Good morning, traders…

Jeff here.

Today, I’m gonna break down one of the most powerful discoveries I’ve ever come across in the stock market.

By primarily sticking to this strategy, I’ve consistently outperformed the market over my 25 years of professional trading.

If you knew what to look for (or were a Burn Notice Alliance member), you could’ve easily profited double-digits from these setups.

There are 390 minutes in a standard trading day. But eventually, at the rate things are going, the last ten might be the only ones that matter…

And some brand-new research is supporting that idea:

Approximately 33% of all S&P 500 stock trades are now executed in the final ten minutes of the session — a 27% increase from 2021, according to data compiled by BestEx Research.

This often-overlooked fact is the basis of my #1 trading strategy, which recently led to overnight gains of +196% and +69% (but more on that later)…

With that in mind, I want to show you how you can potentially execute killer trades using my ‘Burn Notice’ strategy…

How (and Why) ‘Burn Notices’ Work

The crux of my trading strategy revolves around my ‘Burn Notice’ triggers…

This strategy isn’t complicated, you just have to understand how it works…

It all starts with identifying how Wall Street is trading (and weaponizing these moves to your advantage).

Over the last ten years, the volume of assets managed by passive equity funds in the US has grown dramatically, exceeding $11.5 trillion, based on Bloomberg Intelligence data.

This increase has led to a concentration of trading activities towards the end of the trading day.

Active traders flock to this liquidity, creating a “perfect storm” of increased end-of-day trading activity.

In Europe, the closing auction — which takes place after the regular trading hours — now represents 28% of the trading volume on public platforms, an increase from 23% four years earlier, according to Bloomberg Intelligence statistics.

A new research paper titled “Shifting Volumes to the Close: Consequences for Price Discovery and Market Quality” found that shares tend to swing between the end of the trading day and the last price set in the closing auction, yet 14% of that move reverses overnight — a sign it’s fueled by one-sided flows rather than fundamentals.

Meanwhile, on the options front, another factor has caused elevated volume towards the end of the trading day…

On June 21, 2021, something BIG happened in the options market.

The SPDR S&P 500 ETF (NYSEARCA: SPY) — the biggest exchange-traded fund on the planet — started offering Zero-Day-to-Expiration (0DTE) options every day of the week.

At first, this may have seemed like something that would only affect the most degenerate, ‘YOLO’ Reddit traders…

But now, it’s clear that 0DTE options are doing much more than that…

They’re shaking up the entire stock market.

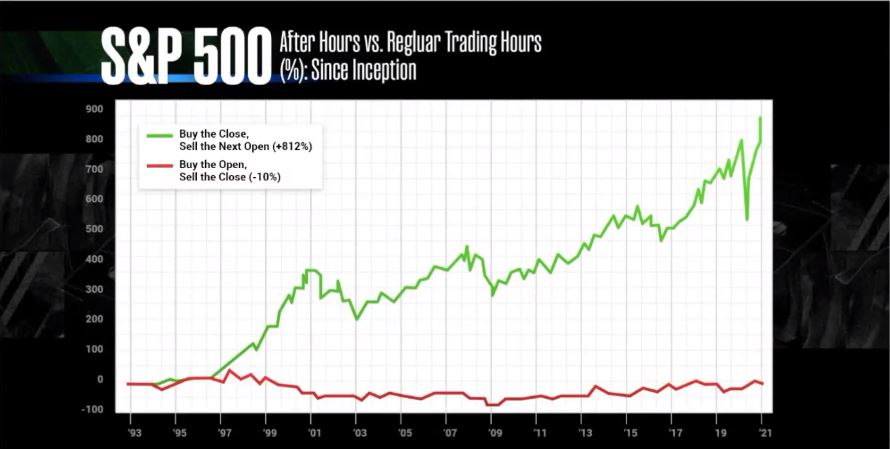

But before I go any further, I want you to look at this chart…

WARNING: If you only pay attention to one chart in your trading career, it should be this one.

This chart shows how much you could’ve gained by buying the close and selling the open on the SPDR S&P 500 ETF Trust (NYSEARCA: SPY) over the last 30 years.

You would’ve made a whopping 812%…

But if you did the opposite, buying the open and selling the close, you would’ve actually lost 10%.

This phenomenon occurs because Wall Street follows different trading rules than you and I do.

As banks, they’re legally required to keep enough cash on hand to fulfill their customers’ withdrawal requests.

This forces Wall Street to free up an estimated $8.3 billion in cash every single day.

SPOILER ALERT: They do this by selling stocks.

When I figured this out, I started formulating a strategy to exploit this little-known weakness.

And the best part is, these plays I’m gonna talk about today wouldn’t have required a ton of capital to trade.

In fact, most of my Burn Notice alerts cost between $2.00-$3.00 in options premium.

Bottom Line: You can put as much (or as little) as you’d like into these ‘Burn Notice’ opportunities.

Which brings us back to ‘Burn Notices.’ Here’s how they work…

- 🔥 Step 1: Wait for the ‘Burn Notice’ to be issued

- 📉 Step 2: Enter as the share price drops (or surges) into the close

- 📈 Step 3: Wait for the stock to bounce (or tank) the next day

- 🎯 Step 4: Sell at my target exit price

It’s these embarrassing cash bleeds from unprofitable institutional trading — combined with large end-of-day withdrawals — that trigger these consistently predictable moves.

But don’t just take my word for it…

Look at some hard evidence of how my ‘Burn Notices’ have been performing recently…

How You Could’ve Nailed 2 Recent “Burn Notice” Winners

On April 17, I alerted Coinbase Global Inc. (NYSE: COIN) 4/19/24 $215 calls at $5.30.

That morning, the stock had sold off hard, down nearly 8% (exactly the type of overreaction I look for in Burn Notice setups)…

So, when COIN hit a double bottom from the previous day around $206, I knew the risk/reward was in my favor buying calls.

And look what happened…

The contracts jumped 69.92% overnight to $8.99.*

But that’s not the only killer ‘Burn Notice’ trade I’ve alerted recently…

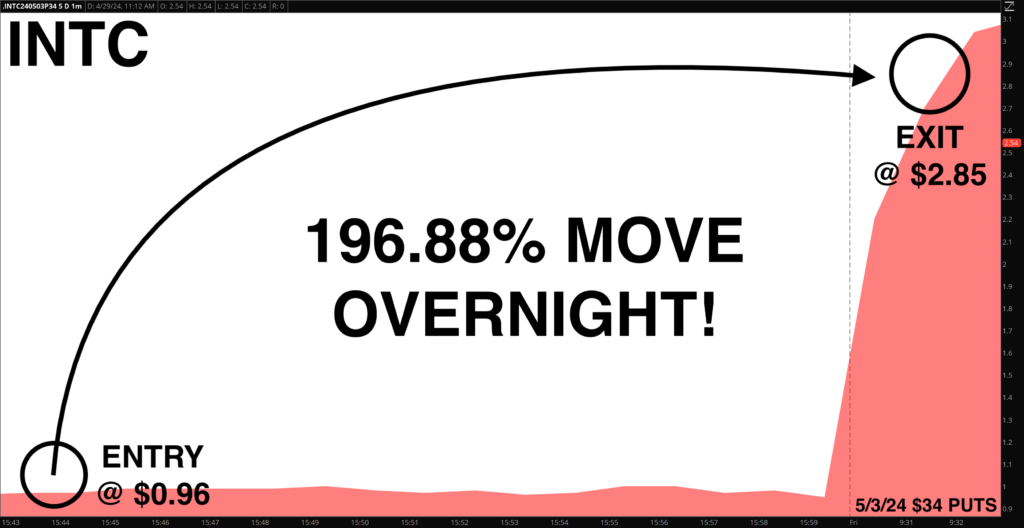

On April 25, I alerted Intel Corp. (NASDAQ: INTC) 5/3/24 $34 puts at $0.96.

I entered this bearish trade the day before INTC’s earnings report for several reasons:

- The stock was up 3% in two days, showing “Burn Notice” price action…

- The options were cheap due to a small implied move (I expected the move to be bigger)…

- The fundamentals of the company were/are absolutely terrible (the long-term chart is trading as if the company is going bankrupt)…

Look what happened to those puts the following morning…

The contracts surged to $2.85 — a gain of 196% overnight.*

I’ve spent decades perfecting this strategy, but you can’t see any of these alerts if you don’t join the Burn Notice Alliance…

What You’ll Gain from the ‘Burn Notice Alliance’

Every week, I’ll share the trades I find inside my flagship research trading service — Burn Notice Alliance!

Here’s what you’ll get by signing up:

- 🔔 4 new trade alerts every week (over 200 opportunities per year)

- 👨🏫 Stock tickers and complete instructions for your options trade

- ⭐ My proprietary ranking system for position sizing

- 📖 Full trade analysis and follow-up game plan

What are you waiting for?! — CLICK HERE NOW TO JOIN THE ‘BURN NOTICE ALLIANCE’

Happy trading,

Jeff Zananiri

*Past performance does not indicate future results