Happy Thursday, traders.

Jeff here.

Over 25 years of professional trading, I’ve created an edge for myself by having a clear understanding of big-picture economic information.

My experience comes from the trenches of Wall Street, where I was part of a trading team that turned $5.1 million in seed money into more than $700 million in live, real-money trading.*

This rich source of knowledge acts like a roadmap, helping me navigate the complex maze of the global stock market — a place where every decision can mean the difference between a massive win and a demoralizing loss.

And considering that the Federal Open Market Committee (FOMC) meeting just concluded, your understanding of the “macro big-picture” is even more important over the next few days.

That said, I get that understanding macro trading may seem like a daunting task…

Luckily, I’m here to help. Today, I’ll show you a few simple steps towards becoming a macro trading mastermind.

FOMC: The Aftermath

Yesterday, following the conclusion of the FOMC meeting, Federal Reserve Chairman Jerome Powell held a press conference to confirm the central bank’s stance on interest rates.

Unsurprisingly, the Fed decided to keep rates unchanged while hinting at future rate cuts.

Frankly, this is exactly what everyone was expecting — but don’t let that fool you.

The SPDR S&P 500 ETF Trust (NYSEARCA: SPY) surged into a mini-breakout to a new all-time high of $520.44 (at the time of writing).

So far, the market seems to be telling the Fed “We don’t care anymore, we’re still buying.”

But over the next few days, market participants will be parsing every word that spilled from Powell’s mouth.

WARNING: This may lead to a delayed reaction in the stock market — a phenomenon that is often followed by some incredible Burn Notice trading opportunities.

But all this will mean nothing to you if you don’t have a strong grasp on certain macroeconomic indicators…

3 Macro Indicators to Watch Closely

As the market digests Powell’s comments over the coming days, consider the following:

Follow the Money

- Understand the importance of the U.S. Dollar as the world’s reserve currency and its pivotal role in the forex market.

- Begin by learning how the dollar interacts with other key currencies like the Euro, Pound, and Yen.

- Recognize that grasping these currency relationships is crucial for successful global trading plans.

Watch Interest Rate Projections and Bond Markets

- Acknowledge the significant impact of interest rates and bond markets on currency markets and the broader economy.

- Observe the effects of interest rate decisions on the U.S. stock market.

- Learn about the role of the Federal Reserve in managing interest rates.

- Dive into the major bond markets in the U.S., Europe, and Japan to discover insights that affect the stock market.

Look at the Big Picture

- Develop a comprehensive view of the markets to create well-informed trading strategies across stocks, options, commodities, and currencies.

- Aim to understand the macro environment rather than focusing on short-term movements of individual stocks or sectors.

- Trust in your broader market strategy overreacting to short-term market signals or volatility.

- Consider larger economic catalysts and their effects on sectors or stocks to make more informed trading decisions.

Don’t be intimidated by macro trading … Start embracing the power of global market moves.

Happy macro trading,

Jeff Zananiri

P.S. I recently joined forces with three elite traders to build a REVOLUTIONARY trading tool…

That spots multiple 100%+ trading moves every day of the week…

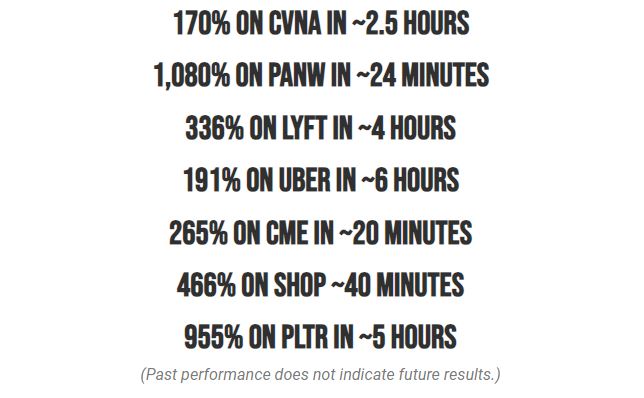

Like these recent 1-day moves it spotted:

TODAY, March 21 at 12:00 pm ET … you’re invited to a LIVE training session with me, where you’ll discover:

How this unique “Pathfinder” Phenomenon works and what YOU can do to take advantage of it.

CLICK HERE TO RESERVE YOUR SPOT NOW.

*Past performance does not indicate future results