Happy Friday, traders…

Jeff here.

As we get deeper into earnings season, one post-report move has stuck out to me more than any other…

I’m talking about Tesla Inc. (NASDAQ: TSLA)…

TSLA is an interesting stock to look at because it’s important for the entire market.

It’s not just because of Elon Musk’s antics and politics and all of that…

Considering its history, the stock sets the tone for a lot of risk.

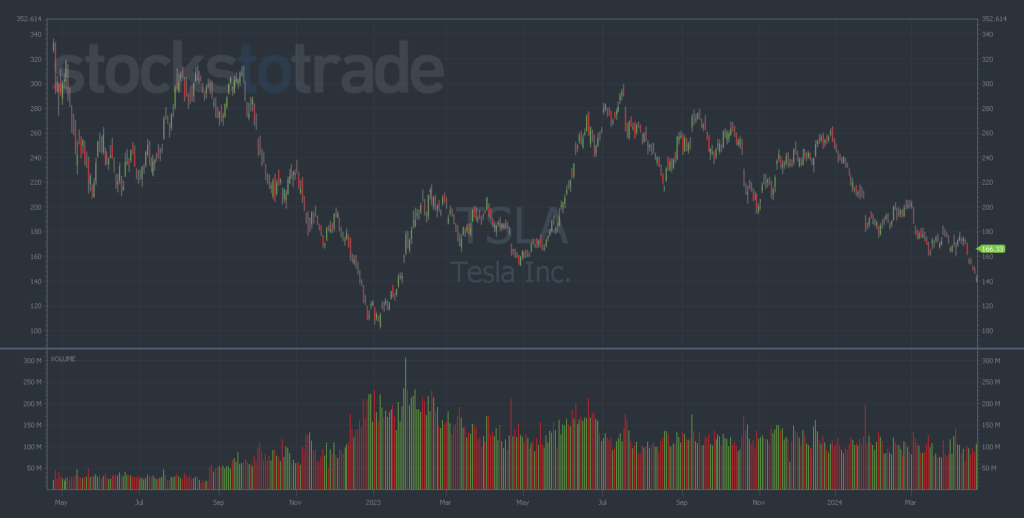

But TSLA has been a horrible stock to own for the past two and a half years.

A lot of this comes down to electric vehicles losing their novelty and TSLA shedding market share as its competitors catch up.

The company has cut prices, fired employees, and canceled crucial projects.

Needless to say, the fundamental story behind TSLA isn’t great…

And it’s really fascinating to observe how the times have changed.

Back in 2020-2022, TSLA was the ultimate super-growth stock. It was like the NVDA of the pandemic rally.

The narrative was that everybody would buy a Tesla, but that simply didn’t happen.

Now that we’re on the other side of that speculative euphoria, the story has changed.

However, when TSLA reported earnings earlier this week, it presented a beautiful contrarian trading setup.

I talked about this in my last Daily Strike Alliance webinar, but a lot of traders missed this golden opportunity.

To make sure you don’t miss the next one, let me show you how you could’ve potentially made 230% on TSLA earnings…

How I Identified the Setup

First things first: When we’re talking about TSLA, we have to remove our fundamental biases.

Maybe you like Elon Musk, maybe you don’t. I don’t really care, nor should anyone else.

What I do care about — and what you should always think about when evaluating trades — is what I can make money on.

What is the probability of a big move happening and in what time frame?

(Think about that as we look at this setup from earlier this week.)

When April began, TSLA was trading near $180. By the time the earnings report was released on Tuesday, it was in the $140s — down about 20% in three weeks.

And it’s even worse when you zoom out further. At the beginning of this week, the stock has lost 43% YTD — down $35 this month and $100 since the start of the year:

This presented a very juicy opportunity heading into the earnings call.

Let’s look at the 4/26/24 $145 weekly call options, which were basically at the money on Tuesday.

These contracts were trading for $6.80 going into earnings. But the market makers were pricing in an 8.2% move. That means to break even, we would’ve needed the stock to trade above $150.

I was looking back at prior earnings moves for TSLA, and they were all bigger than 8.2%.

The past four earnings moves looked like this: -12.3%, – 9.3%, -9.2%, -9.2%.

You don’t have to be a rocket scientist to see that all four moves were larger than 8.2%.

Thinking the move could outpace the expectations, it was a matter of picking a direction.

Why TSLA Calls Surged 230% Overnight

At this point, I’m asking myself: Is TSLA more likely to go up or down after earnings?

Well, looking at how beaten-down the chart was heading into Tuesday, I figured most of the bad news had to be priced in.

Looking at levels, I figured a move to $160 was possible (maybe even probable) on a snapback.

I was watching the $160 level for two reasons:

- The stock had been trading there just a week before the earnings call…

- This level was just outside of the expected move window of 8.2%…

Lo and behold, look what happened on Wednesday:

TSLA surged 15% and the 4/26/24 $145 calls went from $6.80 to a high of $22.97 — up 230% overnight:

More and more, this is how this earnings season is going…

If the chart is stretched to the upside going into the call, the stock is far more likely to drop (regardless of the numbers).

Contrarily, a stock like TSLA — already completely decimated before its earnings call — has a far higher probability of bouncing.

Think about these possible earnings moves based on how stretched the stock is to the upside (or the downside)…

Then, ask yourself: Where is this stock most likely to trade based on new information?

We’re not investors, we don’t buy and hold based on the content of a single earnings call.

We’re traders, and this earnings season is providing some insanely good opportunities if you know how to play them.

Happy trading,

Jeff Zananiri

P.S. Most traders are all but guaranteed to lose money during earnings season…

But by following my unique method for finding trade ideas, savvy traders now have the chance to witness double and even triple-digit gains like:

+69% on BKR in 1 Month

+85% on ORCL in 1 Month

+153% on META in 1 Month

+210% on WKHS in 1 Month

+423% on COG in 1 Month

(Just to name a few…)*

Discover the key behind my “Calendar Stocks” edge in the markets — CLICK HERE TO GET ACCESS NOW.

*Past performance does not indicate future results