Good morning, traders…

Ben here.

Tell me if this has ever happened to you: You find a setup that seems to fit your strategy perfectly…

But when it comes time to pull the trigger, you can’t do it.

The next day, you wake up to see that your “coulda, shoulda, woulda” trade has gone up triple-digits overnight…

It happens to the best of us. You failed to make your move in time and paid the price in missed profits.

If you’ve been trading for more than five minutes, I’m sure you’ve experienced something similar…

Sure, it’s better to miss a win than take a loss. But if you’re constantly missing wins, your inevitable losses will hurt that much more when they happen.

Pulling the trigger on a trade comes down to one word — conviction.

You need to have confidence that the setup has a higher probability of winning than losing.

And to do so, it helps to have certain requirements for every position you enter — a list of attributes you want every setup to contain.

For me, three factors in particular make a perfect options-trading setup.

I call them my “3-Item Checklist.”

SPOILER ALERT: I never would’ve nailed my recent 140% intraday win on Amazon.com, Inc. (NASDAQ: AMZN) if it wasn’t for my 3-Item Checklist.*

Today, we’ll break my checklist down so you can stop wavering in your convictions and start pulling the trigger at the ideal moment.

Checklist Item #1: Smart Money Volume

I’ve built my entire trading strategy around the idea of conviction.

I want an undeniable edge going into my trades, one that gives me the confidence to get in and out of positions whenever necessary.

And that’s exactly why I built my SPYDER Scanner and APEX Scanner…

By following Smart Money insiders into their huge options bets, I remove all the guessing games from my trading.

If my scanner shows millions of dollars being traded on a single contract, I know it’s not my boomer neighbor gambling his social security check — it means the Smart Money knows something we don’t.

It’s as if you were in an elevator on Wall Street and overheard two traders talking about their next big move. That information is priceless (and legal to act on).

But if you still doubt the power of Smart Money trading, let me show you an example that might change your mind…

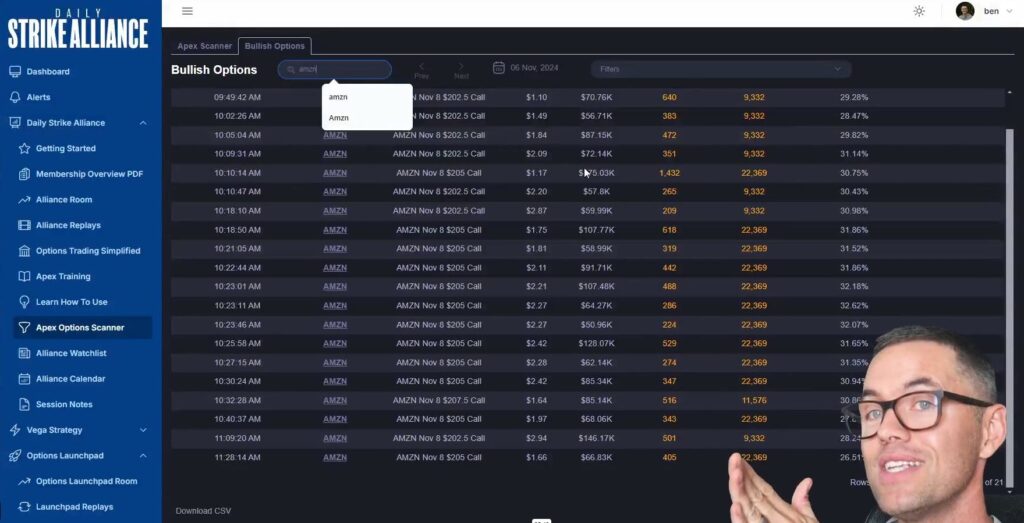

On Wednesday of last week (the morning after the election), I started noticing a huge amount of repeat bets being placed on AMZN 11/15/24 $202.50 Calls:

And when I see a ton of money betting on one strike, that grabs my attention…

Item #1: checked.

Checklist Item #2: Confirmation on the Chart

After seeing a big Smart Money sweep, I’ll move to the chart for confirmation.

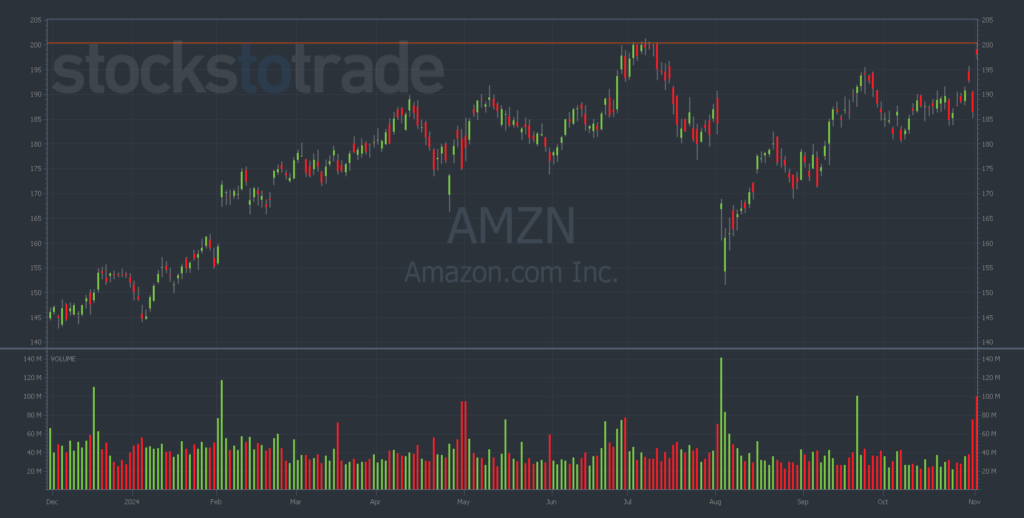

And on this Amazon chart, I was watching something very specific.

Throughout the summer, one price level proved to be serious resistance for Amazon — $200:

Why was $200 so hard for Amazon to break?

- It’s a key psychological level, a big round number, and sellers tend to take over around these numbers.

- Recent headlines said Jeff Bezos was selling $3 billion worth of stock (when it was trading around $200).

When a stock runs up, it eventually runs out of buyers. But conversely: when a stock starts to pull back, it eventually runs out of sellers.

While I was watching the Amazon chart on Wednesday, I was waiting to see the sellers run out at a test of $200.

I knew if it could stay above $200, the buyers would take over. I wanted confirmation that $200 had transformed from resistance to support.

And that’s exactly what happened on Wednesday…

The chart held $200 like a boss, turning former resistance into support, before climbing higher throughout the day…

Once again, confirmation on the chart leads to a winner.

Item #2: checked.

Checklist Item #3: News Catalysts

Items #1 and #2 are absolutely essential to me, I won’t enter a trade without them.

But Item #3 — a solid news catalyst driving the stock — is more of a cherry on top.

I don’t always need to see a news catalyst, but if there is one, that’s a huge bonus.

And speaking of breaking news…

StocksToTrade Breaking News Chat can help keep you up-to-date on the biggest market catalysts BEFORE the news guys hear about it…

Launch your trading with BreakingNews Chat + StocksToTrade — Get your first 2 weeks for just $7!

So, what’s the catalyst for Amazon in November? (Remember that online shopping is a seasonal business)…

You guessed it — Black Friday. The biggest sales day of the year is always a huge earnings boost for Amazon.

Unsurprisingly, the stock often has strong showings in November, as traders anticipate big Black Friday deal spending.

In other words, knowing this catalyst was approaching gave me that much more confidence to pull the trigger, which is what I did near the open on Wednesday morning:

I entered at $2.50 and scaled out four times throughout the day…

And just six hours after my initial entry, I exited my final scale at $6.00:

That’s a 140% win in six hours, all thanks to my checklist.*

Item #3, checked.

The idea is to know what you’re looking for in the options market.

With hundreds of thousands of contracts to choose from, you can’t blindly buy whatever looks good that day.

But if you start working with my checklist, I bet you’ll find those setups have a far higher win rate.

If you want to start nailing trades like my 140% Amazon win, there’s only one place to start:

💰The Biggest Smart-Money Bets of the Day💰

- $4.9 million bullish bet on AMZN 12/20/2024 $210 calls @ $5.25 avg. (seen on 11/12)

- $4 million bearish bet on TLT 12/20/2024 $90 puts @ $1.22 avg. (seen on 11/12)

- $2.8 million bullish bet on XLF 12/20/2024 $53 calls @ $0.19 avg. (seen on 11/12)

Happy trading,

Ben Sturgill

P.S. My 140% win* on Amazon was fantastic, but I think even bigger trades are right around the corner…

TONIGHT, November 13 at 7:00 p.m. EST, my buddy Danny Phee is hosting a LIVE WEBINAR for the Daily Strike Alliance where he’ll be breaking down the most promising trade ideas we’re seeing in the options market right now, like…

170% on CVNA in ~2.5 hours*

1,080% on PANW in ~24 minutes*

336% on LYFT in ~4 hours*

191% on UBER in ~6 hours*

265% on CME in ~20 minutes*

466% on SHOP ~40 minutes*

955% on PLTR in ~5 hours*

Stop missing triple-digit trade opportunities — CLICK HERE NOW TO RESERVE YOUR SPOT!

*Past performance does not indicate future results