Good morning, traders…

Jeff here.

In trading and investing, you’ll hear people talk about “Black Swans” — a term coined by options trader and author Nassim Nicholas Taleb to describe unpredictable events that have a massive impact.

These events are rare, but when they happen, they’re often rationalized in hindsight as if they were expected.

And most importantly, they can have massively negative impacts on markets, economies, or even the entire world.

I hear people misuse this term a lot. Any time the market tanks, there’s some basement dweller on Reddit claiming it’s a Black Swan — when it usually isn’t.

But over the weekend, we got our first legitimate Black Swan event in recent memory.

The same way ChatGPT came out of the thin blue sky and rocked everybody’s world on November 30, 2022…

DeepSeek has come out of left field and is similarly rocking everybody’s world — this time, from China.

DeepSeek is a Chinese large language model (LLM) that appeared on the app store last week and completely blew people’s minds.

It’s arguably faster, better, and more insightful than ChatGPT…

But the craziest part is that they claim to have created the for just $6 million.

Compare that to the hundreds of billions (if not trillions) in CapEx spending on AI infrastructure from U.S. tech companies, and it looks like a huge leap forward in the affordability of building AI — and a huge headwind for the entire AI story.

Rarely in my 27-year trading career have I seen a narrative so thoroughly destroyed in a single weekend.

So, if you’re wondering what this means for your trading, let’s get to the special Black Swan Edition of my Tuesday Market Outlook…

The AI Bubble is Bursting

The entire AI ecosystem — which I’ve long said is a bit of a Ponzi scheme/bubble with Nvidia as the ringleader — is starting to unravel.

In May, I wrote this:

“The more I watch this market unfold, the more I believe that’s what this AI rally is: a moment, a flash, a bubble…

Not a sustainable long-term growth picture.

The thing that people don’t get about Nvidia is that these huge gains are unsustainable growth-wise and sales-wise.

Nvidia’s sales will likely collapse at some point as the AI gold rush reaches its saturation point.

Right now, it’s benefitting from every company on earth trying to strike gold with AI.

But once that rush reaches a zenith, Nvidia’s sales will probably crater very quickly.

Even if AI becomes the biggest thing ever — the most profitable sector over the next few decades — the vast majority of companies attempting to capitalize on it will fail miserably.”

I also warned you about the bearish “regime change” in the options market and, just last week, the frothiness of tech stocks.

Sure enough, my predictions are starting to come true…

Now that people see what DeepSeek accomplished with $6 million, institutional investors are scratching their heads about U.S. tech valuations.

This whole pricing model of GPUs, the insane costs to run AI, and the arms race that created massive FOMO have led to some incredibly inflated P/E ratios.

At the very least, the pricing model for semiconductors isn’t sustainable.

Plus, you can bet your bottom dollar that some nerd in Menlo Park is already working on a cheaper alternative using normal computing power to compete with DeepSeek.

I think we’ll see a Silicon Valley version of DeepSeek sooner than you might expect.

And speaking of Silicon Valley, this whole event reminds me of a similar bubble pop from recent history…

Dot-Com Deja Vu

I’ve said it before and I’ll say it again…

All of this AI hype feels just like the ‘dot-com’ craze of the late 90s.

If Nvidia is the poster child for the 2024 AI bubble, its dot-com counterpart was Cisco Systems Inc. (NASDAQ: CSCO).

At the beginning of 1998, CSCO was a $10 stock.

Just two years later, by April 2001, it traded for $82 — an all-time high that still holds today, 23 years later.

CSCO gained 680% in 2.3 years.

Sound familiar? It should…

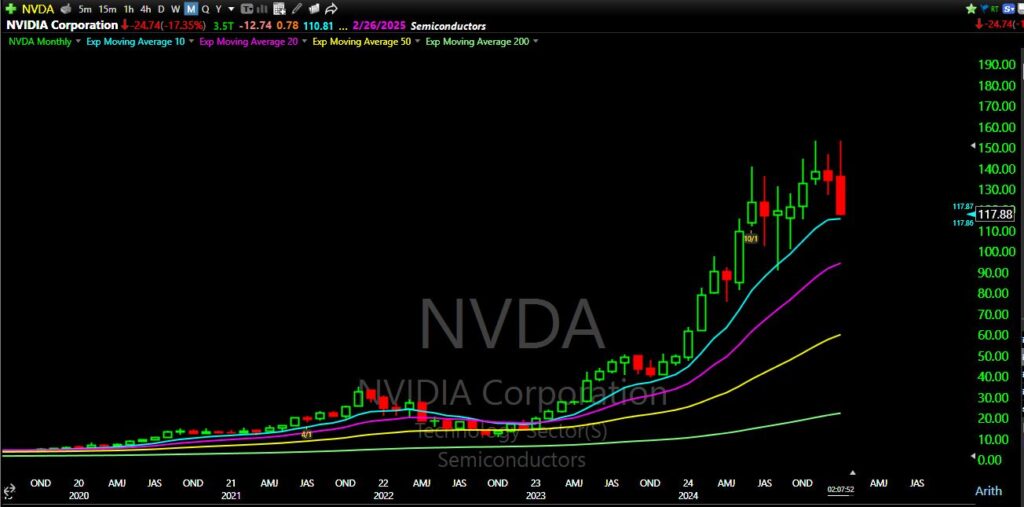

From January 2023 to last week, Nvidia gained 946% in 2.1 years.

Look at these monthly charts side-by-side and tell me they don’t look strikingly similar…

And it’s not just the charts that are similar…

Cisco was running the same kind of business that Nvidia is. Instead of GPUs, it was servers.

Every company that wanted to get in on the early internet was buying servers hand-over-fist from Cisco.

But eventually, when those companies ran out of money, Cisco’s sales plummeted (practically overnight)…

Then look what happened:

Cisco stock dropped over 90% in 2000 as traders rushed to dump the once-beloved darling of the dot-com bubble.

Like desperate patrons trying to flee a burning theater through a single exit door, they couldn’t sell fast enough.

Cisco investors who bought in 2000 with the thesis that the world would be increasingly online were correct.

But they also got terrible entry prices.

And look at what is happening to the NVDA chart now…

Just something I want you to be aware of as this story unfolds…

What This Means for Your Trading

There’s a lot of uncertainty and unknowns that weren’t in the market last week.

I don’t claim to be a tech expert…

But I do know a bubble when I see one. And this bubble is starting to pop.

It’s never good to be an early bull during a bubble pop. Be patient and let it settle.

Once the initial capitulation selling dies down, there will be opportunities to pick up calls and buy dips.

But if you do…

- Stick with the indexes, don’t try to be a hero on individual names.

- Look at sectors that are out of the line of fire (non-semiconductor stocks).

- Focus on relative strength: Which stocks were green (or much less red) on Monday? Those are the ones to watch.

And always, always, always enter near the close on big, heavy-volume selling days. This is the entire crux of my Burn Notice strategy.

If you enter too early on the long side in the middle of the day, there’s a lot more downside risk.

But toward the end of the day, the capitulation often flames out, giving you the best window to enter.

WARNING: If this sell-off capitulates and starts to get really ugly, you won’t be able to hide in non-tech stocks like Dow and Russell 2000 names, they’ll just get hit harder later. Be patient.

A Wild Week Ahead

To add more fuel to this volatility, the Fed is announcing its next interest rate policy decision tomorrow.

Expectations are for rates to stay unchanged, but Powell’s tone and commentary can shake markets further.

Then, big tech earnings hit later this week … we’ve got Tesla, Microsoft, and Google.

Keep some dry powder for those and be careful out there.

Good luck,

Jeff Zananiri

P.S. While most traders are scrambling to position themselves in this volatility, I’ve had a 7-win streak with my Burn Notice trades…*

If you want to start getting in on these setups before they take off, there’s only one place to start…

TODAY, January 29 at 10:00 a.m. EST, I’m hosting a LIVE WORKSHOP to reveal my top Burn Notices for this week.

Stop guessing, start burning — Click here to reserve your seat!

*Past performance does not indicate future results