Happy Tuesday, traders…

Jeff here.

The kitty has come roaring back, if you will…

Yesterday, Keith Gill (a.k.a. Roaring Kitty) — the retail trader whose research sparked the infamous 2021 Gamestop Corp. (NYSE: GME) short squeeze — posted a meme on X for the first time in three years.

GME was up as much as 118%* intraday on the “news.” And just like that, the meme stocks are back…

Now, you may be tempted to try to get in on the wild meme stock euphoria.

But I think that would be a mistake…

However, I understand why less-experienced traders get wide-eyed amid this staggering GME move.

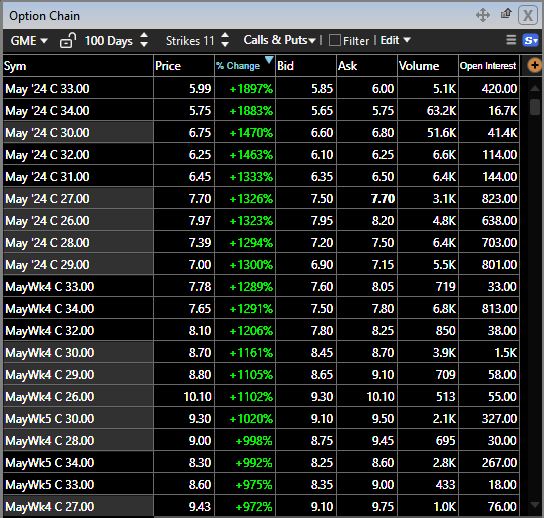

I mean, look at the GME options chain yesterday…

Nearly every May-expiring call option was up over 1000%.*

NOTE: This screenshot was taken mid-day after the stock had dipped 17% from its morning high of $38.20. At the open, some of these contracts were up over 4500%.*

If you were holding GME contracts before yesterday’s parabolic surge, congratulations (and I hope you sold yesterday).

But trying to chase this move any time after Monday morning is a recipe for disaster.

So, in today’s Tuesday Market Outlook, we’ll break down everything that’s going on with the newfound meme stock mania.

Then, we’ll go over two major economic reports coming out this week…

Meme Stocks Triumphant Return

Meme stocks are back with a vengeance.

But really, the meme stocks didn’t go anywhere — it was the meme traders who were broke (and emotionally broken down).

These tickers will lay dormant for months (or even years) as the speculative scalpers who once made it surge try to re-rally the troops.

It’s a similar phenomenon to what happens with crypto sh*tcoins. A euphoric wave of people comes in, they chase the risky asset, and then they crash it back to zero.

Once that group has been flushed out, a whole new fleet of brand-new, naive traders start buying … only to lose a ton of money (just like their predecessors).

Then you rinse and repeat, and the cycle continues…

Tulip mania, the dot-com bubble, AI stocks — all of these situations are due to a similar mechanic.

These euphoric manias tend to occur towards the end of a major market rally.

The original GME short squeeze perfectly coincided with the end of a major overall market rally.

And now, the fact that it’s happening again is telling me that speculative traders need a new game.

People are sick of NVIDIA, penny stocks are getting boring, and crypto has been tanking.

They go back to meme stocks because they need to create a new hot sector — the bubble has to find new ways to feed upon itself.

In other words, moves like the GME re-squeeze are late-cycle hallmarks of trouble ahead.

Whenever you start to see these kinds of parabolic moves — where a single meme posted online more than doubles the market cap of a struggling company overnight — you need to be on high alert.

Horrible traders will try to chase these types of stupid, nonsensical moves. They might make money for a few days and brag about it on social media…

But no matter what, it always ends the same — with a whole lot of tears and pain (and Hollywood screenwriters getting a good story to tell).

Be cautious and don’t allow yourself to get caught up in the meme stock hype. I think it’s going to be over quickly.

And while everyone else is trying to squeeze gains out of GME, I’ll be turning my attention to this week’s massively important economic reports.

2 Major Economic Reports to Watch

One factor has dominated the U.S. economy for two years now — inflation.

Moving on from meme stocks, big inflation numbers are dropping this week.

We’ve got the Producer Price Index (PPI) today and the Consumer Price Index (CPI) on Wednesday.

In an attempt to slow inflation, the Federal Reserve has increased interest rates to the highest level in two decades.

Higher interest rates are generally bad for stocks, as they make it more expensive for companies to borrow money.

This was evidenced by a big dip in the major indexes after the March CPI report when the SPDR S&P 500 ETF Trust (NYSEARCA: SPY) dropped 1.3% the following day.

Now, consider the recent history as we head into Wednesday’s report…

The stock market has been rallying for about a week straight on the idea that we’re having a Goldilocks economy.

We know that Federal Reserve Chairman Jerome Powell doesn’t want to raise interest rates … but does he have an excuse to cut them yet?

This week, we’ll get to see if there’s still really high inflation. If yes, the market might discount all cuts this year.

Right now, betting markets are pushing the possibility of one interest rate cut out to the fall.

This is going to be a very interesting week on the macroeconomic front.

Then, next week we have the most important earnings report of the season when Nvidia Corporation (NASDAQ: NVDA) shares its Q1 numbers.

So, we’ll have to wait and see. But I’m leaning a little bit cautious here because the meme-stock people make me nervous.

Happy trading,

Jeff Zananiri

P.S. During a week as volatile as this one, most traders LOSE MONEY…

But by following my unique method for finding trade ideas, savvy traders now have the chance to witness double and even triple-digit gains like:

+69% on BKR in 1 Month

+85% on ORCL in 1 Month

+153% on Meta in 1 Month

+210% on WKHS in 1 Month

+423% on COG in 1 Month

(Just to name a few…)*

Discover the key behind my “Calendar Stocks” edge in the markets — CLICK HERE TO GET ACCESS NOW.

*Past performance does not indicate future results