Happy Tuesday, traders…

Jeff here.

We’re looking at a much different backdrop than last week.

We’ve already gone through the meat of last week’s economic events and major earnings reports.

This week, there are no major economic catalysts to hang on to.

There are, however, some semi-big companies reporting earnings — like Walt Disney Co. (NYSE: DIS) and Uber Technologies Inc. (NASDAQ: UBER)…

I’ll be watching these reports to see if they move the entire tape (or not).

But really, this is more of a breather week for me, gearing up for what’s right around the corner…

Next week, we have massively important inflation data coming down the pike, as the Consumer Price Index (CPI) and Producer Price Index (PPI) reports come out.

These reports are coming right after last week’s Fed meeting, where Powell was acting super dovish, kicking the can down the road…

Powell is either very right or very wrong about the economy — and it all comes down to next week’s inflation data.

If he’s wrong, the market will need to correct hard.

If he’s right, the market can still correct because his dovishness is already being priced in.

Right now, we need to examine what happened last week to prepare for what’s to come.

Weeks like this are about watching, strategizing, and learning…

But that doesn’t mean they aren’t without HUGE trading opportunities, like Jack Kellogg’s Next Big Trade (more on that later).

With that in mind, let’s get to my Tuesday Market Outlook…

Chairman Powell Gets Dovish

Last week’s big event was the Fed meeting, where Federal Reserve Chairman Jerome Powell was dovish as usual, trying to prop up the market…

He’s a complete political crony and I should have never been in doubt about his tone.

I’m kicking myself because I had a blind spot going into that meeting.

I was too focused on the reality of inflation (which is bad), and forgot just how crooked this guy is.

Powell and the Fed just want to prop stocks up … no matter what.

So, the central bank got dovish and rates went lower.

The lesson I’m pulling away from last week’s Fed meeting is this: eliminate your blind spots.

I had a bit of a bias — a blind spot — going into the meeting. In hindsight, it cost me.

In this market, you never know what’s going to happen next.

Perform your best, but be prepared for the worst — at all times.

After all, even if a stock misses revenue and its number-one product declines, the stock can still rally post-earnings…

The ‘AAPL’ Doesn’t Fall Far From the Fed Tree

Last Friday, Apple Inc. (NASDAQ: AAPL) reported earnings and overshadowed its EPS miss by announcing the biggest stock buyback in U.S. history.

iPhone sales were down 10%, but when the company announced it was buying $110 billion of its stock back, the sales numbers didn’t matter anymore.

AAPL opened 8% higher, which sent the entire stock market up:

So, you could’ve been exactly right about AAPL earnings and still lost money.

Earnings are unpredictable. Betting on an earnings report is closer to gambling than anything else in the options market.

There are still good opportunities to trade during earnings season — but you must be aware of the risks.

One comment on a conference call, a small change in forward guidance, or a completely unrelated market catalyst can cause stocks to do the opposite of what you expect post-earnings.

Special Note: “The War Premium”

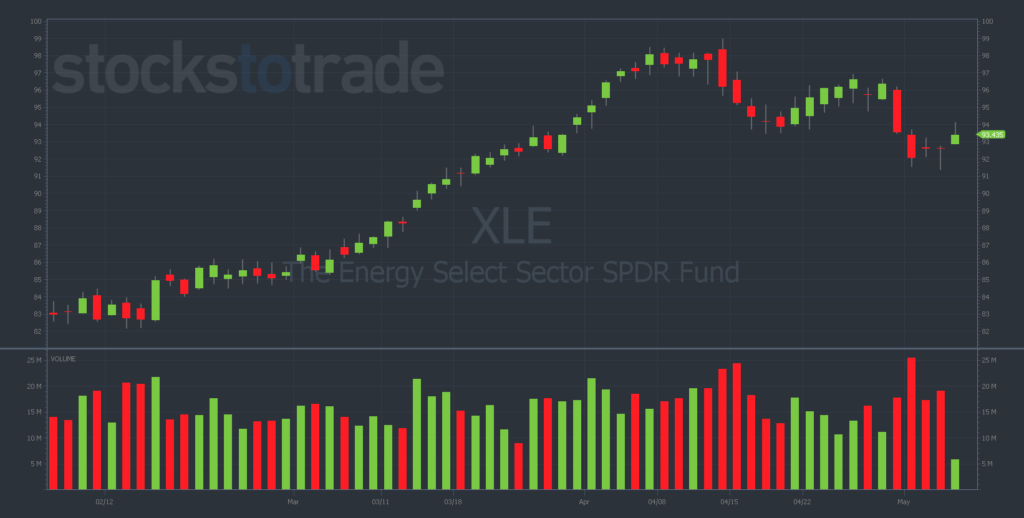

An interesting macro development to keep an eye on is oil, which is catching a bit of a bid here, bouncing off some support levels.

Oil is a really important signal in this tape. It’s giving us hints into the macro picture and what’s going on geopolitically.

And on Monday, oil charts were saying that the “war premium” is rising:

I’m just saying, there could be some intriguing swing trade opportunities in oil stocks soon.

And speaking of killer trading opportunities…

Jack Kellogg’s Next Big Trade

Just days from now, you’ll discover the rare seven-figure profit cycle that’s already made Jack Kellogg rich.

The last time this rare cycle hit … Jack generated seven figures in trading profits.

In just two years, he earned an astounding $8 million.

It was so shocking, Business Insider reached out to interview Jack — asking to verify his trading profits…

It’s been 2 years since we saw this rare profit cycle, but now…

Jack believes that’s all about to change.

And that’s why, this Thursday, May 9th at 8 pm EST, he’ll be breaking down everything you need to know about his Next Big Trade … before it’s too late.

This is the first time Jack has EVER agreed to go public like this.

Thanks to Jack’s incredible strategy, 28 of his top trades have ALL returned over 100%* or more, with 12 soaring over 250%* and 4 skyrocketing beyond 600%.*

So if you miss this LIVE event … you might miss out on Jack’s biggest trade ever.

SIGN UP NOW because time is running out — Click here to secure your spot for Thursday night’s urgent briefing.

Happy trading,

Jeff Zananiri

*Past performance does not indicate future results