morning, traders…

Ben here.

It goes without saying that we’re currently trading through one of the most volatile periods in recent memory.

As much as people might tell you that “great traders thrive on volatility,” that doesn’t make this tape any less hair-raising.

I won’t sugarcoat this: it can be scary to trade when the market is this unpredictable.

You might find yourself second-guessing your entries and exits or falling victim to dangerous emotions like the fear of missing out (FOMO).

This month is a test for traders everywhere…

Will you take advantage of the unique opportunities this crazy price action is presenting? Or will you wither in the face of volatility and let the market humble you with losses?

How you trade this environment could determine the rest of your year.

But if you harness the power of The 3 P’s and The 3 S’s, there are some fantastic options trading setups right now.

With that in mind, let me show you how I used my Apex Scanner (and certain technical indicators) to make a 40% gain in eight minutes…*

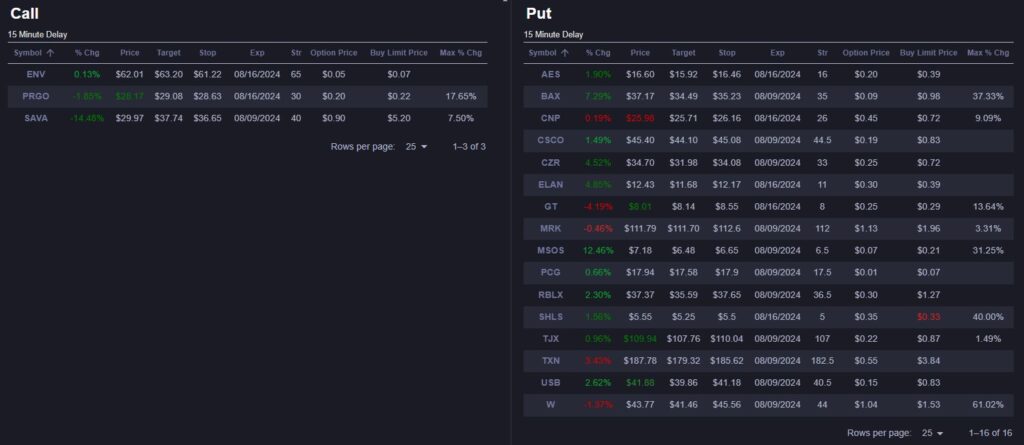

Consulting the Scanner

I start my day by using my Apex Scanner and seeing which names are popping up:

Then I look at volume and strike prices…

Volume Analysis

To see if a contract is worth trading, I look for high trading volume. When I see 10,000+ daily volume on an options contract, it usually means the ‘smart money,’ is in on the trade.

Then, I check these contracts on their options chains, focusing on:

- Volume Compared to Nearby Strikes: I see how the volume of a specific strike compares to those around it.

- Volume vs. Open Interest: I look for when the daily volume is much higher than the open interest, which is a strong indicator.

- Volume Trend Throughout the Day: I check if the volume keeps increasing during the day.

Strike Price Consideration

After looking at volume, I consider the strike price.

I like to trade contracts that are just out-of-the-money (OTM). These strikes are close enough to have a big impact but still offer good potential rewards.

I usually avoid in-the-money (ITM) contracts. But if I see a big order on an ITM strike, I will check the nearby OTM strikes and choose one of those.

Remember, choosing a strike price often comes down to personal preference. For me, the slightly OTM strikes work best for balancing risk and reward.

If I like what I’m seeing with volume and price, I look for further confirmation before making a trade…

40% in 8 Minutes on PYPL

If I like what I see on my scanner, I move to the chart for final confirmation.

This is exactly what I did with Paypal Holdings Inc. (NASDAQ: PYPL) on July 31…

As the stock was trading around $65.50, I started to look at 8/2/2024 $66 calls…

Here’s why I was intrigued by the PYPL setup:

- It had consolidated from the previous day (when it came out with a strong earnings report)…

- The price had held above the previous day’s high…

- We saw a “3x a Lady” breakout including confirmation (holding above the topping wicks)…

- The break above $66 saw an important psychological/round number level getting taken out…

- When the $66 strike calls go ITM, the price of the options can increase much faster than a further OTM strike might…

When I get these multiple levels of confirmation — from the scanner all the way down to the chart — I can’t ask for much more reason to enter a trade.

So, that’s what I did:

I rode the calls from $0.95 to $1.33 — a 40% gain in 8 minutes.*

Clearly, there are some great trades out there in this crazy market.

You just have to know what you’re looking for.

I keep it simple. Look at my scanner, see where the ‘smart money’ is, and look for the confirmation.

And speaking of the ‘smart money,’ let’s look at:

💰The Biggest Smart-Money Bets of the Day💰

- $2.4 million bearish bet on SIRI 09/20/2024 $5 puts @ $2.44 avg. (seen on 8/6)

- $2.3 million bullish bet on GM 10/18/2024 $40 calls @ $2.95 avg. (seen on 8/6)

- $1.8 million bullish bet on VFC 08/16/2024 $16.50 calls @ $1.20 avg. (seen on 8/6)

Happy trading,

Ben Sturgill

P.S. My brand-new specialized system for trading earnings season — Operation: Master Calendar — is off to a rip-roaring start.

Take a look at the results from my first 4 trade ideas:

EQR 8/16/24 $70 calls @ ~ 2.30

20% move from ~$2.30 to $2.75*

FFIV 8/16/24 $185 calls @ ~3.60

456% move from ~$3.60 to $20*

HOLX 8/16/24 $85 calls @ ~0.75

69% move from ~$0.75 to $1.27*

WELL 8/16/24 $115 calls @ ~1.00

116% move from ~$1.00 to $2.16*

If you want access to this system — which can predict moves like these before they happen — Click here now to join Operation: Master Calendar!

*Past performance does not indicate future results