Happy Wednesday, traders.

Ben here.

For the most part, trading is an individual sport.

You sit by yourself in a room full of screens, reading charts, watching scanners, and making trades.

Up to a certain point, trading on your own is a good thing. It forces you to learn valuable skills without relying on outside assistance.

But eventually, every trader needs help and support.

If you think you can master the options market all by yourself, more power to you. That said, if you really felt that way, you probably wouldn’t be reading this.

If you only consult yourself for advice, you might fail to identify your errors. It’s difficult to have an objective view of your own trading.

But luckily, there’s a way to potentially catch those mistakes before taking big losses, by embracing the concept of team trading…

Learn from Your Trading Friends

In the stock market, it’s a huge advantage to have trading friends — peers (or mentors) who can provide unbiased insight and feedback into your performance.

Peer reviewing your recent trades with a trusted trading partner can give you a fresh insight into your trading strategy.

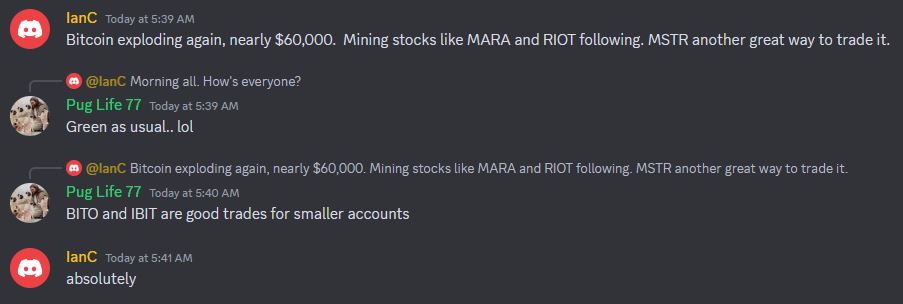

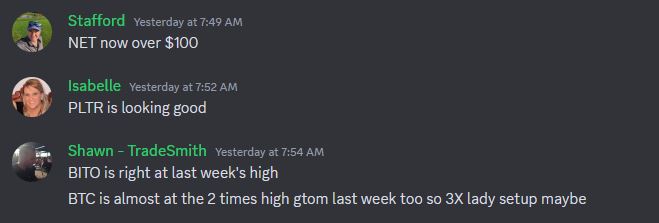

This is one reason why I created my Discord server — sharing select trades, strategies, and outcomes can lead to constructive feedback.

Your friends might spot mistakes that you completely overlooked.

An outside perspective is often less biased and can offer a fresh viewpoint on your trading habits.

That’s why it’s so important to learn from multiple traders.

Look for not one, but a few trusted confidants in our community — traders whose outlook you admire and agree with.

I’m not suggesting that you copy other people’s trades or chase alerts. (Don’t do either of these things.)

Instead, pick the specific parts of our Discord members’ strategies that you identify with and implement them into your overall game plan.

Don’t be afraid to ask questions or respond to others when you have valuable feedback. That’s the entire goal of team trading.

3 Ways Team Trading Can Help You Win

When I was playing Division I basketball, I learned the vital importance of teamwork.

I could practice my individual fundamentals all day to perfection.

But if we didn’t practice as a team, we didn’t win.

And while trading may seem more like golf, where it’s all up to your swing, I think you’ll do yourself a disservice by thinking this.

Start thinking about the market more like basketball, where your teammates can potentially alley-oop a slam-dunk opportunity right to your fingertips.

Here are three specific ways that team trading can benefit you:

Exposure to Different Trading Styles

By collaborating with others, you can learn about different trading styles and strategies, allowing you to diversify your own approach.

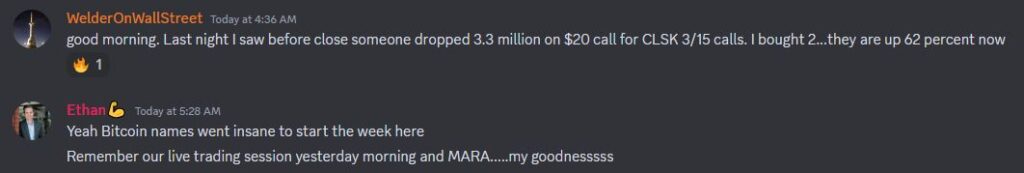

Traders in my Discord may bring up an idea you never would’ve considered or look at a chart with a unique perspective.

There’s a lot to gain from opening your mind to the way other people trade.

Emotional Support

Trading can be a rollercoaster of emotions.

Being part of a team provides emotional support during tough times and motivation during periods of success.

This camaraderie can help you maintain your discipline and focus when your emotions are moving your mindset in the wrong direction.

Accountability

Most importantly, team trading can foster a sense of accountability among Discord members.

You’re more likely to stick to your trading plans and strategies when you know your peers will be reviewing the results.

This accountability can discourage impulsive decisions and promote more disciplined trading.

What You’re Missing in My Discord Server

Team trading doesn’t provide much value if you aren’t actively communicating with your trading friends every day of the week.

But you don’t have to worry about that in our Discord community…

I’ve been blown away by the sheer amount of setups, knowledge, and wisdom that’s being shared.

I would’ve killed to have a resource like this when I first started trading…

There’s a lot to learn in the options market, too much for any trader to discover all on their own.

Open your eyes to what other Spyder members are doing and learn from them.

You never know … If you embrace team trading, you just might stumble upon a strategy, setup, or pattern that changes your entire career.

And speaking of incredible strategies, let’s take a look at:

💰The Biggest Smart-Money Bets of the Day💰

- $3.96 million bullish bet on GOOGL 04/19/2024 $140 calls @ $4.75 avg (seen on 2/27)

- $2.53 million bullish bet on TSLA 03/01/2024 $205 calls @ $3.55 (seen on 2/27)

- $2.1 million bullish bet on CCJ 04/19/2024 $43 calls @ $2.10 (seen on 2/27)

Happy trading,

Ben Sturgill

P.S. Here’s another great opportunity to share trading ideas with the community…

TODAY, February 28 at 12 p.m. EST — my colleague Danny Phee is hosting a LIVE WEBINAR where he’ll reveal the most promising ‘smart money’ trades we’re seeing this week.

Don’t miss out — CLICK HERE NOW TO RESERVE YOUR SEAT.