Happy Easter Monday, traders…

Jeff here.

A famous quotation says, “Those who forget their history are doomed to repeat it.”

My colleague, multi-millionaire trader Tim Sykes, has an even simpler version for traders — “Know your history!”

There’s a reason these lessons hold so much truth for traders: recent history can give you hints about where the market is heading.

And right now, understanding history is crucial because 2024 isn’t like any other year — it’s an election year.

U.S. presidential elections have a huge impact on stock market performance. Who sits in the Oval Office has wide-ranging effects on global markets, central banks, foreign policy, and more…

As we get closer to Election Day, traders will speculate about who may win and adjust their holdings accordingly.

Then, when the results come in, the market faces one of the most consequential catalysts of the past several years.

And the 2024 election is primed to be unique for the market. This time, there’s a $2 Trillion Shock working behind the scenes…

It’s why eighty of Wall Street’s biggest players — including banks like Citi, JP Morgan, and BlackRock — are ALL moving their money NOW.

SPOILER ALERT: They already know the secret I’ll reveal to you today…

And by the time this news breaks inside the Capitol, it’ll be complete chaos.

The Stock Market and Election Years

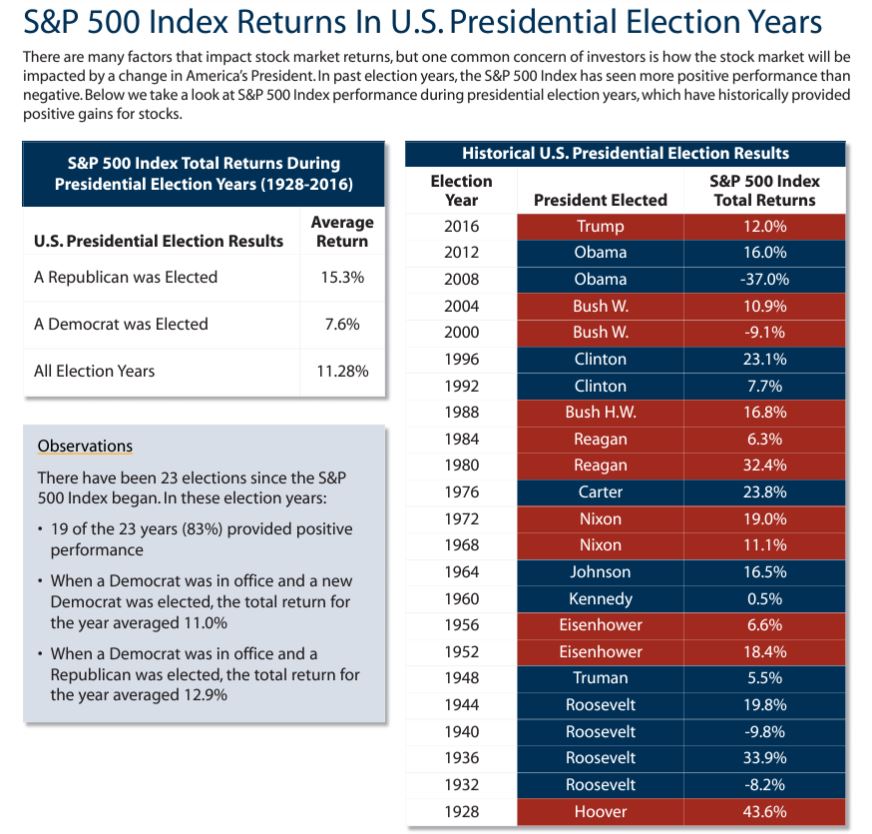

It’s important to know that election years are usually positive for stocks.

Take a look at this breakdown:

As you can see, 83% of election years have seen positive stock market gains.

And so far, this year is no different…

The SPDR S&P 500 ETF Trust (NYSEARCA: SPY) is already up more than 10% in 2024.

This is a huge return after three months, considering that the SPY usually returns around 10% per year.

Recently, I’ve been theorizing about what’s causing the endless bullishness in the market…

And while I still think the younger generations’ gambling mentality and extremely high housing prices are contributing to market gains, I’d be remiss if I didn’t consider how much the impending election is playing into the price action.

The impending price action may shock some … but we’re going to be prepared while the rest of the market is scrambling.

The Year of the Stock Picker

As we get closer to November, we’re likely to move away from a broad-trend-driven market.

Instead, the focus will shift to a more discerning approach.

You’ll likely need to zoom in on specific sectors and individual stocks as the market won’t be about riding a giant wave anymore — it will be about skillful and tactful navigation.

In this environment, paying attention to hedge fund strategies becomes more important.

Active management will take center stage, where entering and exiting positions at the perfect time will be crucial.

Tactical management will also be vital, involving nuanced decision-making and a keen eye for market signals.

In other words, I think this will be the Year of the Stock Picker.

In such a landscape, depending on the market to compensate for a lack of strategy (or poor stock selection) is like walking a tightrope without a safety net.

CAUTION: Don’t find yourself in this situation…

My message for 2024 is simple: Do your homework and know your history.

Understanding the fundamentals of the companies you’re trading, staying updated with election-year trends, and having a clear strategy are non-negotiables.

Every trade you make should be backed by thorough research, a well-founded strategy, and a clear understanding of the risks involved.

Backtest the sector (or stock) you’re looking at against prior election years — noting how it reacted — before making any rash decisions.

Patience and discipline will be key virtues in navigating this election-year market.

But more than anything, it’s about harnessing the power of the upcoming $2 trillion shock…

The $2 Trillion Shock

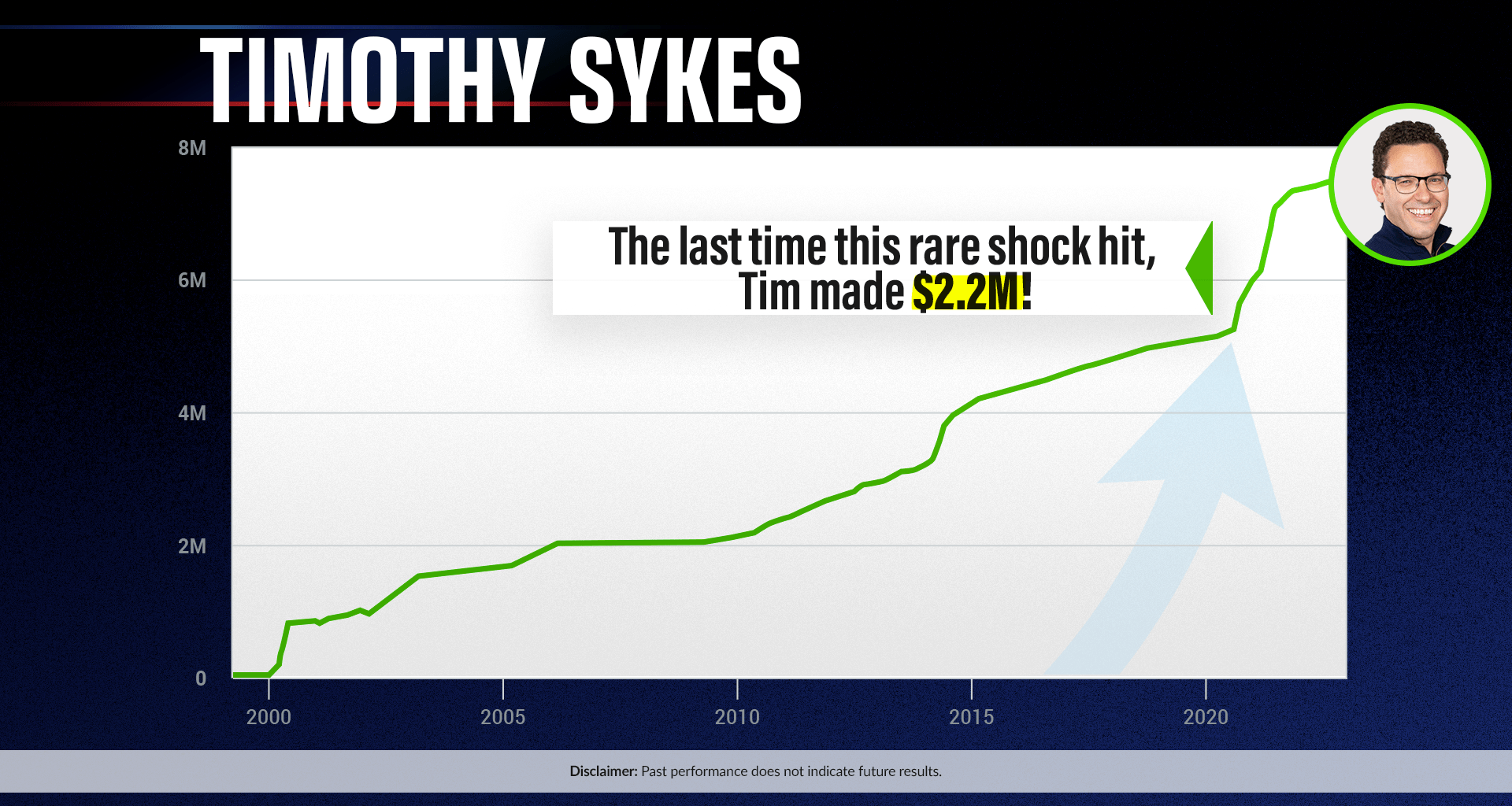

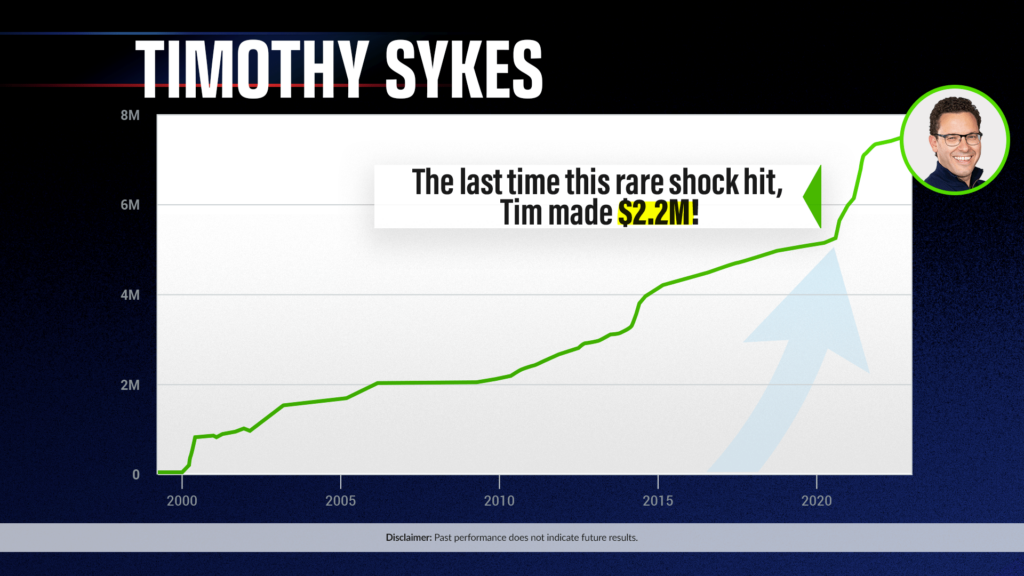

My buddy Tim Sykes is a legend at trading election years…

The last time this “shock” hit, he had the best run of his trading career — generating $2.2 million in profits…

But you don’t need 20+ years of trading experience, like Sykes and me, to take advantage of these incredible, election-based price swings…

Two of Sykes’ top students, Jack Kellogg and Matt Monaco, were also able to hit the $1 million trading mark.

So I strongly urge you to join Sykes when he goes LIVE this Thursday.

He’ll be giving away a radically different type of trade you can make immediately, for free.

And instead of being blindsided like most people in the next 30 days…

You could have a chance to see a potential 300% peak move — the day after our event.

But only if you know how to act Thursday night. Otherwise, you’re going to get left out…

I expect to see you there…

This THURSDAY, April 4 at 8 p.m. EST — CLICK HERE TO RESERVE YOUR SEAT.

Happy trading,

Jeff Zananiri