Good morning, traders…

Jeff here.

It’s official — Donald Trump has been sworn in as the 47th President of the United States…

And the market is giving us a “Trump Pump” in response…

Charts are ripping higher, meme stock price action is back, and everyone seems to be chasing the upside moves.

It’s fast, it’s exciting, and yeah — there’s a lot of money being made…

But there’s a problem…

When stocks start moving this fast, traders stop thinking and start reacting.

The fear of missing out (FOMO) kicks in, and before you know it, people are piling into trades with no plan or strategy — just “holding and hoping” they’ll catch the move before it’s too late.

And that kind of trading rarely ends well.

Look, I’m very optimistic about what Trump 2.0 can do for small business, U.S. large caps, and the market overall…

But don’t get tantalized into trading at the wrong time.

It’s easy to get caught up in the froth, but the traders who make real money in markets like this are the ones who see the game differently.

They understand that timing matters more than anything, and if you jump in at the wrong moment, it won’t matter if you’re “right” about the trade — your entry can kill your profits before they even have a chance to get started.

If you want to stay in control and avoid getting burned in this kind of market, there’s one thing you need to focus on right now: fighting FOMO.

With that in mind, let me show you how to navigate a super frothy market…

The Froth Problem

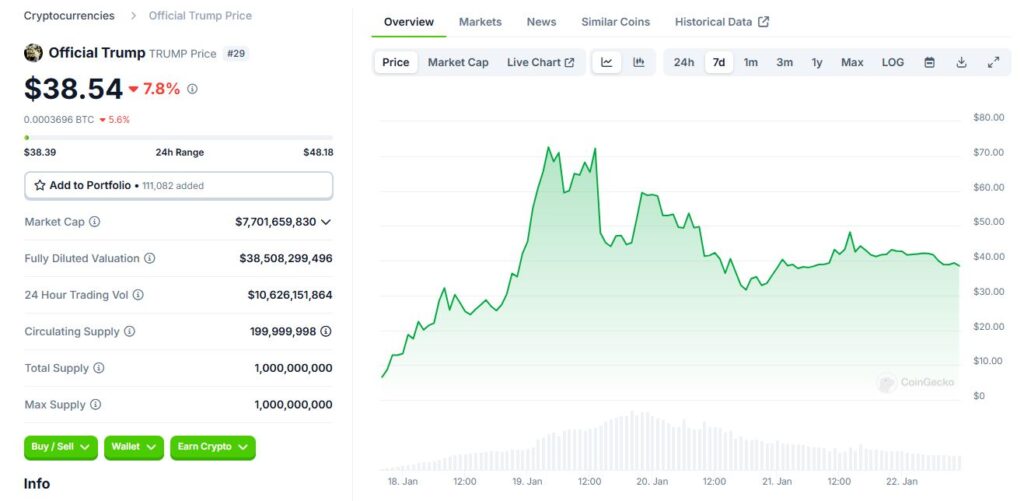

I can’t ignore the froth in this market. Take the $TRUMP meme coin, for example…

It dropped out of nowhere in the middle of the night last Friday. The earliest buyers walked away with millions.

But moves like that always leave a trail of people getting absolutely crushed…

After running to $72, the coin tanked to the low $30s in less than 48 hours, before settling near $40:

Imagine how many people bought in the $70s and got destroyed.

This kind of market can be great for those who know how to play it, but it’s an ultra-dangerous environment for anyone chasing blindly.

Markets are moving fast. Too fast.

Meanwhile, traders are jumping in without a plan, just trying to catch the next big thing.

That kind of behavior leads to avoidable mistakes and costly lessons.

Let’s make sure you steer clear of them…

Your Worst Enemy in This Market

Right now, the FOMO in the market is palpable. It’s leading traders to chase upside moves, ignore risk, and throw money at stocks without a solid plan.

This type of thinking leads to bad entries, and bad entries are tough to recover from. Getting in at the wrong time can turn a winning idea into a losing trade.

Even if the original idea was solid, a bad entry point makes it nearly impossible to make money.

In options trading, the risk is even higher. Time decay and volatility can eat away at a position before the trade even has a chance to work.

Subpar entries are one of the biggest reasons traders struggle to stay profitable in a market like this.

How to Avoid FOMO

The key to avoiding FOMO is harnessing your patience. Trading opportunities are like buses, there’s always another one coming. The market isn’t going anywhere, and new setups appear all the time.

There’s no need to jump into trades just because everyone else is. The traders who wait for the right setups, stick to their strategies, and focus on quality opportunities are the ones who survive a frothy market.

Take a step back and evaluate the risk before hitting the buy button. Your decisions should always be based on a disciplined process, not emotion.

Every trade needs a verifiable edge. Good setups happen when price, timing, and risk management coalesce. You want not one, but a confluence of factors leading you into a trade.

Without those factors, the chances of profit drop significantly. Chasing random trades just to be involved in the action is a recipe for utter disaster.

3 Tips for Trading the Froth

Markets will always throw flashy opportunities in front of traders. Some of them will work out, but a lot of them won’t.

Staying disciplined and focusing on the right setups is what separates winning traders from the rest.

Instead of getting caught up in the hype, focus on what actually works:

- Stick to a trading plan and avoid impulse decisions.

- Only take trades that align with a proven strategy.

- Avoid chasing overextended moves to the upside.

FOMO is the easiest way to blow up an account. This market rewards discipline and punishes emotional decision-making.

Stay focused, trade smart, and don’t let the froth pull you into chasing bad trades.

Stay sharp out there,

Jeff Zananiri

P.S. While most traders are scrambling to position themselves in this volatility, I’ve had a 7-win streak with my Burn Notice trades…*

If you want to start getting in on these setups before they take off, there’s only one place to start…

TODAY, January 23 at 10:00 a.m. EST, I’m hosting a LIVE WORKSHOP to reveal my top Burn Notices for next week.

Stop guessing, start burning — Click here to reserve your seat!

*Past performance does not indicate future results