Happy Tuesday, traders…

Jeff here.

A real curveball has been thrown into the market this week…

Just as traders were getting excited about the 50 basis point interest rate cut, China decided to shake things up in a major way…

In typical fashion, the Chinese government is determined to send a message to investors and traders around the world.

After all, when it comes to economic stimulus, nobody loves throwing a “stimmy party” more than the Chinese Communist Party (CCP)…

But even for them, China’s latest move has been especially aggressive.

The CCP rolled out massive support for its real estate sector, offering huge margins for stock trading and even floating the idea of a government-backed stock equity fund.

These bold actions led to Chinese stocks having their best day in 16 years, leaving institutional investors and hedge funds scrambling to keep up.

So, what does all this mean for your trading? It’s not what you think…

Today, we’ll break down China’s big stimulus push and why it’s causing such a stir in the stock market.

I’ll also show you why hedge funds are getting caught off guard, how it led to the largest short squeeze since COVID-19, and what it could mean for your trading strategy…

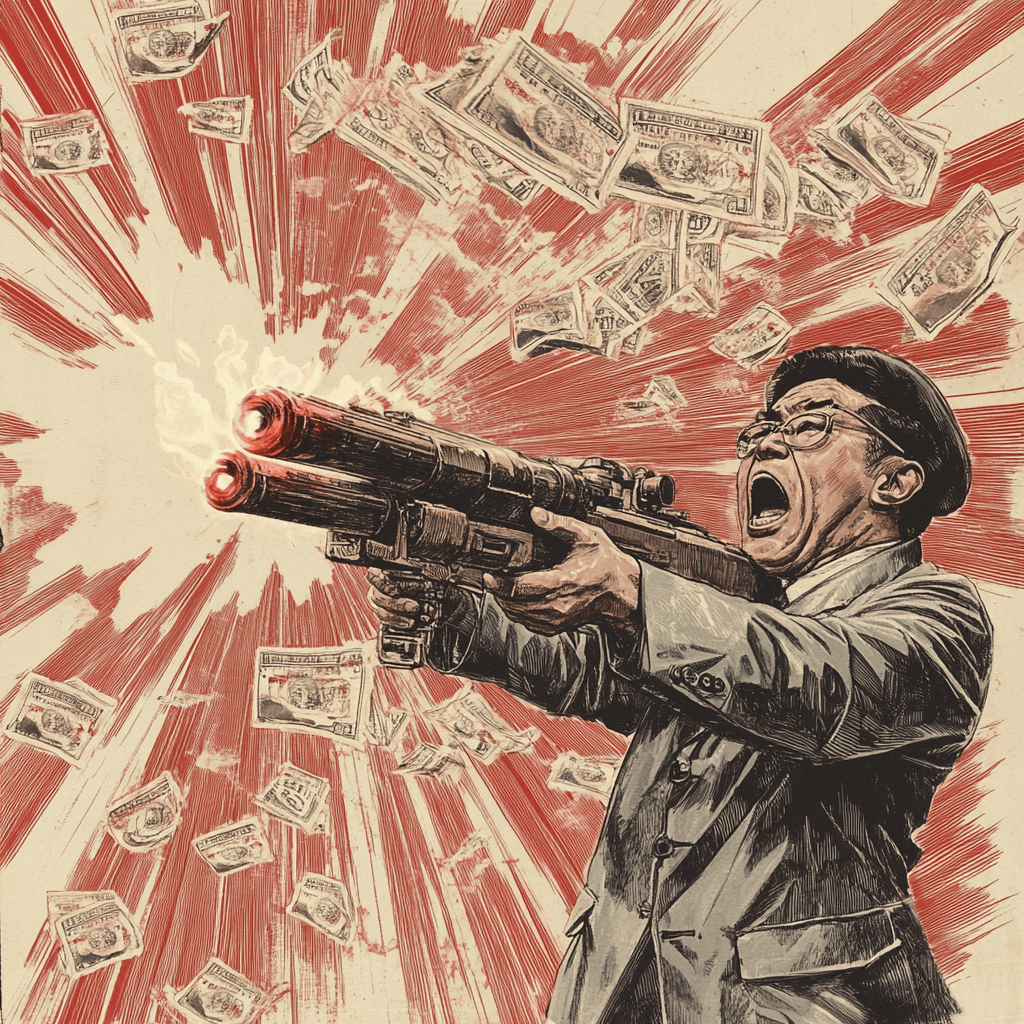

China Pulls Out the “Bazooka”

China’s economy has serious problems, particularly in the real estate sector.

With slowing growth and mounting debt, the Chinese government knew it needed to act fast.

So, the CCP has pulled out what some are calling the “Bazooka,” a massive injection of funds aimed at supporting the struggling real estate market…

This move was designed to show the world that China is willing to do whatever it takes to keep its economy stable.

But the CCP didn’t stop there…

They’ve also made it easier for people to borrow money to trade stocks, offering huge margins for stock purchases.

On top of that, they’ve floated the idea of creating a government-backed stock equity fund, which would help prop up the stock market even further.

These measures signal that the CCP is serious about supporting its economy and keeping traders interested in owning Chinese stocks…

Hedge Funds Are Caught Off Guard

While these moves by China have sparked optimism among some traders, others have been caught completely off guard — especially hedge funds.

And when hedge funds find themselves uncertain, confused, and off-balance — they make mistakes, which open up incredible trading opportunities for us.

I’ll be alerting some massive Burn Notices in the next few weeks. Don’t miss them — Click here now to join the Burn Notice Alliance.

You see, over the last several months, many hedge funds were positioned to profit from China’s economic struggles, betting that the slowdown would continue.

But with China’s aggressive stimulus measures, those bets have gone up in flames…

The result has been an enormous short squeeze in Chinese stocks, one of the largest we’ve seen since the early days of COVID-19.

This squeeze has been so violent that it’s even helped keep the broader global market afloat.

The surge in Chinese stock prices has created an “Uber bid,” with many foreign investors — particularly those in the U.S. — pouring money into Chinese markets.

Trillions of U.S. dollars are now flowing into China, adding fuel to the rally…

A Sea Change in the Stock Market

As China’s stock market heats up, many investors are shifting their focus from the U.S. to international opportunities.

Over the past five years, the U.S. has been the go-to market for most investors, particularly in the tech sector.

You would’ve been called crazy for trying to trade anything outside of the U.S., especially in China…

But now, with China’s stimulus efforts driving a massive rally, traders are taking a step back, looking at the big picture, and rethinking their strategies.

One of the key trends to watch is the relationship between U.S. and Chinese equities, particularly the “Magnificent Seven.”

Tech stocks like Nvidia Corporation (NASDAQ: NVDA), which is still up 148% YTD, are starting to feel the impact of this shift.

Traders are selling off shares in these big tech names to fund their positions in Chinese stocks, creating a fascinating (and tradeable) sea change in the global equity market.

What’s Next?

The relationship between U.S. and Chinese stocks is one of the most important dynamics to watch in today’s market.

As China continues to stimulate its economy, I expect more traders and investors will shift their focus away from the U.S. and toward international opportunities.

But this regime change also raises questions about the future of U.S. tech stocks…

The “Magnificent Seven” have been unstoppable for years. But with capital flowing out of the U.S. and into China, it’s unclear how long they’ll be able to maintain their position at the top.

For traders like you and me, understanding these trends will be crucial to navigating the markets in the months to come.

Stay tuned.

Happy trading,

Jeff Zananiri

P.S. See how my brand-new algorithmic trading system has delivered returns of 145% on QCOM, 235% on TECS, and even a staggering 900% on PBR.*

TOMORROW, October 2 at 7 p.m. EST, StocksToTrade Lead Trainer Tim Bohen is joining me to reveal everything you need to know about my AI-powered GAMMA Code System.

Seats are limited — Click here to reserve your spot now!

*Past performance does not indicate future results