Happy Thursday, traders…

Jeff here.

You need to hear this…

Throughout my years working on Wall Street, I learned why hedge fund traders are so much more successful than the average retail trader.

Sure, the big institutions have access to information you don’t, Bloomberg terminals at every desk, and billions of dollars at their disposal.

But these aren’t the most important factors in Wall Street’s overall success…

Rather, there are certain personality traits, skills, and considerations that separate the pros from the joes, so to speak.

And the best part is that these tips aren’t difficult to implement. You’re only a few easy steps away from majorly improving your trading game.

Most traders have no idea about these things because they’ve never actually experienced Wall Street from the inside.

But I have…

And now, I’m gonna reveal the most glaring differences I see between hedge fund wizards and the 90% of traders who fail…

Think for Yourself

To be a great trader, you need to be independent and not just do what everyone else is doing.

You’ve gotta sift through all the information and news out there and make your own judgments … regardless of what the majority thinks.

But to do so, you must think for yourself.

You need to understand what kind of trader you are — personality, risk tolerance, strategy, etc.

Ask yourself the following questions:

- Can you wait patiently for a trade thesis to play out, or do you want to see results quickly?

- Do you plan to hold onto runners or book profits quickly?

- How big of a loss could you stomach without shattering your confidence?

- Do you prefer digging deep into a single sector and becoming an expert, or keeping an eye on the bigger picture?

Understanding these things about yourself is crucial when you’re coming up with a plan for trading.

A big mistake a lot of newbies make is trying to copy someone else’s strategy without thinking if it matches their personality and style.

It’s like trying to wear shoes that don’t fit your feet — it won’t feel comfortable.

Take it from me, a Wall Street veteran with 20+ years of experience…

In my early days, I realized that I was cut out for short-term trading. I didn’t like holding positions for a very long time, nor did I care about knowing every tiny detail about the companies I was trading.

I’ve always been more interested in understanding the larger macro trends affecting the markets and stocks.

By knowing myself, I’ve been able to develop a consistent strategy — making big, macro-driven swing trades — that fits my personality perfectly.

And speaking of developing a consistent strategy…

Avoid Strategy-Hopping

If you find yourself tempted to strategy hop — changing your trading strategy as often as you change your socks — it’s time to pay attention…

Constantly flipping between trading strategies is a recipe for disaster. You’ll never find consistency, and worse, you’ll likely overwhelm yourself without ever truly mastering anything.

What you ought to do instead is hone your skills in a few reliable strategies, making them your bread-and-butter.

The world’s best institutional traders tend to do exactly this — they build a consistent game plan and stick with it until it stops working.

This means investing your time and effort to deeply understand and practice several methods, patterns, and setups.

Recognizing their strengths and limitations and adapting them to align with your trading persona can be game-changing.

Consistency is your best friend in the stock market.

Mastering a select few strategies not only grants you an upper hand in managing your risks but also helps in defining a clear picture of your risk-reward landscape.

Moreover, sticking to a well-thought-out plan can make trading easier by eliminating trades outside of your strategy.

That way, when you see others trading a setup that doesn’t perfectly fit your game plan, you’ll pass on that trade. It’s that easy.

Or, you can simply do what I do and stick to the single most consistent and profitable trading strategy I’ve ever developed…*

The Strategy That Changed My Career FOREVER

A lot of traders try to ‘buy low and sell high,’ all in one day.

But believe me, that’s extremely hard to do … and completely unnecessary.

Wall Street taught me that the stock market has a predictable rhythm, with most of the easiest gains happening overnight.

By focusing on these overnight setups — which I call Burn Notices — I take all of the guessing games out of my trading.

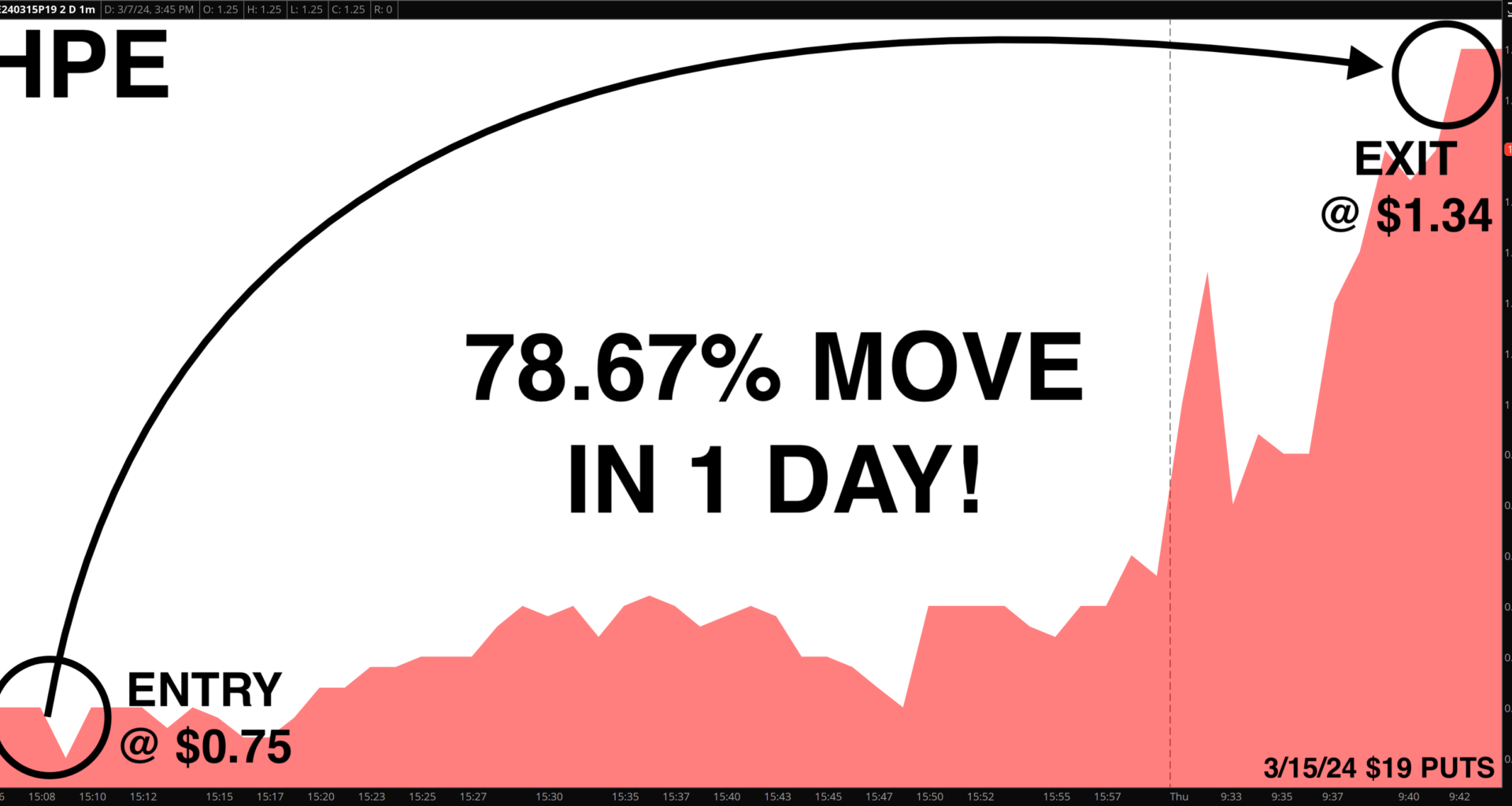

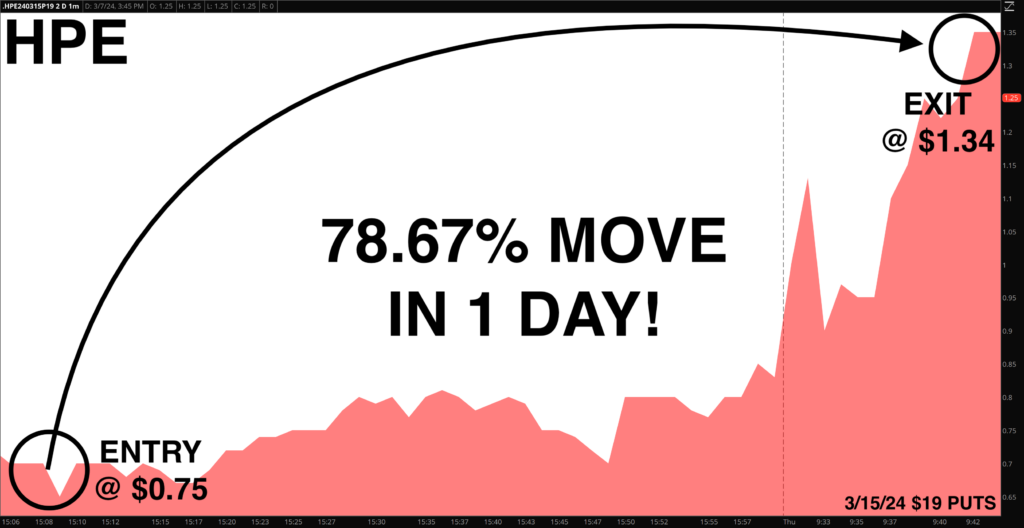

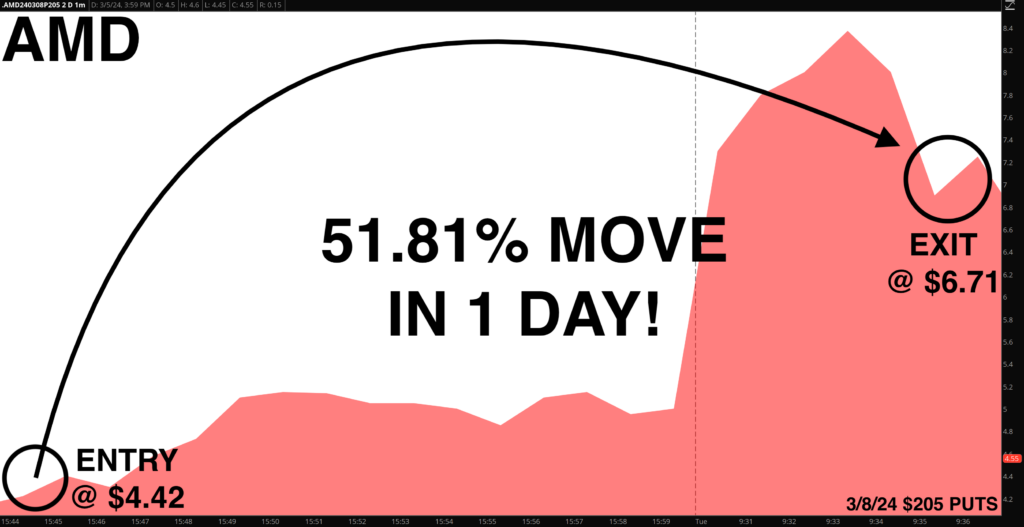

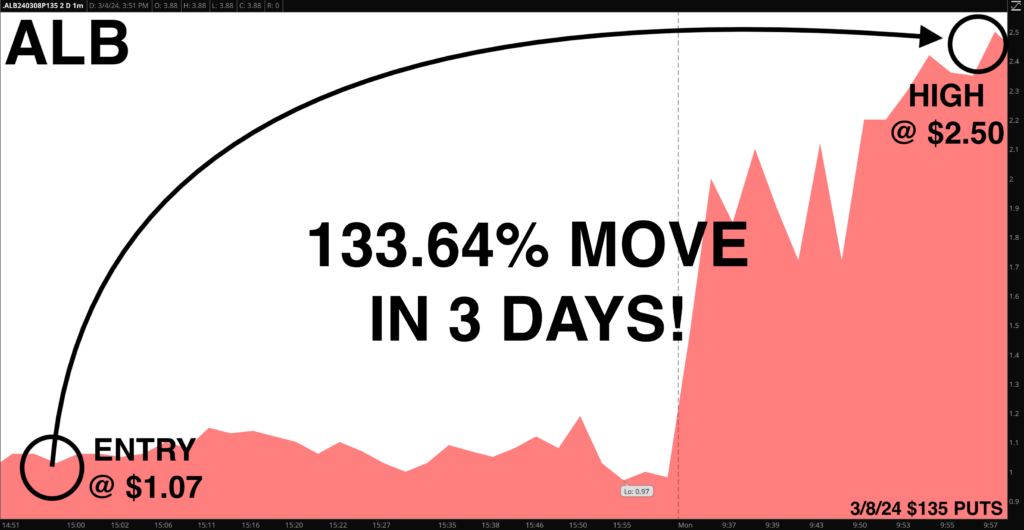

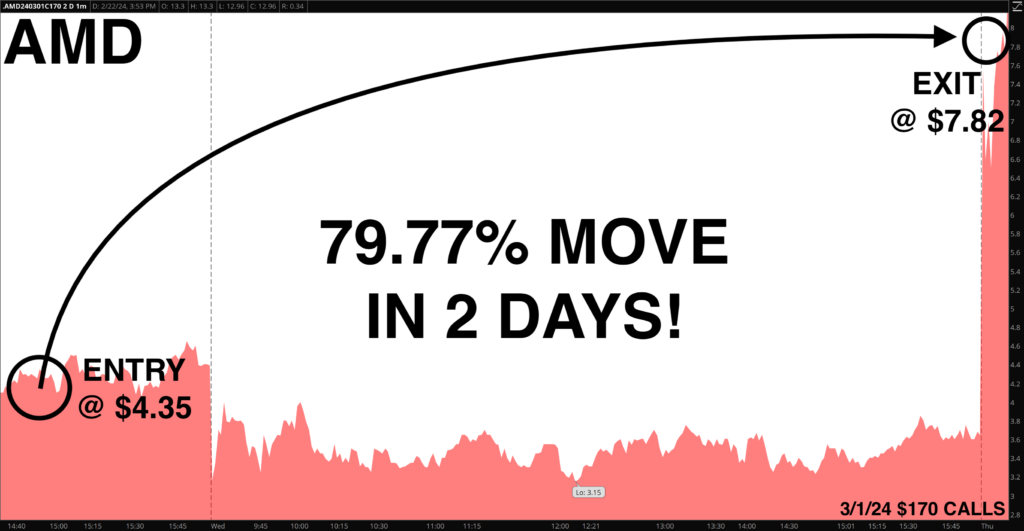

If you don’t believe me, take a look at some recent Burn Notice wins*:

And I haven’t even gotten to the best part yet…

You don’t have to trade perfectly to make serious money with this strategy.

It’s more about understanding the broader trends and moods of the market, which takes away a lot of the stress and pressure associated with day trading.

I’ll tell you something you might not believe…

Hypothetically, if all my accounts went to zero tomorrow — I would throw the last dollars I had into a brokerage account and feed my family with my Burn Notice strategy.

That’s how confident I am in Burn Notices.

Look, reaching Wall Street heights from your home office won’t be easy, but it’s not impossible either…

You can do this.

I’ve hired kids who failed community college and then watched those kids become millionaire traders.

So, no matter what, don’t doubt yourself…

With the right attitude, strong work ethic, and powerful self-motivation, you’ll be shocked by what you can accomplish in the market.

Happy trading,

Jeff Zananiri

P.S. What are you waiting for?

Every week, I share trade ideas (just like the ones above) inside my flagship research trading service — the Burn Notice Alliance.

Here’s what you’ll get by signing up:

- 🔔 4 new trade alerts every week (like the five home runs I just mentioned)

- 👨🏫 Stock tickers and complete instructions for your options trade

- ⭐ My proprietary ranking system for position sizing

- 📖 Full trade analysis and follow-up game plan

But you can’t see ANY OF THIS if you don’t join NOW…

CLICK HERE TO JOIN THE ‘BURN NOTICE ALLIANCE’

*Past performance does not indicate future results