Good morning, traders…

Ben here.

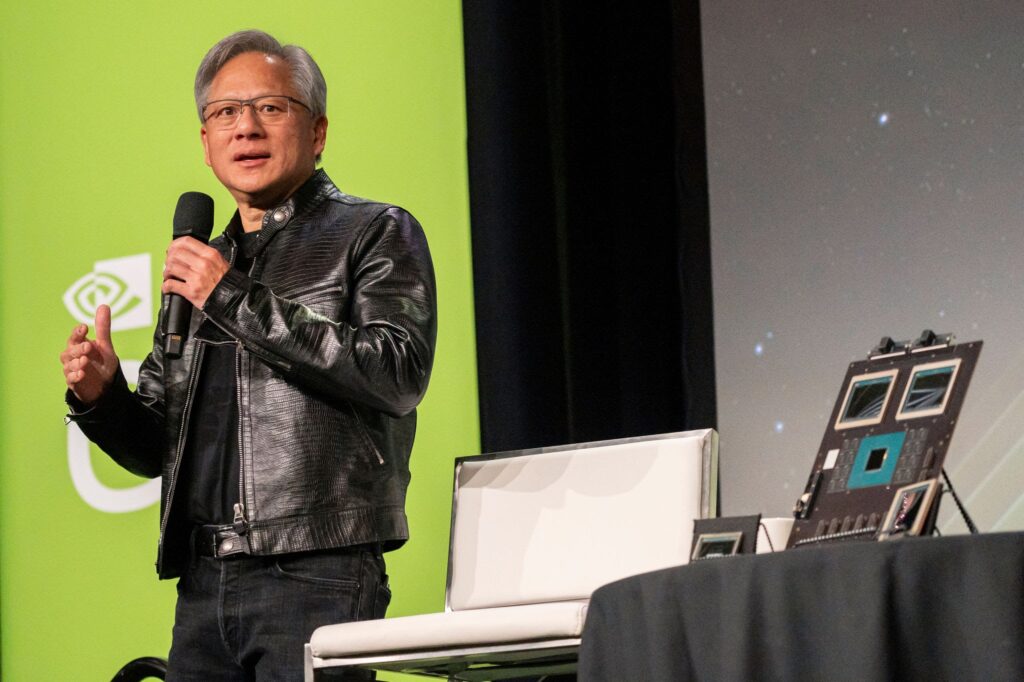

Today’s the day…Nvidia Corporation (NASDAQ: NVDA) releases its Q1 2024 earnings report after the closing bell.

Known for making the best computer chips and graphics processors, Nvidia’s stock has gone up over 200% in the past year:

I don’t think I need to remind you of the stakes here, but I will…

Today’s NVDA report is a massive test for the broader market, the entire artificial intelligence (AI) rally, and the U.S. economy at large.

Unsurprisingly, I’m getting a ton of questions from students about how to play this earth-shattering earnings trade…

My answer? One word: spreads.

I’m not talking about Dijonnaise, but rather a specific type of options position that allows you to profit off of an expected earnings move without risking more than you want to.

Let me show you the strategy I’m hinting at, how to execute it, and why I think it’s the best way to trade this monumental earnings print…

What Are Iron Condors?

An iron condor is an advanced options trading strategy that involves four options contracts: two calls (one long and one short) and two puts(one long and one short), all with the same expiration date…

It’s a multi-leg, risk-defined, market-neutral strategy with less profit potential (but also, less risk) than a single-leg calls or puts trade.

And while this strategy may contain more contracts than you’re used to, it’s nothing to be afraid of…

The key idea is to create a range within which the stock price is expected to stay until the options expire.

If the stock price stays within this range, you can potentially profit from the premium received from selling the options.

And the best part is that we usually know exactly what that range is (but more on that later)…

Here’s a breakdown of the iron condor setup:

- Sell a lower-strike put (short put)

- Buy an even lower-strike put (long put)

- Sell a higher-strike call (short call)

- Buy an even higher-strike call (long call)

The short put and short call are closer to the current stock price, while the long put and long call are further out.

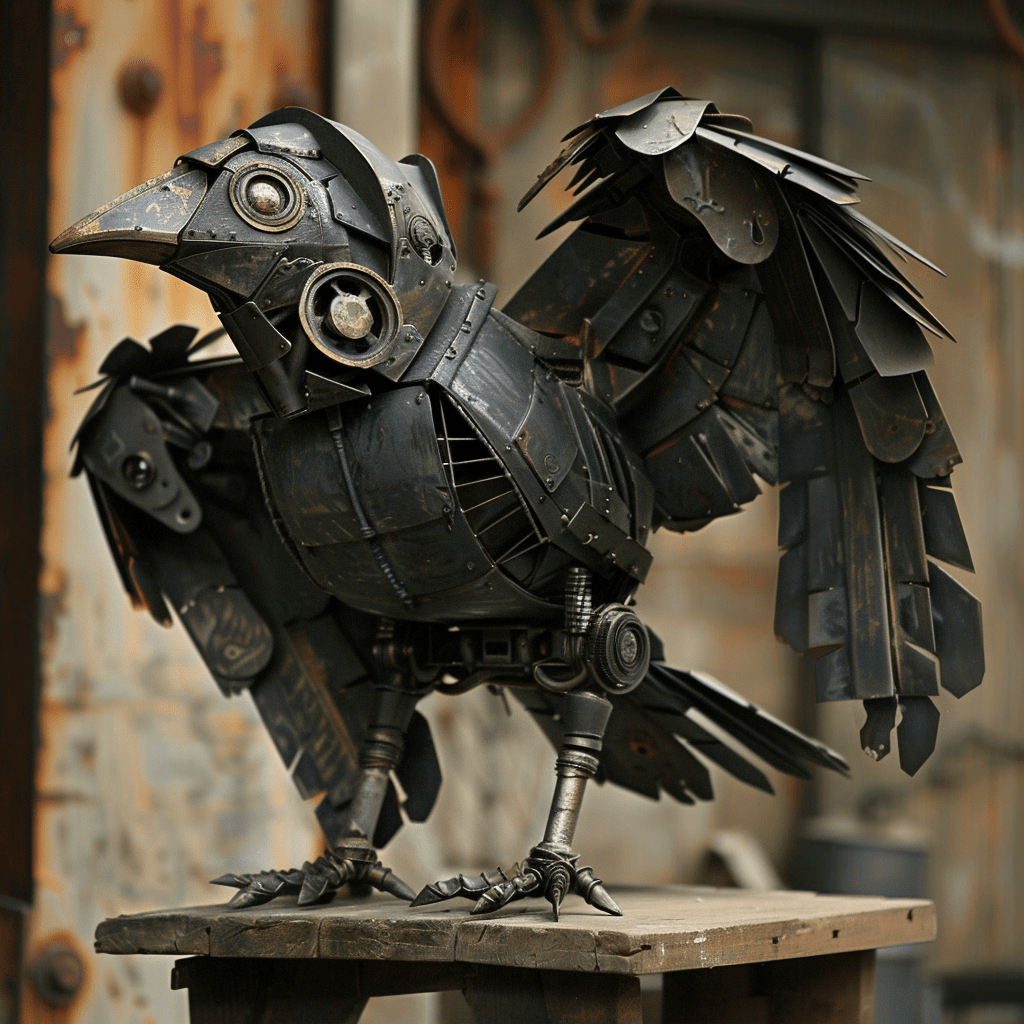

This creates a “wings” structure that resembles a bird, hence the name…

How Do Iron Condors Work?

Iron condors generate profit through the premiums received from selling the short call and put options…

The long calls and puts are purchased to limit potential losses, providing a safety net if the stock price moves significantly beyond the expected range.

Profit Potential

The maximum profit is achieved if the stock price remains between the strike prices of the short put and short call at expiration. This means the options sold will expire worthless, allowing the trader to keep the premiums collected.

Loss Potential

The maximum loss occurs if the stock price moves outside the range defined by the long put and long call. This loss is limited to the difference between the strike prices of the short and long options, minus the net premium received.

Why Use Iron Condors Around Nvidia’s Earnings Report?

As you know, earnings reports are major catalysts that often cause significant price movements in a stock.

However, sometimes the actual price change is less dramatic than expected. This is where iron condors can be particularly useful.

It all comes down to implied volatility used by market makers…

Here’s a step-by-step example:

- Determine the Expected Move: Before Nvidia’s earnings report, you must know the implied volatility (IV) from the options market. IV gives you an idea of the expected post-earnings price swing. Today, analysts expect Nvidia to move by ±8.7% from its current price of $950. This means the market anticipates a range between $868 and $1,032.

- Set Up the Iron Condor:

- Sell a put at $840: This is slightly below the lower end of the expected range.

- Buy a put at $820: This is further below the lower end to limit potential losses.

- Sell a call at $1,040: This is slightly above the upper end of the expected range.

- Buy a call at $1,060: This is further above the upper end to limit potential losses.

- Calculate Potential Outcomes:

- Maximum Profit: If Nvidia’s stock stays between $840 and $1,040, all options expire worthless, and you keep the premium.

- Maximum Loss: If Nvidia’s stock falls below $820 or rises above $1,060, the long put or long call protects you, but you still face a loss capped by the spread between the strikes (minus the premium received).

Why Use Iron Condors Instead of Normal Calls or Puts?

Risk Management

Iron condors limit potential losses. With normal calls or puts, you could potentially lose your entire upfront investment if the stock price moves significantly against your position. In contrast, iron condors expose you to less risk (with slightly less reward).

Range-Bound Strategy

Iron condors are ideal if you believe a stock will stay within a certain range. Earnings reports can cause volatility, but if you expect Nvidia to stay within the expected move, an iron condor could be the perfect play.

Premium Collection

By selling the call and put options, you receive premiums immediately and keep them (as long as the stock remains within the anticipated range).

As you see, this strategy allows you to profit from the premiums collected while managing risk effectively.

By understanding the expected move and setting up the iron condor within this range, traders can potentially profit from Nvidia’s earnings with a defined risk and reward structure.

And while iron condors limit losses compared to normal options, they still require careful planning and consideration of market conditions.

If I was going to trade anything around this earnings report, it would be an iron condor.

That said, remember this…

You don’t have to trade Nvidia today.

When everyone and their grandma is talking about one stock, it’s often best to sit on the sidelines, trade other names, and wait for the craziness to subside.

Personally, I’ll be focusing on:

💰The Biggest Smart-Money Bets of the Day💰

- $3.05 million bullish bet on AEM 06/21/2024 $65 calls @ $5.80 avg. (seen on 5/21)

- $2.63 million bullish bet on TSLA 05/24/2024 $180 calls @ $2.51 avg. (seen on 5/21)

- $2.5 million bearish bet on WBD 05/31/2024 $8 puts @ $0.20 avg. (seen on 5/21)

P.S. If you want access to more ‘smart money’ sweeps (like the one that led to my recent 250% win on KDP)…*

There’s no better place to start than in my Spyder Webinars.

TOMORROW, May 23 at 12:00 p.m. EST — I’m hosting an urgent LIVE WEBINAR where I’ll reveal the MOST PROMISING ‘smart money’ setups I’m seeing this week.

Don’t miss out — CLICK HERE NOW TO RESERVE YOUR SEAT.

*Past performance does not indicate future results