Good morning, traders…

Ben here.

You need to hear this…

World-class options traders tend to have two things in common…

First, they’ve mastered the fundamentals of trading. They understand the personality of the options market, how to read and analyze charts, and the finer points of timing and execution…

But there’s something even more important, beyond the nitty-gritty details of trading, that the world’s best traders share…

They all have a unique edge in the stock market.

By developing an individual style that fits your personality, account size, and risk tolerance … you can potentially carve out an edge that other traders aren’t exploiting.

Don’t underestimate this. Edge is the single biggest difference between the average unprofitable retail trader and the best traders on the planet.

And the latter is what I want you to be striving toward.

Today, I’ll show you how I found my trading edge (and how you can potentially find your own)…

What is Edge?

First, let’s talk about what “edge” really means in trading…

You can think of edge as an advantage, but ultimately it’s about employing a strategy that other traders are sleeping on.

Most people enter the stock market with no clear advantage.

They’re using the same tools, software, and information as every other retail trader … expecting remarkable results.

But they’re really gambling (more on that later)…

If you’re using the same information as everyone else, it’ll be very difficult to stand out from the crowd.

To stand out from the 90% of traders who lose money, you’ve gotta create an edge in the way you trade…

Whether that’s a specific technical indicator you use (that others don’t), or a chart pattern that works consistently … you need to find a unique aspect of your trading that’s nearly impossible to duplicate.

This is what every great trader I’ve ever met has done (and why I’ve worked to do the same with my ‘Smart Money’ trading strategy)…

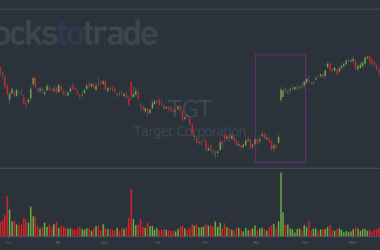

My edge lies in using my Spyder Scanner to identify when ‘smart money’ insiders are making massive bets on near-term options trades.

This gives me (and anyone who uses my scanner) a clear edge by knowing what the ‘smart money’ is doing when the rest of the market doesn’t.

It’s that simple.

Edge: The Fine Line Between Trading and Gambling

If you don’t have an edge and you’re buying options, that’s no different than gambling…

And the fine line between the two lies in the information you have before making your bets.

Let’s say you’re playing blackjack, a game where you’re forced to bet before you have any data whatsoever.

Once the cards are dealt, you can’t add or subtract from your initial position (except for some unique situations, like splitting hands).

If you get dealt a 16 when the dealer is showing a face card, you’ll probably wish you could reduce your initial bet. But you can’t.

This is a major difference between trading and gambling. You can always adjust your position sizes in the market.

Next, there’s another important distinction between trading and gambling — asymmetry.

You see, depending on your strike and expiration date, an options bet can increase several times beyond your principle in a very short period.

With options, you don’t need to risk a ton of money to have some huge potential upside.

This asymmetry allows you to define your risk strictly while still having incredible opportunities to earn profits.

But casino betting and sports betting rarely offer you such opportunities. You might be able to 1.5x your money on a blackjack hand, but you have no chance to 5x, 10x, or 20x (like you do in the options market).

The best options traders understand this asymmetry and harness it to their advantage.

They have a true skill (which naturally leads to edge).

Have you ever heard the saying, “It’s better to be lucky than good?”

Well, this isn’t true in the stock market…

You need to be good at trading — really good — if you want to succeed long-term.

Luck will only get you so far.

Sure, even the most skilled trader can be blindsided by randomness (chance), but the overall positive results of their performance are due to their strategy (skill).

But remember: any tough skill worth mastering is difficult. If it wasn’t, everyone and their grandma would be a multi-millionaire options trader.

That said, it’s not impossible. Most traders fail, but not all of them.

Stick with me, and I’ll show you how to develop your skills (and eventually find your edge)…

How to Find Your Edge

The first step to finding your edge is understanding that there are no shortcuts or magic bullets.

Long-term options trading success requires effort, commitment, and thinking for yourself.

Begin by analyzing your strengths and weaknesses. Know who you are as a trader.

What are you good at, and where do you struggle?

Maybe you have a talent for spotting undervalued stocks, or you’re excellent at predicting market trends. Lean into your strengths and improve your weaknesses.

On the options side, take note of what contracts you trade the best. Do you perform better trading short-dated options quickly, or holding mid-term swing trades?

Another key to finding your edge is keeping up with the latest trends and developments in the market.

This means reading industry news, staying informed about macroeconomic changes, and connecting with other traders.

Remember, the market constantly evolves. Strategies that work today might not work tomorrow, and what works for someone else might not work for you.

Be flexible and willing to adapt your strategies as needed.

Now, before we go, let’s look at…

💰The Biggest Smart-Money Bets of the Day💰

- $2.3 million bearish bet on TLT 06/28/2024 $85 puts @ $0.93 avg. (seen on 4/24)

- $2.08 million bullish bet on TSLA 04/26/2024 $170 calls @ $3.05 avg. (seen on 4/24)

- $2.22 million bullish bet on AMD 09/20/2024 $195 calls @ $7.85 avg. (seen on 4/24)

Happy trading,

Ben Sturgill

P.S. My edge lies in my ‘Smart Money’ trading strategy…

TOMORROW, April 26 at 12 p.m. EST — My colleague Danny Phee is hosting an urgent LIVE WEBINAR where he’ll reveal the most promising ‘Smart Money’ trades we’re seeing this week.

What are you waiting for? CLICK HERE NOW TO RESERVE YOUR SEAT