Happy Tuesday, traders…

Jeff here.

At first glance, the markets might seem quiet right now. The major indexes are barely moving, and the VIX is sitting in the $13s.

Yet underneath the hood, a different story is unfolding…

Last week we saw The Santa Claus Rally and The Trump Trade in full swing.

But by mid-day yesterday, the market was starting to look pretty bearish. The stocks that had been leading those rallies — banks and crypto — got destroyed Monday.

For traders willing to play both sides of the chart, this environment is packed with opportunities — you just have to know where to look.

My Burn Notice strategy is ideal for this tape because it’s designed to take advantage of these big overnight moves in individual stocks.

And this week, that environment could get even juicier…

We have a major economic event on the calendar that has the potential to stir up volatility and unlock even more trading setups across the board.

If you’re ready, this could be one of the most important weeks of the month.

With that in mind, let’s get to my Tuesday Market Outlook for this week…

Big Moves in Individual Stocks

Traders who know where to focus their attention this week could see some incredible setups unfold.

It’s all about stock picking right now…

Look closely, and you’ll see individual stocks are making wild moves.

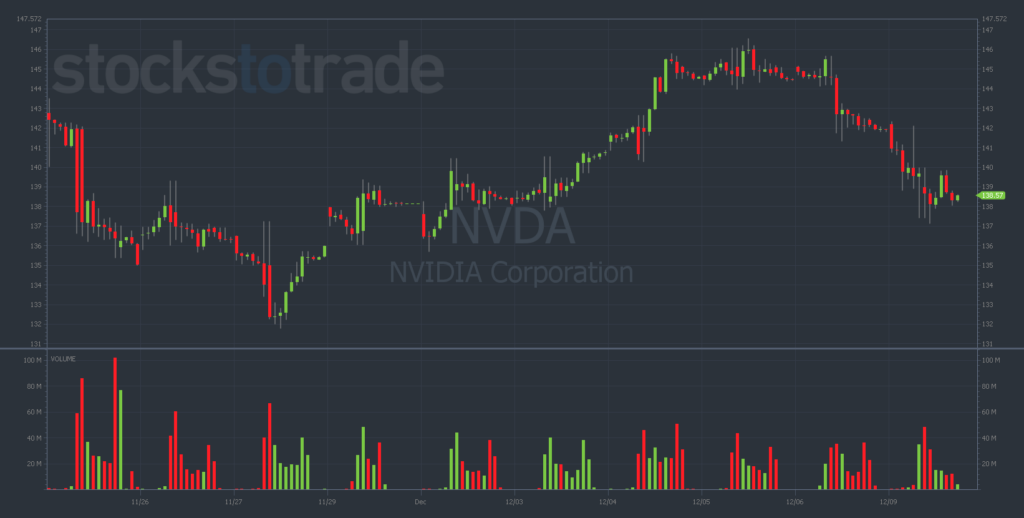

Take Nvidia Corporation (NASDAQ: NVIDIA), for example — the biggest company on the planet has been making 3% moves almost every day:

Or Palantir Technologies Inc. (NYSE: PLTR), one of the highest-flying stocks in the market, which opened 8% higher yesterday, only to reverse lower and finish the day down 4%:

Meanwhile, software names like Fastly Inc. (NASDAQ: FSLY), Fiverr International Ltd. (NASDAQ: FVRR), and Upwork Inc. (NASDAQ: UPWK) have been building strong bullish uptrends.

These are incredible trading opportunities in super-liquid stocks. And this kind of action isn’t isolated — it’s happening all across the market.

Bottom Line: The broader indexes may look boring, but single-stock volatility is off the charts.

What to Watch This Week

Tomorrow, we’ll get a look at the Consumer Price Index (CPI) report — one of the Fed’s key inflation gauges.

Watch for the following:

1. The Inflation Trend

The CPI report will show whether inflation is continuing to cool, holding steady, or ticking higher. A higher-than-expected number could spell near-term trouble for stocks, while a lower number might re-invigorate the Santa Claus Rally.

2. The Fed’s Next Move

The Federal Reserve closely monitors the CPI when deciding on interest rate policy. A hot CPI will likely pause the rate-cutting cycle, while an expected (or lower-than-expected) number might inspire the Fed to cut further at its next meeting.

3. Sector-Specific Clues

Certain sectors are more sensitive to inflation data. For example:

- Tech and Growth Stocks: These tend to struggle with higher rates stemming from inflation, so a hotter CPI could hurt this sector.

- Energy and Commodities: A jump in energy prices might show up in the CPI report and influence commodity-linked stocks.

Expect the VIX to Move: Right now, the VIX (Volatility Index) is languishing in the $13 range. If the CPI report surprises the market, we could see volatility spike, which would open the door to broader market opportunities.

Stock-Specific Action: Don’t sleep on the big movers. Stocks like NVIDIA and PLTR are showing massive intraday swings, software names are surging, and AMD is arguably bottoming out.

The Seasonal Edge: December is historically very bullish. But last week was pretty euphoric, and a pullback could be in the cards here. Pair that with the potential impact of the CPI, and you’ve got an environment where big swings are on the horizon. Burn Notices will thrive.

How I’m Trading This Week

This week, the key is to prepare for potential volatility while taking advantage of the current stock-specific setups.

Don’t try to predict the CPI result — be positioned to profit no matter what happens.

Here’s what I’m focusing on:

- Burn Notices on stocks with the potential for big overnight gaps.

- Keeping dry powder ready for any post-CPI opportunities in the broader market.

- Paying close attention to the major indexes and the VIX to inform my trading decisions.

The market has been lulling traders into a false sense of security. But this week is set to shake that up.

Big moves are already happening in individual stocks, and the CPI report could amplify that action across the board.

Let’s make some money,

Jeff Zananiri

P.S. My brand-new algorithmic trading system has already delivered returns of 145% on QCOM, 235% on TECS, and even a staggering 900% on PBR…*

If you want to start finding trades like these before they take off, you’ve come to the right place…

TODAY, December 10 at 12:00 p.m. EST, my buddy Danny Phee is joining me for an URGENT LIVE EVENT to break down the biggest GAMMA trades we’re making this week.

Stop missing out on triple-digit trades — Click here to reserve your spot now!

*Past performance does not indicate future results