Happy Tuesday, traders.

Jeff here.

This is a big week in the stock market — the first full trading week of March.

We’ve got lots of craziness and palpable mania in different pockets of the market.

There’s FOMO, there’s greed, and there’s chasing…

Semiconductor stocks, AI stocks, and crypto have been going to the moon.

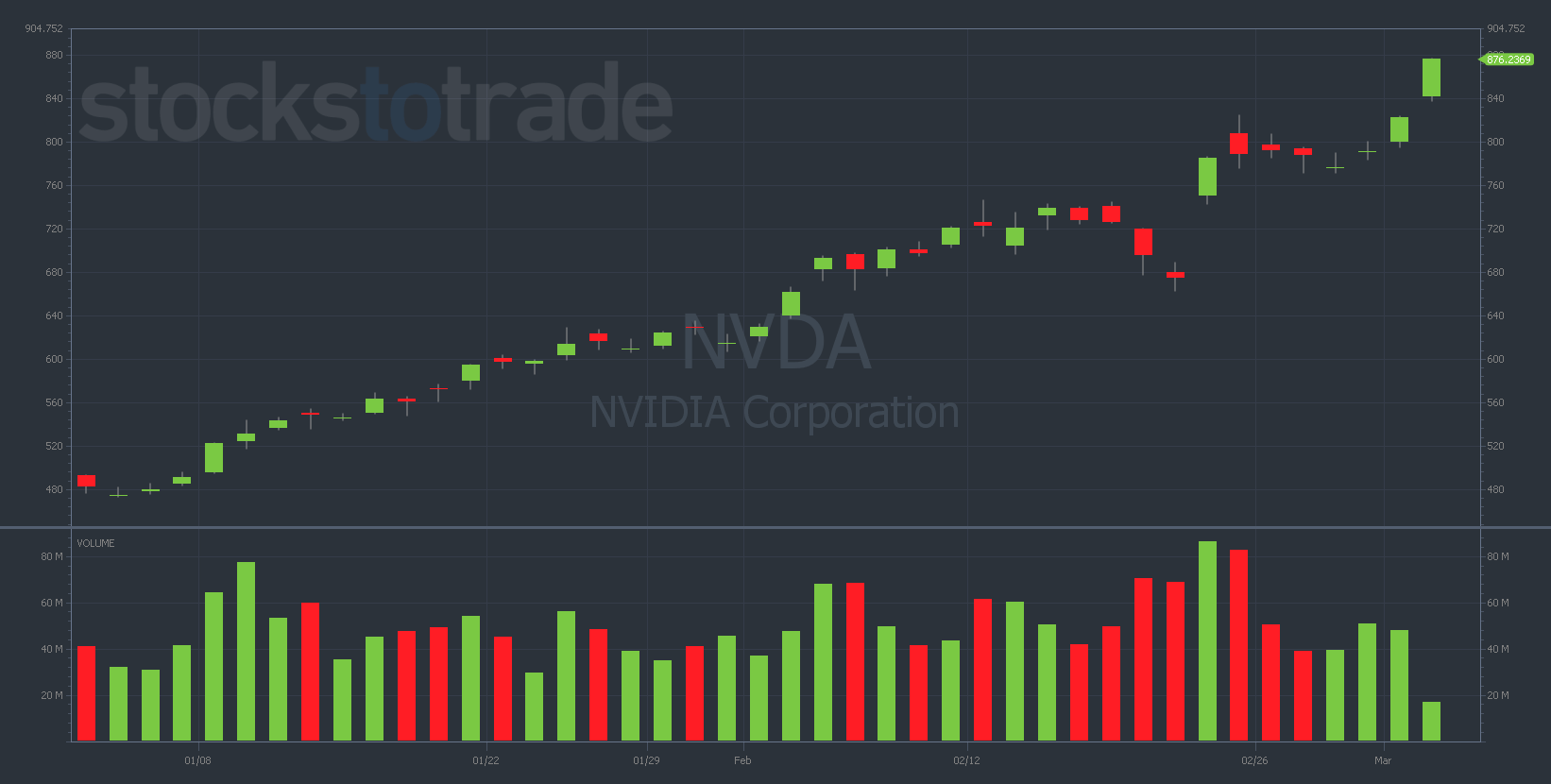

Of course, Nvidia Corporation (NASDAQ: NVDA) keeps crushing…

NVDA YTD daily chart — courtesy of StocksToTrade.com

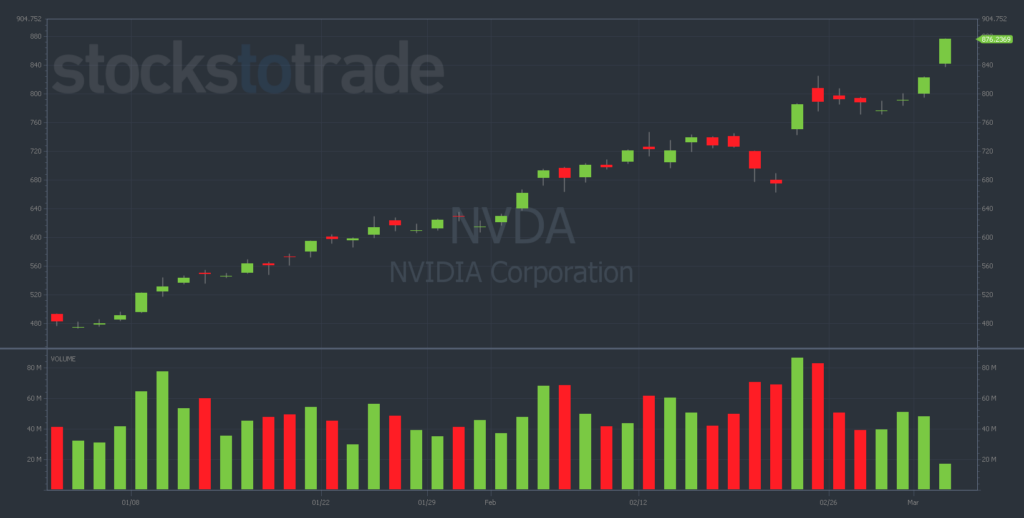

And with Bitcoin (BTC) edging closer to all-time highs, we’re seeing crypto stocks like MicroStrategy Inc. (NASDAQ: MSTR) make 25% moves…

MSTR 10-day 5-minute chart — courtesy of StocksToTrade.com

But what’s interesting is that these moves aren’t boosting the entire tape.

Yesterday, we had some selling in certain pockets of the NASDAQ, which is intriguing, to say the least…

This contained bearishness is creating opportunities in the short run called “dislocations” — immediate moves where a stock breaks the trend from its sector.

One example would be Apple Inc. (NASDAQ: AAPL) shedding 3% yesterday.

The former “could-do-no-wrong” tech darling is now being sold off while NVDA makes new highs daily.

A lot of less-experienced traders will look at this and think they should buy AAPL because it’s a laggard.

WARNING: No, that’s not what you should do.

To me, these dislocations are a clear sign that the market is not as healthy as people think.

When you start to see former darlings starting to lag, you’re very likely to see more selling in the near term…

Growth vs. Defense

Moving on from tech, there was one big move that surprised me yesterday

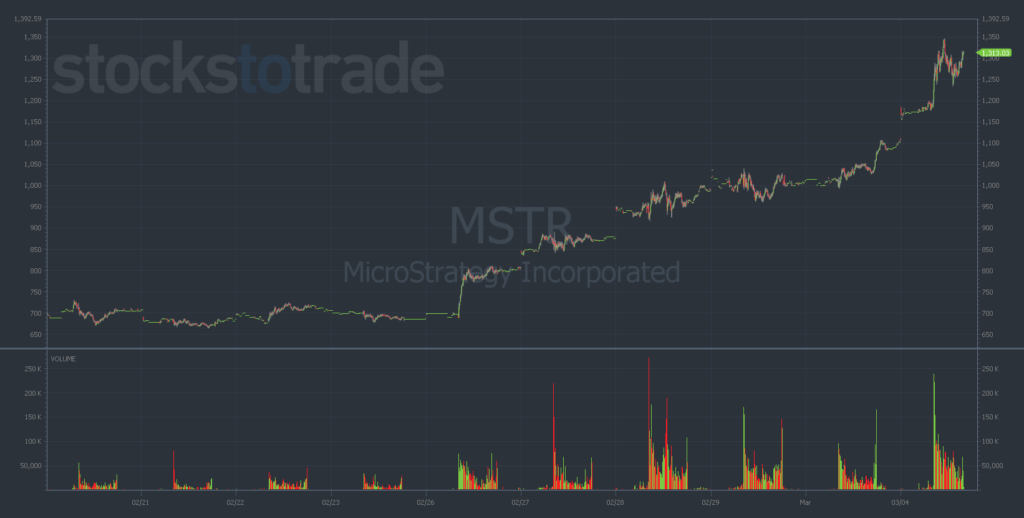

I’m talking about the counterintuitive 3.5%+ surge in the VanEck Gold Miners ETF (NYSEARCA: GDX).

GDX 10-day 5-minute chart — courtesy of StocksToTrade.com

The recent rally in tech stocks has been driven by FOMO, greed, speculative technology, and crypto.

These are growth sectors — the exact opposite of defensive stocks.

Considering this, you may be wondering why GDX — one of the most classic “defensive plays” in the market — gained so much yesterday…

Well, it makes perfect sense if you’re thinking about it from the viewpoint that crypto is seen as a store of wealth.

If crypto is a store of wealth and people are scared of FIAT currency, then gold looks more attractive as a hedge to FIAT currency.

So, I think this GDX run might have legs for the entire week. Keep a close eye on this one from the long side.

The February Jobs Report

Turning to the macro side of things, we have Federal Reserve Chairman Jerome Powell speaking to Congress on Wednesday and Thursday.

Then, on Friday, we’ll get a look at the February jobs report, which is gonna be extremely important for the near-term direction of the market.

When these big reports come out, Wall Street traders have a hidden weakness…

If you know what to look for, you can identify this fear cycle and devise a strategy to weaponize your trading for this exact situation.

Here’s what you need to know:

1. The actual jobs number doesn’t matter

I don’t care about the actual jobs number.

As shocking as this may sound, it’s the truth.

Anyone who tells you they know what the number will be is lying. I’m not in the business of predicting events out of my control.

Rather, I care about the fear cycle surrounding it…

2. Pay attention to ‘The Fear Gauge’

As anticipation for the release of the jobs report starts to grow, traders are on the edge of their seats.

The market’s anxiousness is measured by volatility, a.k.a. “The Fear Gauge”…

And that uncertainty is where your focus should be if you want to potentially profit off of this situation…

Watch for spikes and dips in the volatility index (VIX) for signals about where the market is headed this week.

But most importantly, don’t let FOMO get the best of you. Don’t chase this rally.

Chasing stocks like NVDA or MSTR makes no sense right now, especially in the options market.

A lot of these moves are already priced in with implied volatility (IV).

So, you have to let the overall exuberance settle down a little bit before picking your spots. You might even consider playing some puts because they’re so cheap right now.

But to chase the calls on the upside here is an exercise in futility.

Stay disciplined out there.

Happy trading,

Jeff Zananiri

P.S. You’ve gotta stay as market-neutral as possible amid this insane trading mania.

And in times of market uncertainty, there’s one move that works better than any other…

Click here to see the trading loophole that changed my life.