Happy Monday, traders…

Jeff here.

After a calm first half of the year, market conditions have taken a volatile turn over the past few weeks.

In August, the VIX surged to $38 and cratered back to $14. And at the start of September, it’s curled back up above $20.

Investors tend to shy away when things get choppy, but that’s exactly when traders should get to work…

Increased volatility means more trading opportunities. Last week’s big sell-off felt like Christmas came early for me.

Here’s the thing: most people are conditioned to fear volatility. It’s almost counterintuitive.

They want to buy stocks when they’re in an uptrend, hitting record highs. As soon as stocks reverse, they freeze. But that’s when the real opportunities come knocking…

That said, you have to be cautious and disciplined to trade this tape effectively…

The key is to expect the unexpected. Prepare for anything and everything.

Realize that the next few months will be packed with trading opportunities, especially with the election getting closer. But you’ll need to execute your strategy to perfection.

Today, I’ll show you how to navigate the fall trading season like a pro…

The Fall Trading “Regime Change”

The first half of the year was incredibly calm, almost boring. It was just up, up, and up, with record highs seemingly every other day.

But now, the sentiment has shifted…

We’re in the midst of what I’d call a regime change, and I don’t expect that calm to return anytime soon — at least not for the rest of this year.

Get ready. We’re going to see some big moves both up and down.

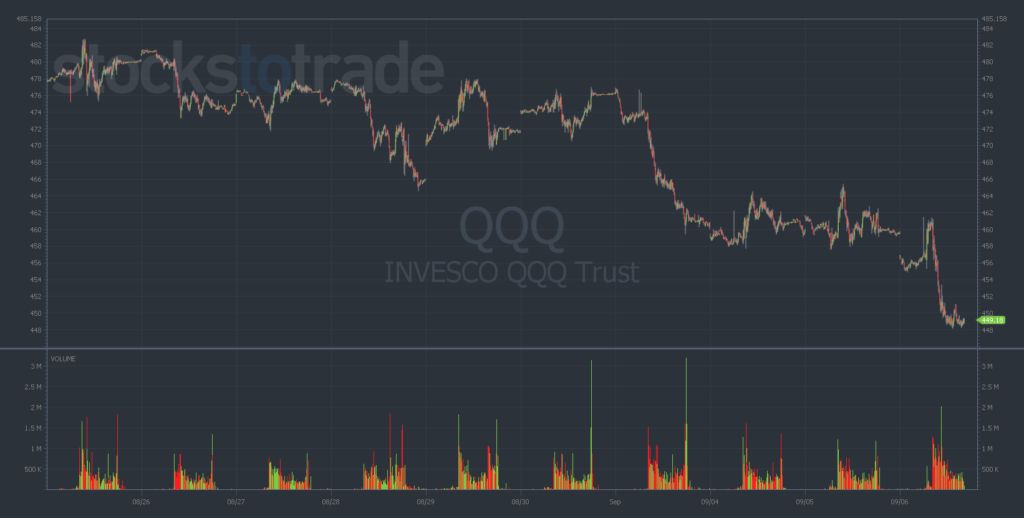

Last week was a prime example as we saw huge drops in the major indexes.

The NASDAQ was down more than 3% on Tuesday before dropping another 2.7% on Friday:

This wasn’t surprising to me. Don’t say I didn’t warn you about:

- The dangers of going long around the September Effect

- The possibility of rate cuts leading to a sell-off in stocks

More notable than the % moves themselves was the volatility. Previous selloffs in 2024 have been controlled, orderly moves lower…

But now that we’re seeing the VIX above $20, the swings are getting more violent … and less predictable.

That said, If you know how to navigate volatile market conditions, this is an excellent time to make quick overnight swing trades, like Burn Notices…

If I had to start my career over with a small account today, I would trade this strategy exclusively…

Better yet, I share the trades I find inside my flagship research trading service — the Burn Notice Alliance.

Here’s what you’ll get by signing up:

- 🔔 4 new trade alerts every week (over 200 opportunities per year)

- 👨🏫 Stock tickers and complete instructions for your options trade

- ⭐ My proprietary ranking system for position sizing

- 📖 Full trade analysis and follow-up game plan

But you can’t see ANY OF THIS if you don’t join NOW…

Stop missing out — CLICK HERE NOW TO JOIN THE BURN NOTICE ALLIANCE!

How to Trade the Fall Season

With the general election looming, financial markets will get even more dynamic.

We’ve got two ideologically opposed candidates, which means different potential economic outcomes.

As traders, we need to stay agnostic about politics. Emotions have no place in the market. What I focus on is what the market is telling me.

If there’s positive Trump news, I’d expect a bullish reaction for small-cap stocks — think about companies in the Russell 2000 that have been beaten down by inflation (and the constant flow of money into big tech).

Small caps have been ignored for a while, but lately, they’ve had some inflows. We’ve seen a significant underperformance of the Russell 2000 compared to the NASDAQ for several years, but that gap has started to close in recent weeks.

It’s clear to me that Wall Street is putting on big Money Link trades right now (matching a long position with a short in two stocks with a high correlation).

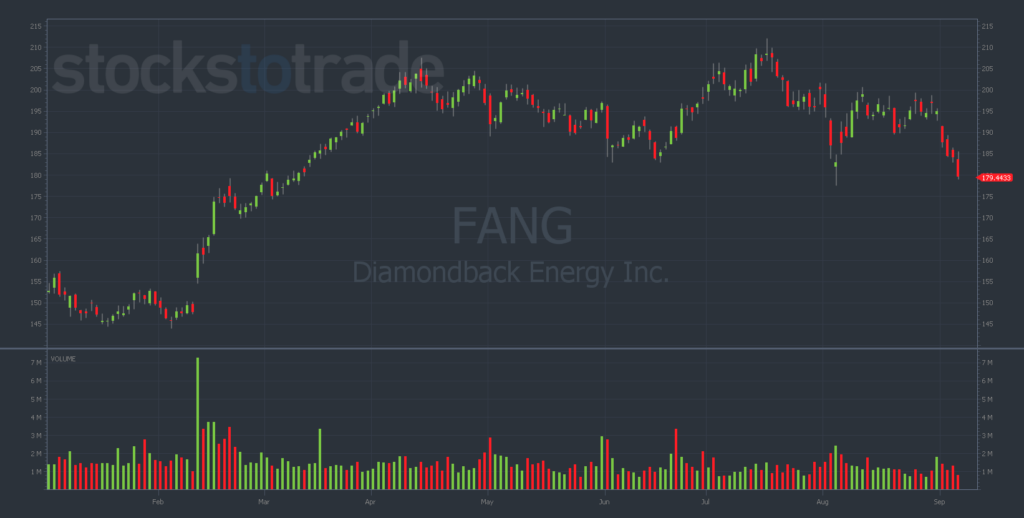

If Trump wins the election, I also see energy (particularly fossil fuels) benefiting. I like Western Midstream Partners LP (NYSE: WES), which is in the natural gas processing space, and Diamondback Energy Inc. (NYSE: FANG) out of Texas:

These are solid plays if deregulation happens.

On the flip side, if Kamala represents a continuation of Biden’s policies, that could be a positive for the tech sector. (All things considered, tech stocks have done pretty well under the current political regime.)

That said, there are still geopolitical tensions — Taiwan and China, Israel and Iran — the outcomes of which play a huge role in the market’s future.

No matter who wins the election, the chip industry is going to be impacted. Nvidia is still the star of the show, up over 100% this year, but even with the recent pullback, it’s by no means a value play yet.

It’s important to respect the price action. You’ve got to be prepared for anything.

Don’t try to predict the market six months out — it’s like trying to forecast the weather, anything can happen.

One last piece of advice: do your homework!

There’s no cheat code for professional trading. You have to grind. I’ve always done my own research, even when I was trading for hedge funds.

Listen to what the market is telling you, but always think for yourself.

Happy trading,

Jeff Zananiri

P.S. My proprietary AI-powered Gamma Code system, which can detect algorithmic glitches in real-time with a 90% accuracy rate, has already led to explosive gains like 216% on CHWY calls in 24 hours* and 200% on QCOM puts in 48 hours!*

Claim your 50% off GAMMA CODE membership before it’s too late!

*Past performance does not indicate future results