Happy June, traders…

Jeff here.

It’s a new month of trading and the markets are already off to a fascinating start.

Yesterday, we got mixed signals from the S&P 500 PMI and ISM manufacturing numbers. These reports are making the market jumpy as traders are unsure about what’s next.

On top of that, GameStop Corp. (NYSE: GME) is back in the spotlight because of a certain Roaring Kitty comment, causing the stock to soar.

The return of meme stocks may tempt you to go long, but there may be some aspects of this crazy move you aren’t considering (more on that later)…

Looking ahead, we’ll get a fresh jobs report on Friday, which could give us a better idea of where the economy is headed.

But if you’re unaware of any of these events (or their potential effects,) you could miss a huge trading opportunity, (or worse, face an easily-avoidable loss).

So, let’s break down what you should be paying attention to this week and how you should approach your trading over the next few days…

The Mixed Economic Data

On Monday morning, we got some conflicting economic numbers, causing a bit of confusion in the market.

First, we had the S&P 500 PMI, which showed inflationary pressures. Then, we got the ISM manufacturing number, which came out very weak.

Now, I know the S&P 500 PMI isn’t the United States government’s official data, but I actually prefer it.

Why? Because it pulls data from the biggest corporations, which I find more accurate and reflective of the real economy than what some economists in Washington D.C. might predict.

The weak ISM number is a bit more troubling…

At first glance, we’re looking at a “stagflation” scenario: inflation is still high, but manufacturing is starting to weaken.

This isn’t great news and traders are still digesting the numbers.

The market was flopping around Monday morning, unable to decide which way to go.

The Roaring Kitty Effect

In other news, GameStop is back in the spotlight.

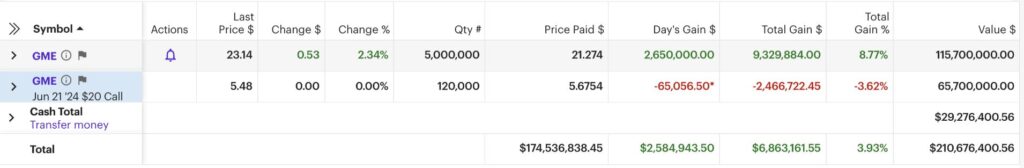

Keith Gill, also known as Roaring Kitty, has made headlines again as he went on Reddit over the weekend and posted a screenshot of a $210,000,000 long position in GME:

Keep in mind this is the same guy whose research sparked the infamous 2021 GameStop short squeeze.

A few weeks ago, he posted a meme on X for the first time in three years, and GameStop was up as much as 118% intraday on this “news.”

I understand the widespread temptation to get caught up in the meme stock euphoria, but I think that would be a mistake.

Less-experienced traders often get wide-eyed at these staggering moves, but you have to be cautious…

Roaring Kitty pumped GME stock a few weeks ago, got everyone to buy in, and then dumped it, letting it crash.

People who followed him were left holding the bag.

Recently, he started buying a huge amount of call options, specifically short-dated ones expiring in June.

This caused another frenzy as people noticed these unusual trades and realized it was him behind it all.

GME was up 75%+ in pre-market on Monday, then dumped 30% in 35 minutes, and dumped even more into the close…

All of these retail traders who bought the open were destroyed again…

The Importance of Options Trading

This kind of manipulation shows just how important it is to watch and trade options.

The market can be heavily influenced by such moves, and understanding this can give you an edge.

There’s a good reason I trade near the close every day. The close can provide significant insights and opportunities.

You’ve gotta realize that options trading is a critical aspect of the current market environment.

With the summer months typically being slower, options provide a way to stay active and potentially profit from these manipulative moves.

Roaring Kitty’s use of 6/20/2024 GME calls is a prime example of how options can drive market sentiment and create huge opportunities — long and short — for savvy traders.

This week, keep an eye on the options market for clues about where the big players are placing their bets.

The Upcoming Jobs Report

Next up, we’ve got a big jobs report coming out on Friday.

This will be a crucial indicator of whether the economy is cooling off (or not).

If the report shows a significant slowdown in job growth, it could suggest that the Fed’s efforts to tame inflation are starting to work.

Conversely, if job growth remains strong, it’ll tell us the economy is still running hot, which will put a damper on rate cut expectations.

And we know these reports can have a big impact on the broader market…

We saw this earlier in the year when the SPDR S&P 500 ETF Trust (NYSEARCA: SPY) dropped 1.3% the day after the March CPI report.

This week’s jobs report is particularly important because it will provide more insight into the labor market’s health when stocks are at all-time highs.

A cooling labor market could mean less pressure on wages and, consequently, less inflation.

This could give the Fed some room to adjust its tone and policy, but we’ll have to wait and see.

The Macro Perspective (and Market Sentiment)

From a broader perspective, the market is currently in a state of flux…

We’ve seen a rally over the past week, driven by hopes of a Goldilocks economy — one that’s not too hot or cold — but the reality might be more complex.

Federal Reserve Chairman Jerome Powell doesn’t want to raise interest rates further if he can avoid it, but he also needs concrete data to justify any rate cuts.

This week’s economic reports, including the jobs data, will be critical in shaping market expectations for the rest of the year.

The market is influenced by many factors, from economic data to individual stock movements driven by influential traders like Roaring Kitty.

Understanding these dynamics and staying flexible in our strategies will be key to navigating the weeks ahead.

First, keep an eye on the economic data. The mixed signals from the PMI and ISM reports suggest that the market could continue to be volatile.

Second, watch the options market closely. The actions of big players can provide valuable clues about market sentiment and potential moves.

Finally, prepare for the jobs report on Friday. This will be a critical indicator of where the economy is headed and how the Fed might respond.

Stay sharp, stay informed, and trade smart. Let’s see what the rest of the week brings.

Happy trading,

Jeff Zananiri

P.S. You’re probably wondering how to find the best trades in the options market.

Well, there’s only one place to start…

THIS FRIDAY, June 7 at 8:30 a.m. EST, I’m hosting a LIVE WEBINAR for the Daily Strike Alliance where I’ll be breaking down the most promising trade ideas I’m seeing in the options market right now, like…

170% on CVNA in ~2.5 hours*

1,080% on PANW in ~24 minutes*

336% on LYFT in ~4 hours*

191% on UBER in ~6 hours*

265% on CME in ~20 minutes*

466% on SHOP ~40 minutes*

955% on PLTR in ~5 hours8

Stop missing great opportunities — CLICK HERE NOW TO RESERVE YOUR SPOT!

*Past performance does not indicate future results