Good morning, traders…

Jeff here.

We’re less than two weeks away from one of the most important moments of your trading career…

You guessed it — the November 5 election is the biggest market catalyst we’ve seen in recent memory.

Elections always have consequences for markets. But this election is especially important for traders because of how drastically different the two candidates are.

Donald Trump and Kamala Harris have radically different plans for the economy, meaning their policies would have radically different effects.

Now that we’re just two weeks away from finding out who the next president is, you need to prepare for either outcome.

We want to make money no matter who wins the election.

But when you’re approaching such a massive catalyst — one that everyone on the planet is keenly aware of — you can’t just go with the obvious plays.

You need to think outside the box.

The straightforward election trades — like buying oil stocks for a Trump victory — are too overcrowded. Millions of traders have already front-run those trades.

If you really want to have an advantage during one of the most anticipated market catalysts in years — you need to find setups that the rest of the market is sleeping on.

With that in mind, let’s go over four high-probability trade ideas for each potential election outcome…

If Trump Wins…

Crypto Keeps Moving Higher

If Trump wins, one of the major plays I’m looking at is cryptocurrency, specifically Bitcoin (BTC).

Trump has been very vocal about his support for crypto, which in and of itself could cause coins to soar on the back of a Trump victory.

He even rolled out his own cryptocurrency last month.

And you’ve gotta think Trump would likely get rid of people like SEC Chairman Gary Gensler — a huge enemy of the crypto industry.

With a Trump White House, I think BTC could reach $100,000 in 2025.

Coinbase Could Go to $300

While the whole crypto space could rally, I’m focusing on Coinbase Global Inc. (NYSE: COIN).

We’ve seen a pattern here before — last time Bitcoin hit $70,000, Coinbase was trading at $300.

So, if BTC does shoot up after a Trump win, I wouldn’t be surprised to see Coinbase climb back to $300 in 2025.

It’s the largest crypto exchange and the most compliant with federal regulators.

And with regulators starting to crack down on some of the riskier crypto platforms, COIN stands out as a safer bet. If crypto rallies, Coinbase is set to benefit in a big way.

Avoid the smaller, speculative cryptocurrencies. The best crypto bet for a Trump win is in large, established names like Coin and BTC.

Don’t get caught chasing waterfalls in high-risk cryptos. Stick with the big boys.

If Harris Wins…

If Kamala Harris wins, we’re likely to see more of the current economic environment continue without any drastic changes in the short term.

But that doesn’t mean there aren’t juicy trading opportunities looming in such a scenario…

The Gold Trade

Gold is already starting to break out, currently trading around $2,700. And I believe this trade is front-running a possible Harris victory.

(Remember Stanley Drucknemiller’s comments about inflation on Bloomberg at the beginning of the week…)

A Harris win, especially with a Democratic Congress, could lead to a highly inflationary environment.

Her policies would push for more spending and stimulus, adding fuel to the inflation fire.

Gold is traditionally used as a hedge against inflation, which is exactly why we’re seeing it rise now.

Traders are already preparing for a potentially inflationary Harris White House.

If she does win, I expect gold to have 30% more upside in 2025.

My Contrarian Defense Sector Trade

Historically, Republicans are the candidates of the defense sector…

Conservative administrations are usually more likely to get the U.S. involved in foreign wars (Iraq, Afghanistan, etc.)

But lately, there’s been a shift in this trend. Republicans are calling for the end of several foreign wars, while we’ve seen defense stocks perform extremely well under the Biden administration.

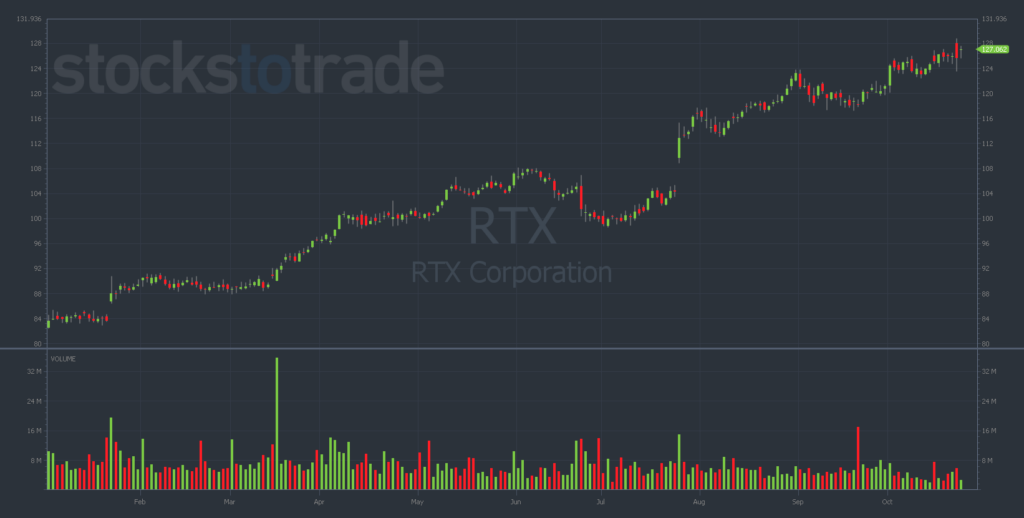

Let’s take Raytheon Technologies (NYSE: RTX) as an example. This stock is up 50% in 2024 alone…

That’s an incredible run for a defense company. But now, RTX is becoming historically expensive.

Its price-to-earnings ratio is currently at 23, way higher than its typical range.

Here’s my contrarian take — if Trump wins, we could see some of the current foreign conflicts get resolved, which could lead to a decrease in defense spending.

That would bring defense stocks like RTX, Palantir Technologies Inc. (NYSE: PLTR), and Lockheed Martin Inc. (NYSE: LMT) down from their lofty heights.

Defense stocks have been on a tear under Biden, but a Trump victory could change that trajectory.

This is a key point because many traders will expect defense stocks to rise if Trump wins (based on traditional assumptions).

But if the geopolitical conflicts stabilize under Trump’s leadership, defense companies could see reduced demand, causing those stocks to take a big hit.

(It’s not a bad idea to hold some put options on these names through the election. Consider expiration dates in January.)

Right now, it’s all about…

Thinking Outside the Box

When it comes to a market event as massive as this election, you can’t just follow the herd — because the herd will get slaughtered.

The obvious trades have already been front-run a thousand times over.

Finding the opportunities that most people aren’t looking at — like defense stocks potentially dipping with a Trump win — can set you apart from the 90% of traders who lose money.

Crypto, gold, and defense stocks — these are the sectors I’m watching closely as we approach the election.

Each scenario offers different opportunities. The key is to be flexible — ready to capitalize on either outcome.

By thinking creatively and considering trades others are ignoring, you can find an edge in what’s sure to be one of the most significant market catalysts in years.

And if you want more election trade ideas…

I appeared on SchwabTV this week and discussed this in detail with Nicole Petallides:

You can watch the full interview right here.

Happy trading,

Jeff Zananiri

P.S. My brand-new algorithmic trading system has already delivered returns of 145% on QCOM, 235% on TECS, and even a staggering 900% on PBR…*

If you want to start finding trades like these before they take off, you’ve come to the right place…

TODAY, October 24 at 8:30 a.m. EST, my buddy Danny Phee is joining me for an URGENT LIVE EVENT where we’ll reveal everything you need to know about my AI-powered GAMMA Code System.

Let AI help you find triple-digit trades — Click here to reserve your spot now!

*Past performance does not indicate future results