Good morning, traders…

Jeff here.

The Federal Reserve’s two-day policy meeting concludes today, with Chairman Jerome Powell set to announce the central bank’s highly-anticipated decision on interest rates…

This meeting is particularly crucial because Powell has essentially guaranteed that the Fed will cut rates today.

The question is: Will the cut be 25 or 50 basis points?

Some traders don’t even know this meeting is happening, while others don’t pay enough attention…

But ignoring the Fed meeting is a mistake. Take it from me, a big part of my edge in the market comes down to macro trading.

I spend hours parsing economic data, Bureau of Labor Statistics reports, and Federal Reserve commentary.

This may sound boring. You might be wondering why I put so much emphasis on monetary policy. I’ll tell you why…

Macro events move the market more than anything else, it’s that simple.

Furthermore, the S&P 500 is being rebalanced on Friday, adding yet another catalyst to this chock-full week of events.

Knowing this, I’ve got a very special trade lined up … and I’m ready to show you exactly how I plan to profit big from this move…

This FRIDAY, September 20 at 10 a.m. EST — I’m hosting a Special Burn Notice Event to go over my trading plan in detail — Click here to reserve your seat!

Now that you’re signed up, let’s break down everything you need to know about trading the Fed’s interest rate decision…

What to Watch for During the FOMC Meeting

The FOMC plays a pivotal role in the U.S. economy by setting monetary policy, which directly impacts interest rates, causing broader implications for financial markets.

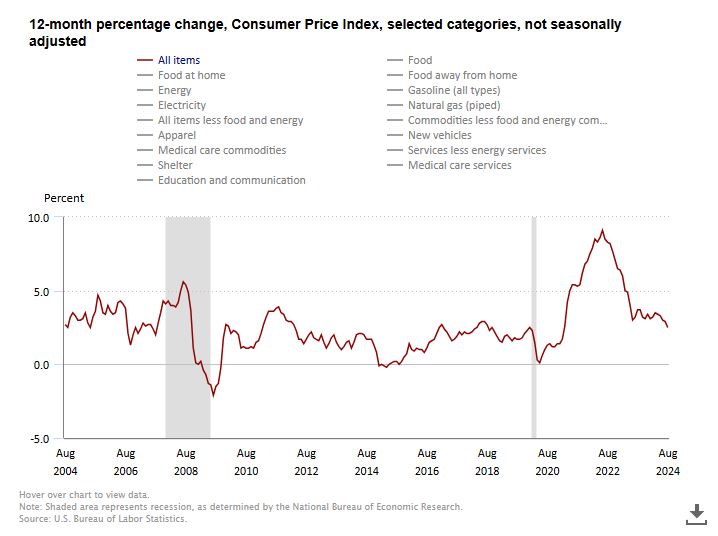

In the first quarter of 2024, both the core CPI and core PCE indicated historically high inflation.

However, recent figures have been more promising.

We’ve gone from over 9% inflation (June 2022) to 2.5% (August 2024):

Particularly, the “super-core services” — excluding housing, food, and energy — have slowed considerably.

Big picture, we’re way off the highs of inflation, but still just above the Fed’s 2% target.

Expected Rate Cut: What It Means for You

Most experts predict a 25 basis point cut, while some are expecting a larger 50 basis point cut.

The outcome of this decision matters to traders for several reasons:

- Lower borrowing costs: When the Fed cuts rates, borrowing becomes cheaper. This can encourage businesses to invest more and consumers to spend more, which boosts economic activity. As someone who might be involved in the markets or thinking of making significant purchases, lower interest rates often lead to higher stock prices as companies benefit from lower costs and increased demand.

- Impact on bonds and interest-rate-sensitive sectors: Lower interest rates reduce the returns on bonds, making them less attractive to investors. That may sound counterintuitive at first, but here’s how it works: When interest rates fall, newly issued bonds will offer lower yields (since bond yields are tied to prevailing interest rates). However, bonds that were issued before the rate cut will have higher fixed interest rates compared to the new bonds. As a result, those older bonds become more valuable because they pay better returns than newly issued bonds.

- Currency fluctuations: Lower interest rates can also weaken the U.S. dollar as foreign investors seek higher returns in other countries. A weaker dollar tends to boost exports, which can be good for companies that sell goods overseas. Keep an eye on how the dollar reacts to any rate cut.

4 Key Indicators to Watch from the Fed

To grasp how the Fed’s decision will affect the markets, listen closely for commentary about the following indicators:

- Inflation: The Fed’s primary goal is to keep inflation in check, ideally around 2% annually. Over the past year, inflation has been falling, which is why the Fed is now considering a rate cut. However, some parts of the economy, like housing, still have higher-than-expected inflation, which could make the Fed cautious about cutting rates too aggressively

- Employment: The labor market is another critical factor. Although the U.S. job market has been strong in recent years, there are signs of weakening, with slower job growth and higher unemployment. The Fed will weigh the risks of slowing job creation against the need to control inflation.

- Economic Projections: During the meeting, the Fed will release its quarterly Summary of Economic Projections (SEP). This report provides forecasts for key economic metrics, including GDP growth, inflation, and unemployment. These projections offer insights into the Fed’s long-term outlook.

- Global Economic Conditions: The Fed doesn’t make decisions in isolation; global economic trends also play a role. Slowing growth in major economies like China and Europe could lead the Fed to take a more cautious approach. Additionally, any signs of instability in global markets could push the Fed toward a more accommodative policy.

Why I’m Preparing for a Bearish Reaction

Conventional wisdom would tell you that a long-awaited interest rate cut will be a good thing for stocks…

But I’m here to present a counter-narrative — I think the market is going to react negatively to this, here’s why:

There’s not going to be a surprise today, everyone and their grandma is expecting this rate cut. (The only question is the size of the cut.)

And when events are already priced in — as I believe this interest rate cut to be — the market’s reaction is often underwhelming, or even opposite to what’s expected.

This can lead to a phenomenon known as “buy the rumor, sell the news” … when stocks gradually rise as they approach a “positive catalyst,” only to dump as soon as the event actually occurs.

Now, I don’t have a crystal ball. There are no guarantees about what will happen in the markets today, tomorrow, or ever.

However, my nearly three decades of professional trading experience tell me to be incredibly cautious and skeptical of conventional wisdom in this tape.

As traders wonder if the cut will be 50 or 25 basis points, the Fed is caught between a rock and a hard place:

- If the Fed cuts rates by 50 basis points, the market could interpret that as a panic move, suggesting that the economy is in worse shape than expected. This would likely trigger fear and lead to a market selloff.

- If the Fed cuts rates by only 25 basis points, the market might feel like the action wasn’t aggressive enough. Traders could see this as the Fed not doing enough to support the economy, and the market could still react negatively.

With that in mind, I’m holding some VIX calls to play the volatility, and some puts on tech stocks to protect against downside risk.

But I have an even bigger trade idea right around the corner…

Happy trading,

Jeff Zananiri

P.S. If you want to learn how to use options to take advantage of these crazy market moves…

Now is the time.

This FRIDAY, September 20 at 10 a.m. EST — I’m hosting a Special Burn Notice Event to go over my strategy in detail.

I’m excited to see you there, but space is limited … Click here to reserve your seat!