Good morning, traders…

Ben here.

As the market continues to surge, and Nvidia Corporation (NASDAQ: NVDA) makes new all-time highs nearly every day, a specific problem is popping up for a lot of students…

I’m talking about the fear of missing out (FOMO), a mental trap that can tantalize even the most experienced traders.

Tell me if this has ever happened to you…

You see other traders posting online about their glorious gains and feel insignificant.

Then, you start thinking to yourself: If only you had made that trade, you would have those gains as well…

But make no mistake — this mentality is a recipe for disaster.

If you wanna have a long and successful career as a professional trader, you must extinguish FOMO from your mindset.

On the other hand, If you fall victim to FOMO, you’ll find yourself entering trades too late, under-researched, and without a clear exit plan.

Then, you’ll be left holding the bag while all those pumpers on social media count your money.

But I want to help make sure this doesn’t happen to you. Let me show you how to say “No” to FOMO once and for all…

Don’t Chase the Upside

The first step to avoiding FOMO is to tell yourself you’ll never chase setups that have gone way beyond any decent entry price.

If you make this promise to yourself and stick to it, you’ll have nothing to worry about when it comes to FOMO.

But this is difficult for many less-experienced traders to execute in action.

They see a stock ripping and Reddit traders pumping it. Then, their emotions take over, causing them to buy way too high into the pattern cycle.

I see this exact phenomenon happening around NVDA. This stock is now light years beyond all reasonable levels of hype and FOMO.

Yesterday, NVDA surpassed Microsoft Corporation (NASDAQ: MSFT) to become the most valuable company in the world.

And many traders are still chasing the upside on NVDA at all-time highs…

You’ve really gotta pay attention to the trading volume here. Notice how elevated the volume bars have been over the past week…

The NVDA FOMO is indescribable. Just look at some of these delusional Reddit posts (two sides of the same coin):

The pessimist…

The optimist…

Even if NVDA hits their targets in time, these traders are playing a dangerous game, “holding and hoping” for their preferred outcome.

In other words, they’re chasing. (Please, don’t be like these guys.)

More than likely, NVDA will eventually revert to the mean and many of these traders will be left holding the bag.

But, other times, you’ll see the play working after your setup happened and it’ll sting that you’re not in it.

I get it — I’ve been there many times before. But if you recognize that it’s probably too late to enter, it shouldn’t be too difficult to simply accept it and move on.

REMEMBER: Trading opportunities are like trains … there’s always another one coming.

I promise you, if thousands of traders on social media are pumping a stock that’s deep in the green, you shouldn’t go long on it…

That’s textbook chasing caused by FOMO. Avoid chasing and, in turn, avoid FOMO.

However, if you really want to play the momentum of a high-flying stock without entering an overcrowded trade, you can do what I did yesterday and trade a sympathy play…

486%+ Potential on QCOM Calls

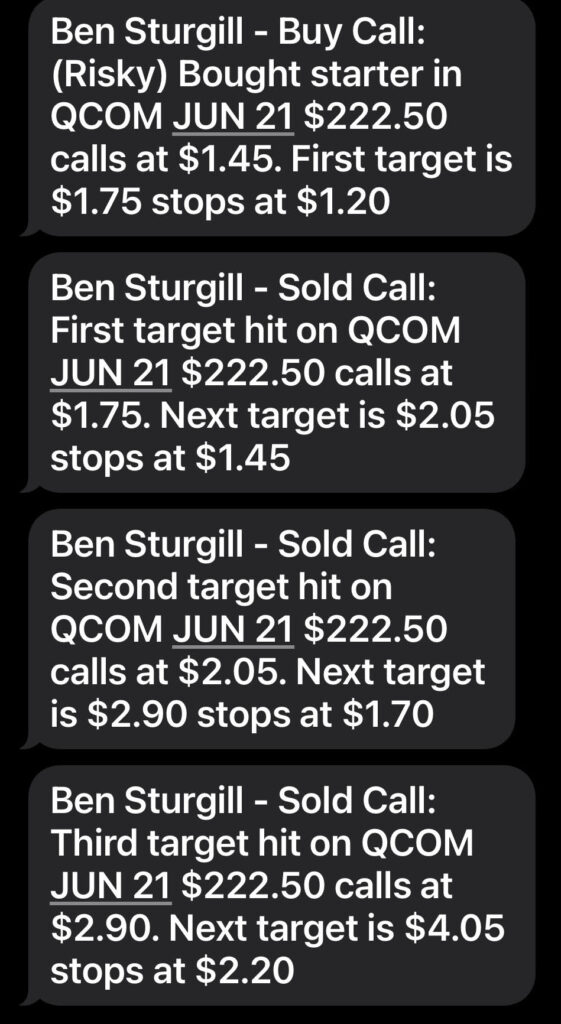

On Monday, June 17, during my Spyder Webinar, I called out Qualcomm Inc. (NASDAQ: QCOM) 6/21/24 $222.50 calls at $1.45.

I liked this setup because:

- The calls had huge ‘smart money’ options volume…

- The company had news (a potential partnership with Samsung)…

- The stock is a ‘sympathy play’ to the NVDA rally…

I sent out the following text alerts as I scaled out:

My final scale was at $5.60 for a gain of 286%.*

However, had you held into the high on Tuesday, you could’ve potentially made 486% overnight.*

Only Enter Trades That Fit Your Strategy

If you subscribe to my alerts, you’ve probably noticed that I’m very picky about the stocks that I trade.

If I let FOMO get the best of me, I’d make a bunch of trades that don’t work within my game plan.

But years of trading experience have taught me to stay patient and disciplined.

These days, I know exactly which setups work for me — ‘smart money’ sweeps with huge options volume attached.

If I miss a good trade, it’s no big deal. I’d rather miss a potential win than take a big loss.

So, next time you’re considering a trade opportunity, ask yourself if it fits your overall game plan.

Or, you can take the “guessing games” out of your trading by following my Spyder Scanner trade alerts.

DISCLAIMER: That doesn’t mean you should chase my alerts…

On the contrary, I want you to use my alerts as indicators. Look at the ‘smart money’ contracts I’m calling out, and then decide which plays fit your personality, account size, and risk tolerance.

And speaking of ‘smart money,’ let’s look at…

💰The Biggest Smart-Money Bets of the Day💰

- $4.25 million bullish bet on AAPL 11/15/2024 $245 calls @ $4.35 avg. (seen on 6/18)

- $1.01 million bullish bet on XLF 08/16/2024 $41 calls @ $1.15 avg. (seen on 6/18)

- $942,000 bullish bet on PLTR 11/15/2024 $28 calls @ $3.15 avg. (seen on 6/18)

Happy trading,

Ben Sturgill

P.S. Hedge fund legend Jeff Zananiri recently discovered a way to turn Wall Street’s greatest strength into its biggest weakness … and he’s witnessed lightning-fast gains like 51%*, 107%*, and even 630%* … in less than 24 hours:

This is why TONIGHT, June 19 at 7 p.m. EST, Jeff is joining Tim Bohen for the 24-Hour Glitch Livestream…

But because this is a live event and the room can only hold up to a certain number of attendees, access to this event is on a first-come, first-served basis.

Spots are filling up fast, so hurry and claim your FREE seat before it’s too late.

Reserve your spot now by clicking right here.

*Past performance does not indicate future results