Happy Monday, traders…

Ben here.

One of the most challenging tasks you’ll face as a trader is filtering through the overwhelming amount of information bombarding you daily.

From market news to earnings reports to social media buzz, it can be difficult to determine what truly matters — the signal — versus what is irrelevant — the noise.

Learning how to sort the signal from the noise is critical to becoming a winning trader. The market thrives on information, but not all information is created equal…

This is especially important in the era of trading Discords, message boards, and Reddit “due diligence.”

I can’t tell you how many times I’ve seen someone post a chart comparison on Reddit, claiming the current market is exactly like period X, Y, or, Z (and the charts will catch up) … only for that prediction to go up in flames.

Take a look at this guy, for example:

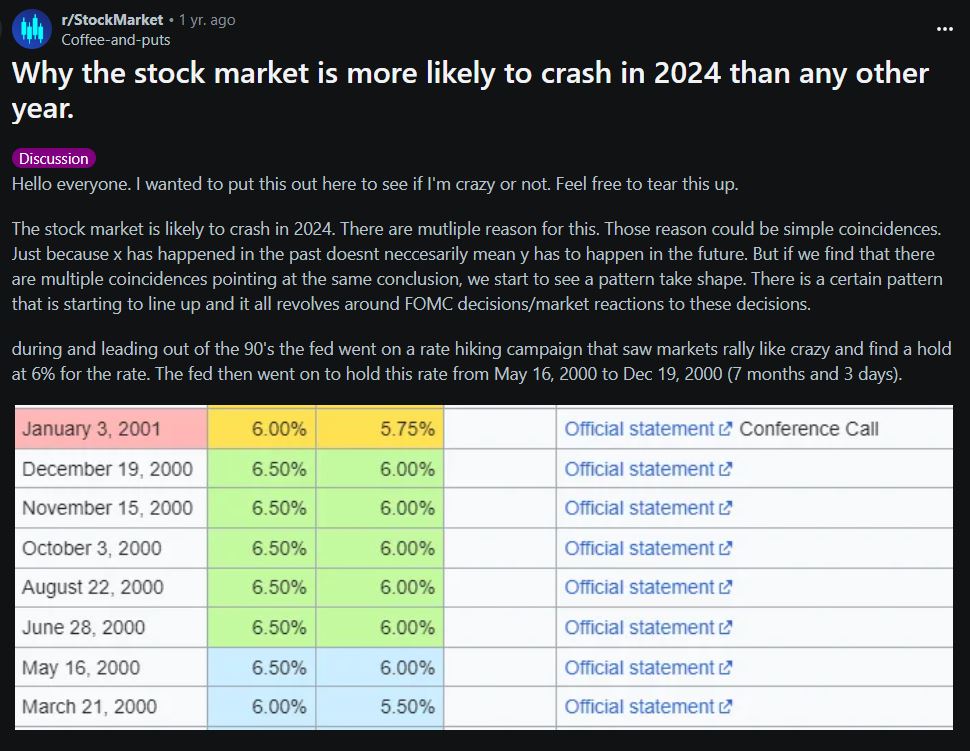

Towards the end of 2023, Reddit user u/Coffee-and-puts posted a five-page, 1500-word “due diligence” post on r/StockMarket predicting the market was “likely to crash in 2024.”

He based his thesis on the Fed’s interest rate cycle, which he claimed correlated perfectly with the 2000 market crash.

SPOILER ALERT: u/Coffee-and-puts was dead wrong. A crash didn’t happen — quite the opposite. The S&P 500 has soared 21% in 2024.

Had you trusted this faceless stranger, you would’ve made a horrible trade — and missed out on massive gains on the long side.

The lesson here is simple…

If you take everything (or anything) you hear online as gospel, you’re bound to enter trades that are under-researched, mistimed, or even worse, based on completely incorrect information.

Stop wasting mental energy on the wrong information. Let me show you how to sort the signal from the noise…

What is Signal vs. Noise?

First, it’s important to understand what I mean by “signal” and “noise” in trading.

Signal refers to meaningful and actionable information — headlines that can directly affect the stock market (or the price of a specific stock).

Signal often comes from fundamental data, changes in economic policy, or technical indicators that reveal important market trends.

Noise refers to all the irrelevant or misleading information that may not have any long-term impact on the stock’s value.

Noise often comes from the constant media chatter, random price fluctuations, and emotional reactions to short-term events. In essence, noise is anything that distracts you from making sound trading decisions.

To crush the options market, you must be able to sift through the noise and identify the signal that truly matters.

Here’s how to do it:

Step 1: Reliable Data Sources

The first step to identifying signal: looking at reliable sources of information.

Not all news is created equal, and if you’re constantly listening to speculation and rumors, you’re setting yourself up for failure.

Reddit posts, tips from traders without track records, fund managers on CNBC talking their book — this is all noise.

Tune out the noise, and find the signal in reliable sources, like:

Official financial reports: Quarterly earnings reports, balance sheets, and corporate income statements are some of the most trustworthy pieces of information you can access.

Earnings reports: The numbers don’t lie, but the people who speak on conference calls can. Focus on the hard data in an earnings report (and how the market reacts).

Respected financial news outlets: Focus on outlets that have a reputation for in-depth analysis, such as Bloomberg, The Wall Street Journal, or Reuters, rather than relying on hype from social media or message boards.

The goal is to narrow down your sources so you’re only digesting useful signal that can help you assess the market accurately.

Step 2: Technical Analysis

In addition to monitoring reliable news sources, technical analysis can be a powerful tool to help separate signal from noise.

Charts allow you to focus on the actual movement of the stock rather than the emotions surrounding it.

Price and volume tell a story. A true story.

Here are some technical indicators that can help you filter out the noise:

Moving Averages: A simple moving average (SMA) or an exponential moving average (EMA) smoothens out price action, showing you the overall trend. If a stock is trading above or below a moving average, it can be a good signal of its strength or weakness. (Check out the 21-day EMA.)

Relative Strength Index (RSI): RSI measures the speed and change of price movements, giving you a clear picture of whether a stock is overbought or oversold. A chart with an RSI above 70 is generally thought to be overbought, while one under 30 is thought to be oversold. (I use the 14-day RSI on all of my charts.)

Volume: Share price is the king, but don’t sleep on volume. Large bullish price swings accompanied by high volume usually indicate a strong interest in the stock, which could mean a sustained trend. Conversely, moves on low volume are usually just noise.

Step 3: Plan Your Trade

I’ve said it before and I’ll say it again:

You must have a solid trading plan. A well-defined plan will give you the confidence to tune out the distractions and focus on your own system.

Have a plan, stick to your plan, and trade your plan.

This plan should include:

Entry and exit rules: Clearly defined rules for when you’ll enter and exit trades will prevent you from making impulsive decisions based on short-term noise. Know your price target and your risk level before entering any trades.

Risk management strategies: Set stop-loss levels and take-profit points to ensure you don’t let emotions sway your trades. Noise often leads traders to second-guess their decisions, but having predefined risk controls will help you avoid emotional trading.

(You can see my complete step-by-step day trading routine right here.)

As a trader, distinguishing signal from noise can be the difference between success and failure.

By focusing on reliable data sources, using technical analysis, sticking to your trading plan, and being mindful of emotional biases — you’ll start to tune out the distractions and zero in on the information that really matters.

In an era where information overload is the norm, those who can sift through the noise and act only on clear signal have an enormous edge over those who can’t.

Before we go, let’s look at:

💰The Biggest Smart-Money Bets of the Day💰

- $4.5 million bullish bet on DHI 11/15/2024 $170 calls @ $4.45 avg. (seen on 11/1)

- $3.7 million bullish bet on LEN 11/15/2024 $175 calls @ $3.70 avg. (seen on 11/1)

- $2.7 million bullish bet on KWEB 01/17/2025 $30 calls @ $3.82 avg. (seen on 11/1)

Happy trading,

Ben Sturgill

P.S. It’s time to stop playing guessing games and flipping coins during earnings season…

…And start using Earnings Edge to see whether a company will beat or miss before the market catches on.

For example: Earnings Edge projected a 95.9% earnings beat probability on Taiwan Semiconductor Inc. (NASDAQ: TSM) … the day before its 10/25/2024 $195 call options exploded by 208%!*

TOMORROW, November 5 at 1 p.m. EST, I’m hosting a LIVE Earnings Edge Workshop to break down how you can weaponize this strategy THIS WEEK.

Seats are filling up quickly — Click here to lock in your spot before it’s too late!

*Past performance does not indicate future results