Happy Friday, traders…

Jeff here.

Look, everyone and their grandma is talking about the recent volatility in the stock market.

From peak to trough, the SPDR S&P 500 ETF Trust (NYSEARCA: SPY) dropped 9.6% in the sell-off, while the Invesco QQQ Trust (NASDAQ: QQQ) lost 15.8% in 25 days.

And while it’s looking like tech stocks are trying to find a bottom this week, we’re not out of the woods yet.

That said, I’m seeing a lot of incorrect information out there. Traders don’t seem to understand exactly why the market has been struggling over the past three weeks.

Let me clarify: this is a news-driven market. One negative headline can send this tape into a tailspin, while a single positive story can spark enormous relief rallies.

In such an environment, it’s absolutely essential to stay up-to-date on finance, politics, and foreign affairs. It all factors into the broader narrative.

With that in mind, let’s break down the six stories fueling this market volatility…

1. Weak Jobs Report

The weak July jobs report is one of the primary factors contributing to the market’s recent volatility…

Employment data is a crucial indicator of economic health, and disappointing numbers can signal trouble ahead.

The latest jobs report revealed lower-than-expected job growth, raising concerns about the strength of the economy…

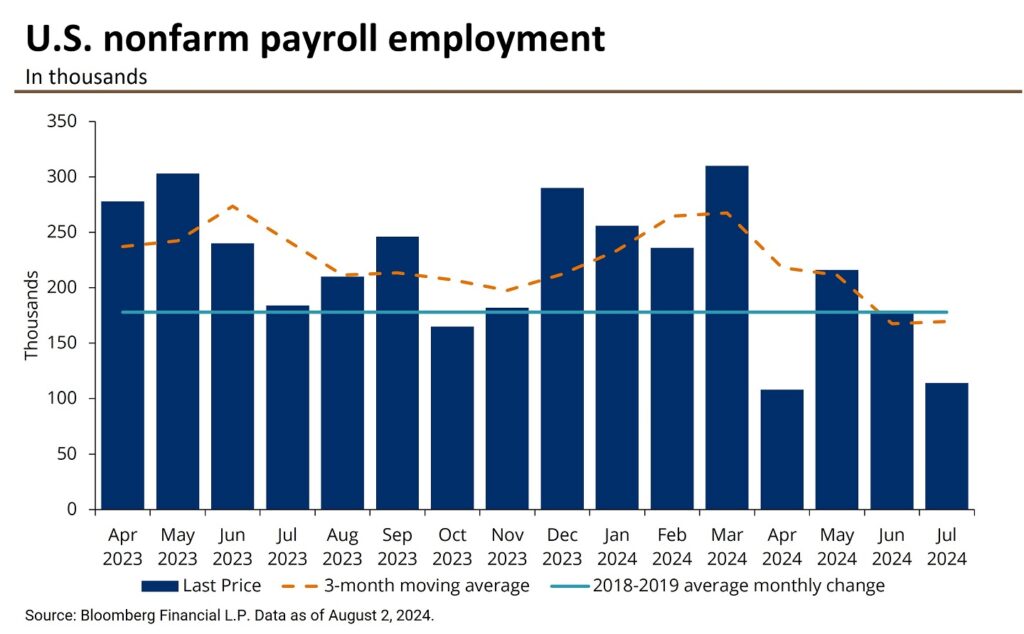

The report showed that nonfarm payrolls increased by only 114,000 in July 2024, significantly below the average monthly gain of 215,000.

This marks three straight months of job declines, a shortfall indicating that the labor market might be cooling off, which can lead to decreased consumer spending and lower corporate earnings.

Traders reacted to this news with increased caution, leading to a sell-off in the stock market (Fox Business) (Investopedia).

2. Buffett Trimming His Apple Stake

Another major factor affecting the market is Warren Buffett’s Berkshire Hathaway selling a large portion of its Apple Inc. (NASDAQ: AAPL) shares…

As arguably the most influential investor in history, Buffett’s actions are closely watched by the market.

When Berkshire Hathaway announced it had sold 49% of its stake in Apple — the holding company’s largest position — it sent shockwaves through the financial universe.

Apple, being one of the largest companies in the world, has a significant impact on the major indexes.

The news of Berkshire Hathaway’s sale led to a sharp decline in Apple’s stock price, which in turn dragged down the broader market.

This event highlights how actions by major investors can create significant market ripples — especially when it’s the Oracle of Omaha himself.

3. The Iran-Israel Conflict

Geopolitical tensions have always been a source of market volatility, and the recent Iran-Israel conflict is no exception…

Escalating tensions between these two nations can create uncertainty and fear in the global markets.

Traders worry about the potential for conflict to disrupt oil supplies, increase energy prices, and create broader economic instability.

Recent reports of military skirmishes and threats have exacerbated these fears. As tensions rise, the risk of a larger conflict increases.

In my opinion, this won’t have a major impact on the market unless Iran launches a serious attack. Let’s pray that doesn’t happen.

4. General Election Anxiety

Political uncertainty is another significant factor contributing to market volatility…

The upcoming general election, with Vice President Kamala Harris taking on Former President Donald Trump, has created anxiety among traders…

There’s a famous saying in politics, “Elections have consequences.” And there are few places where this is more apparent than in the stock market…

General elections can lead to policy changes that have the potential to impact small businesses, large-cap stocks, and the world economy at large.

I think the market will rally harder if Trump wins.

But the unexpected announcement of Harris replacing Biden has led to speculation about potential shifts in economic policy.

Traders tend to be wary of political transitions, especially when there are significant policy differences between candidates.

The uncertainty about future policies on taxes, regulations, and government spending can cause market fluctuations.

As the election approaches, this anxiety is likely to continue, contributing to ongoing volatility.

5. Broader Economic Concerns

In addition to these specific factors, broader economic concerns also play a role in the market’s volatility.

Rising inflation, supply chain disruptions, and changing consumer behaviors are all contributing to an uncertain economic landscape.

These issues can affect corporate earnings and economic growth, leading to fluctuations in stock prices.

For example, rising inflation can erode purchasing power and increase costs for businesses, squeezing profit margins.

Supply chain disruptions, which have been ongoing since the pandemic, can lead to shortages of goods and increased production costs.

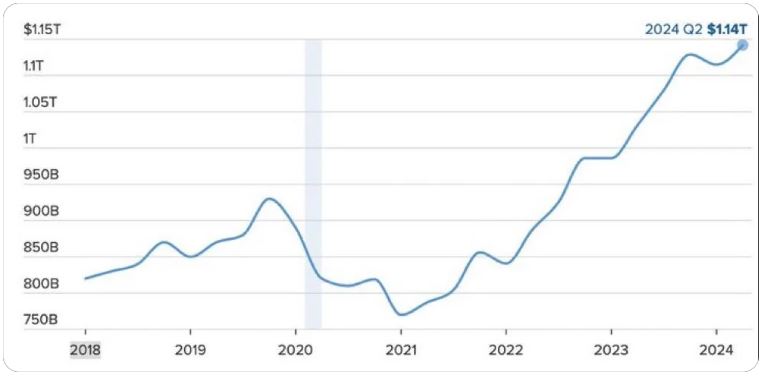

Furthermore, it’s important to consider the health of the American consumer right now. U.S. credit card debt has reached a record high of $1.14 trillion, with the average consumer holding $6,329 in high-interest debt balances:

These broader economic issues create an environment of uncertainty that fuels market volatility (Investopedia).

6. Federal Reserve Policy

The Federal Reserve’s monetary policy is another critical factor…

Traders are closely watching the Fed’s actions and statements for clues about future interest rate changes and monetary stimulus.

Recent comments from Fed officials suggesting potential rate cuts have added to the market’s uncertainty.

Lower interest rates generally support higher stock prices by reducing borrowing costs and encouraging investment. Conversely, hints of tightening monetary policy can lead to fears of reduced liquidity and higher costs, prompting a sell-off in stocks.

But I think we’re in a unique paradigm right now. The conventional wisdom won’t necessarily apply.

Everyone is already pricing in a rate cut. There’s no doubt that the Fed is going to cut rates sooner rather than later. So, it won’t be a surprise, which could mute its effect on stocks.

Even with the recent drop in the major indexes, an imminent (especially an “emergency”) rate cut could counterintuitively lead to further selling.

Why? Because it would suggest that the Fed is more concerned about the economy than it’s implying recently.

Don’t sleep on the Fed. Monetary policy can have a profound impact on the stock market.

These are the six stories dominating the financial news cycle right now.

Keep a close eye on their developments and trade accordingly.

Happy trading,

Jeff Zananiri

P.S. Wall Street is asleep at the wheel.

Their advanced algorithms and trading systems are making fatal mistakes EVERY SINGLE DAY, leading to outrageous mispricing…

If you can spot these glitches in real-time, you could enter these “artificially cheap” trades right after they crash — and before they skyrocket — for gains of 51%, 107%, and even 630% … in less than 24 hours.*

On Thursday, August 15th, at 8 PM Eastern, I’m sitting down with legendary millionaire, mentor, and trader Tim Sykes to reveal Wall Street’s dirty little secret — The 24-Hour Glitch.

So, if you want an inside look at the AI-powered system that’s turned Wall Street’s biggest weakness into my greatest strength…

Click here now to reserve your seat!

*Past performance does not indicate future results