Happy Tuesday, traders…

Jeff here.

After several weeks of crazy up-and-down volatility in the stock market, this weekend was relatively calm on the news front.

Stocks have had a strong bounce back from their nasty correction, and now, all eyes are back on the Federal Reserve…

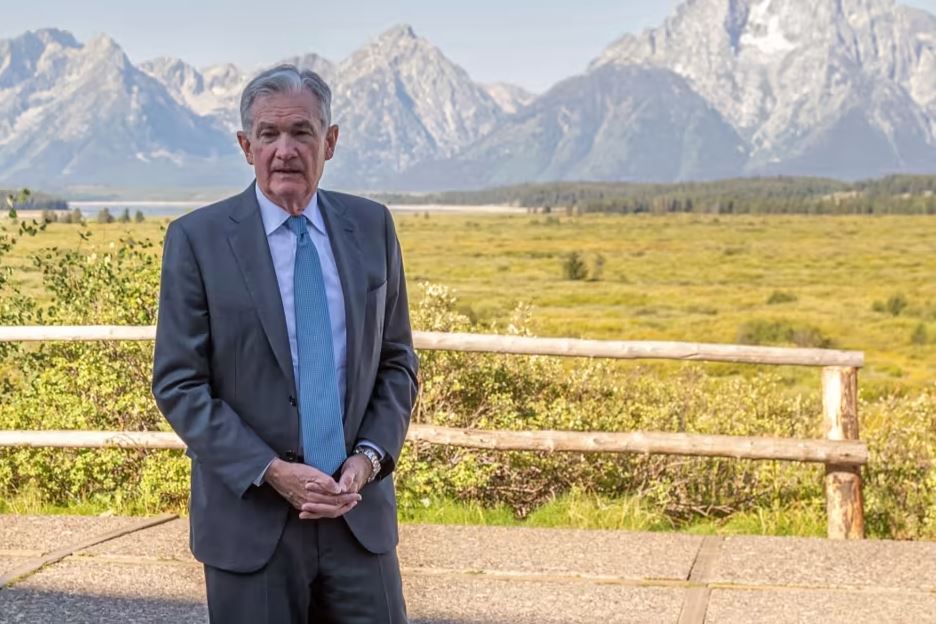

This week, the Fed is holding its annual meeting in Jackson Hole, WY — a symposium that brings together central bankers, economists, and policymakers to discuss monetary policy…

The main event will be Jerome Powell’s speech on Friday at 10 a.m. EST. Powell often uses these speeches to give hints about interest rate decisions, so it’s important to listen closely.

This is even more important considering the recent shift in market conditions. The tone of the Federal Reserve meeting could decide whether the market is headed back toward all-time highs or back down to where they were two weeks ago.

With that in mind, I have three tips for this week’s Tuesday Market Outlook…

Develop Your Playbook

Every competent trader should have a diverse bag of tricks they can pull from during different market conditions — this is your trading playbook.

I love European football and my favorite team is Liverpool…

My favorite coach they’ve ever had, Jurgen Klopp, was a strategic genius during his time at the club, from 2015 to 2024…

He built a deep and fine-tuned playbook of strategies to employ depending on the opponent they were facing.

This playbook led to Liverpool winning the Premier League title in 2020 for the first time since 1990.

I try to approach my trading like a great sports team, like Liverpool. I’ve spent years developing a playbook that works for me.

Depending on what’s going on in the stock market, I have a variety of patterns and setups that I can trade…

I have my three favorite strategies:

- If I’m trying to exploit Wall Street’s repositioning for an overnight trade: Burn Notices…

- If I’m trying to take a more market-neutral approach: The Money Link…

- If I’m trying to take advantage of market glitches with the help of algorithms and AI: The 24-Hour Glitch…

But when the price action calls for it, I’ve been known to trade everything from exotic foreign commodities to macro-based ETFs, both long and short.

So, if you’re still developing your playbook, take your time. Don’t rush it.

I’ve been building out my playbook for decades and I’m still learning new things about the stock market every day…

Stay Nimble (Don’t Be Stubborn)

Some traders are naturally stubborn. Many newbies want to nail every setup to the absolute maximum, to top-tick every chart.

In other words, they’re perfectionists. (But this mindset is dangerous…)

I’ll always recommend that you strive to be the absolute best trader you can be. (But there’s a fine line between patience and stubbornness…)

If you think you’ve found the one-and-only strategy that will work in every market condition — you’re wrong.

I’ll let you in on a hard truth: One day, that pattern will fail to deliver.

And in those moments, if you don’t have a diverse playbook to pull from, you’ll be left in the dust by other traders who do.

CAUTION: Prepare to adapt to ANYTHING the market throws at you.

If a certain sector has been tanking for weeks, and it’s finally seeing a bounce … You should be entertaining the possibility of dip-buying.

On the other hand, if the stocks you’re trading long have been soaring consistently, only to face a hard rejection … You need to be ready to flip to the short side.

Play both sides of the chart. Don’t be stubborn — be nimble.

Be Humble (Avoid Overconfidence)

So, you’ve developed your playbook and eliminated stubbornness from your mindset…

You’re on the right track, but there are still concerns to be aware of.

Your first big hurdle will come after you make your next great trade…

As strange as this sounds, one winning trade can be a newbie trader’s worst enemy.

Picture this: An inexperienced student nails one of their first trades. Maybe it was pure luck, or maybe they had a strong trade thesis. (Regardless, it was only one good trade.)

After this trade, the newbie thinks they’re an amazing trader. They get overconfident and start to feel invincible.

Then, on their next trade, they size up HUGE. Why not? They’re super-skilled, right? Wrong!

These stories usually end in the newbie blowing up their entire account.

Overvaluing your skill level — and/or oversizing your trades — is a recipe for disaster, especially in a market like this one.

Don’t be like these unfortunate traders. Stay humble, avoid overconfidence, shrink the game, and you’ll be a better trader for it.

Happy trading,

Jeff Zananiri

P.S. Wall Street is making HUGE mistakes … and it’s time for us to take advantage.

I’ve developed a system to enter these “artificially cheap” trades right after they crash — and before they skyrocket — for gains of 51%, 107%, and even 630% … in less than 24 hours.*

*Past performance does not indicate future results