Happy Friday, traders…

Ben here.

Today, I’m going to tell you the story of one of the most influential figures in trading history (that you’ve probably never heard of).

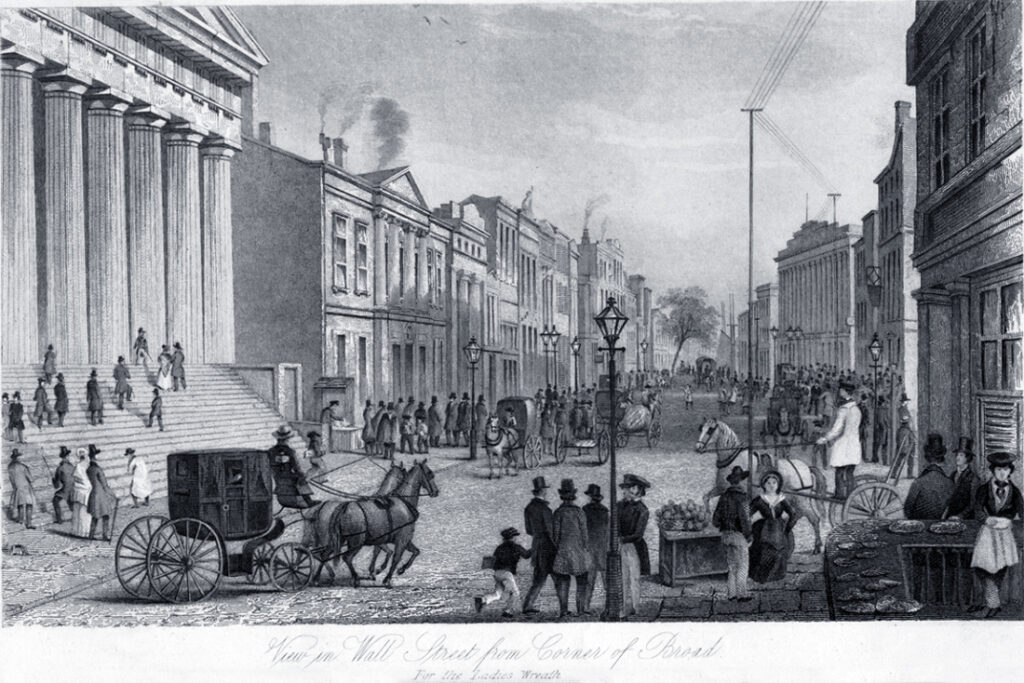

But first, we have to get in a time machine and travel back to Wall Street in the late 19th century…

Picture it: there’s no internet, no cell phones, no digital screens showing charts — just chalkboards, paper, and a lot of yelling.

Into this whirlwind walks a precocious young man, only 15 years old, starting his first job as a stock runner.

His name was Richard Wyckoff…

But Wyckoff wasn’t just any teenager when he started on Wall Street. From day one, he was like a sponge, soaking up every ounce of knowledge he could gather.

While he ran messages back and forth across Wall Street’s trading floor, he watched, listened, and learned.

He had a front-row seat to the most intense action. But instead of being overwhelmed, he started picking up on strategies the Smart Money was using.

By doing so, he discovered a way of looking at the stock market that changed trading forever…

The Wyckoff Method

What set Wyckoff apart was how he viewed the market…

Unlike many traders who chased every small move in stock prices, Wyckoff took a step back. He observed, studied, and began to understand that the market was a living organism.

There was rhythm, a certain “beat” to how the tape moved. He saw that the Smart Money — those traders with enough power and capital to influence the market — weren’t just betting on random stocks, they were setting the tone of the entire game.

This realization led Wyckoff to create what we now call the “Wyckoff Method” — analyzing price, volume, and time to get a glimpse into the minds of these market influencers.

He saw that every move on Wall Street had a purpose, and if you could figure out the motive behind a price swing, you could anticipate the market’s next move.

It was a strategy that combined fundamental and technical analysis with the emotional swings of the market — and that was a game-changer.

Wyckoff’s approach taught traders to watch the market like a detective at a crime scene, looking for clues and signals left by the Smart Money.

By tracking these signals, Wyckoff found a way to “read” the market’s intentions. He was learning the rhythm of Wall Street itself…

Sharing the Wealth (of Knowledge)

But Wyckoff’s story doesn’t end with him making a fortune by keeping this knowledge to himself.

He believed that anyone could learn to beat the market and he wanted to spread his insights to empower others.

In 1907, Wyckoff founded the Magazine of Wall Street, a publication that transformed how people thought about trading.

Before Wyckoff’s magazine, stock trading felt like an exclusive club, where only the elite had access to high-level strategies.

Then, out comes a magazine that begins to lay open the secrets of the stock market for everyone to see.

Through the Magazine of Wall Street, Wyckoff shared his strategies, offering regular people a peek behind the curtain of Wall Street.

(Imagine a 19th-century version of the Daily Strike Report…)

He was like a whistleblower of trading secrets, showing readers how to approach the market with the same insights that were once only known to the top traders.

People started understanding that trading is about more than just luck — it’s a game of skill.

But Wyckoff wasn’t satisfied with just a magazine. In the 1930s, he went even further, founding the Stock Market Institute.

There, he taught eager students techniques that most people would never have dreamed of knowing.

If this sounds familiar, it should…

Just like Wyckoff, I’m here to teach you how to spot the Smart Money’s biggest trades — and weaponize that knowledge to your advantage.

Why Wyckoff’s Story Matters Today

In today’s world of advanced technology, where algorithms and AI are changing the game, Wyckoff’s story is more important than ever.

His focus on understanding the “why” behind market movements — rather than just following trends — is a huge part of how I approach my trading.

Even with all our modern tools, the core of trading remains unchanged: it’s about understanding the psychology of the market.

When you’re trading, remember Wyckoff. Think about the young stock runner who saw through the chaos of Wall Street to develop a method that would change trading forever.

Embrace that same curiosity, that desire to understand not just what the market is doing, but why it’s doing it.

Like Wyckoff, I love trading and teaching. I believe we can all win by learning together and supporting one another in this journey.

The market is full of ups and downs, but by focusing on why those moves are happening, we can learn to profit from them, just as Wyckoff taught.

His story inspires me to pass on the lessons I’ve learned to you.

And the most important lessons I’ve learned in 20 years of trading? Follow the Smart Money.

With that in mind, let’s look at:

💰The Biggest Smart-Money Bets of the Day💰

- $4.4 million bullish bet on NVDA 11/22/2024 $147 calls @ $2.16 avg. (seen on 11/14)

- $3.9 million bearish bet on X 01/17/2025 $35 puts @ $3.90 avg. (seen on 11/14)

- $2.3 million bullish bet on WMT 12/20/2024 $86.67 calls @ $2.60 avg. (seen on 11/14)

Happy trading,

Ben Sturgill

P.S. The election just triggered the most epic 90-day profit window of the decade —

and our $3 million AI has already selected its “Top 5 Plays”…

Get all the details from Tim Bohen on Wednesday, November 20th at 8 p.m. EST — Reserve your spot now!

*Past performance does not indicate future results