Happy Tuesday, traders…

Jeff here.

Just like a rising chart can cause FOMO (fear of missing out) buying, a falling market can spiral into a vicious cycle of selling triggered by the FOLM (fear of losing money)…

And that’s exactly the kind of environment we’re in right now.

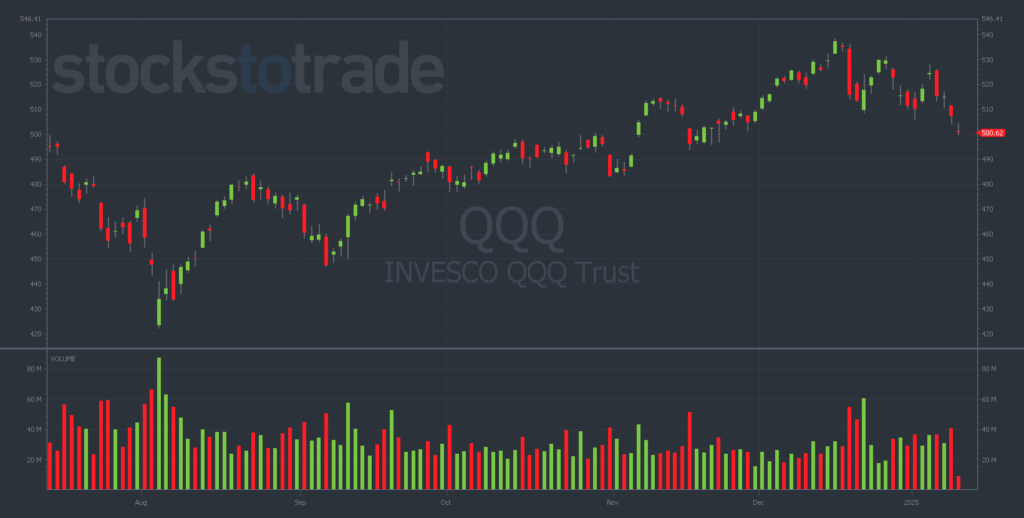

The week opened with more bearishness, with the Nasdaq now 7% off its December 16 highs:

And treasury yields won’t stop climbing…

Add these ingredients together, and you’ve got a recipe for major downside — especially in high-flying growth stocks.

To make things worse, it’s not just the overextended individual names getting hammered…

Entire sectors are unraveling — semiconductors are hitting multi-month lows, crypto’s taking a brutal hit, and high-beta hedge fund darlings are collapsing.

Meanwhile, traders are staring down the barrel of Wednesday’s Consumer Price Index (CPI) core inflation number — a single data point that could swing the market massively in either direction.

If you’re wondering how to trade an environment like this, I’ve got you covered…

Let’s unpack the key drivers behind this selloff — and go over how to insulate your portfolio from destruction…

Why the Market is Selling Off

The market opened the week in rough shape, with the Nasdaq down another 1.5% on Monday morning…

If you’re wondering what’s going on, stocks are tanking for three main macroeconomic reasons:

- Inflation is still stubbornly high.

- The job market is still piping hot.

- Treasury yields are surging — even following rate cuts — with no signs of letting up.

This perfect storm of bearishness is putting a tight squeeze on growth stocks and dealing a major blow to some of 2024’s biggest winners.

Even the once-unstoppable semiconductors are taking it on the chin. Sector leader Nvidia Corporation (NASDAQ: NVDA) has dragged the whole group lower, and we’re now seeing multi-month lows.

There was a little glimmer of hope in Advanced Micro Devices Inc. (NASDAQ: AMD) on Monday, as it was marginally green on a day when all of its peers were red, showing relative strength. It looked like it might be bottoming out, but we’ll have to see if that sticks.

For now, semis are firmly in the bears’ grip.

Crypto is no better. Bitcoin (BTC) has been slammed back into the low $90,000s, wiping out much of the speculative gains that had built up over recent months — and names like Coinbase Global Inc. (NYSE: COIN), Marathon Digital Holdings Inc. (NASDAQ: MARA), and Riot Platforms Inc. (NASDAQ: RIOT) are down even more.

Something to note: The sectors suffering the most are the ones that hedge funds had piled into for high-beta, post-election plays. In these corners of the market, this isn’t a minor pullback — it’s a full-scale washout.

Quantum stocks, rocket stocks, crypto stocks, and software names have all been getting absolutely demolished over the past several sessions.

As I mentioned earlier, selling feeds on itself.

Just like FOMO drives euphoric buying in a rally, fear of loss creates a cascade of selling in a decline.

Traders panic, sell into weakness, and the downward spiral accelerates. It’s like everyone in a crowded theater rushing for a tiny exit door.

Once the panic sets in, it’s a mad dash to escape before the guy next to you…

It’s human nature, and it’s part of why the market can feel so brutal during periods like this.

But remember: The market has an uncanny ability to catch everyone off guard at the most unexpected moment. Just when everything seems the most hopeless, BAM — there will be a face-ripping relief rally that destroys Zero-Days-to-Expiration (0DTE) puts.

Now, the next big catalyst is Wednesday’s CPI number. This isn’t just another data point. It’s one of the most important indicators of inflation, and in a market this sensitive, it has the potential to move the major indexes up or down, a lot.

A low CPI number could give the bulls some much-needed relief, while a high number will likely deepen the blood-red we’re already seeing.

How to Trade This Environment

First: You’ve got to be hedged…

If you’re sitting in long-only positions right now, you’re probably miserable. Watching call premiums erode while “holding and hoping” for a miracle reversal is not a winning strategy. You need to have both calls and puts in your portfolio to stay balanced and protected against sudden moves in either direction.

Second: Don’t be afraid to get stopped out, but keep trying…

This is a market where you need to be nimble. If a trade isn’t working, cut it and move on. The worst thing you can do is let ego or stubbornness keep you in a losing position.

If one trade doesn’t work, rinse and repeat. This market is punishing, but it also rewards persistence. You don’t need to hit a home run — you just need to keep swinging at good pitches.

Third: Don’t chase overextended moves…

Buying into the top end of a relief rally or shorting aggressively after a major drop is just asking to get burned by a sharp reversal. At the same time, don’t try to guess the bottom and load up too soon. This market demands patience and discipline.

Looking ahead, the upside feels capped in the short term unless we get a strong catalyst like a surprisingly low CPI number.

But oversold markets can also bounce hard, so don’t get too comfortable betting in either direction.

The key is to stay balanced and flexible, without letting emotions cloud your judgment. Don’t be a perma-bull or perma-bear.

The people who come out ahead in markets like these aren’t the ones clinging to a single narrative.

They’re the ones who adapt, stay open-minded, and use the tools at their disposal, like my GAMMA Code system.

This week is a real test of your strategy and discipline. Be careful. Traders will be made and unmade in this tape.

Stay nimble, stay hedged, and stay in the game…

Happy trading,

Jeff Zananiri

P.S. My algorithmic trading system — the GAMMA Code — has already delivered returns of 145% on QCOM, 235% on TECS, and even a staggering 900% on PBR…*

If you want to start finding trades like these before they take off, you’ve come to the right place…

TOMORROW, JANUARY 15 at 12:00 p.m. EST, my buddy Danny Phee is joining me for an URGENT LIVE EVENT where we’ll be revealing the biggest GAMMA trades we’re making this week.

Let AI help you find triple-digit trades — Click here to reserve your spot now!