Happy Tuesday, traders…

Jeff here.

Last week we saw something rather unusual in the markets, at least for 2024…

On Thursday, the SPDR S&P 500 ETF Trust (NYSEARCA: SPY) dropped 2%+ intraday for the first time in over a year.

This was followed by a major rally on Friday that saw the index gain 1% before cooling off towards the afternoon.

So, what does this price action tell us? We’re entering a new phase of volatility…

A lot has changed in American politics in the last week, which naturally brings more uncertainty into the tape.

Not to mention we have massive earnings reports due this week from tech giants like Microsoft Corp. (NASDAQ: MSFT) and Amazon.com, Inc. (NASDAQ: AMZN).

Roughly 30% of the NASDAQ is reporting over the next few days. How these companies perform will have wide-ranging implications on the entire stock market.

And speaking of the NASDAQ … Ben, Ethan, Danny, Bryce and I recently had the pleasure of being invited to tour the floor, as well as the New York Stock Exchange…

In today’s Tuesday Market Outlook, I’ll share a few interesting things I noticed on Wall Street last week, and then break down how I’m approaching this new volatility regime…

The Prodigal Son Returns … To Wall Street

I started trading on Wall Street in 1998. And last Friday, I returned to my old stomping grounds…

The atmosphere was intense on the floors of the NASDAQ and the New York Stock Exchange.

When I arrived at the NASDAQ on Friday morning, the screens were deep red. However, by the time I left, the market had turned green.

Some saw this as a positive indicator. But to me, it was just a typical sign of this new volatility regime.

Later in the day, around 2:30 PM, I walked into the NYSE, where the market had been solidly green throughout the morning. Yet, by mid-afternoon, it started dipping into the red.

Notice the trend? A lot of red-to-green, green-to-red moves were happening (i.e. volatility).

Faces on the floor showed concern, confusion, and fear. There weren’t many people around, but those who were present definitely lacked the usual calm and confidence.

This is why I was invited to appear on the Schwab Network…

Active traders, like you and me, have a different perspective than the institutional dinosaurs on the floor.

Make no mistake — in volatile times such as these, we actually have an edge over Wall Street.

By understanding the unique requirements that Wall Street institutions must trade within, we can exploit this knowledge to our advantage…

And one of the best ways to do that is through The Money Link…

My Brand-New “Money Link” Trade

There’s a good reason why it’s been classified by the SEC as Wall Street’s #1 trading strategy across all markets.

Here’s how The Money Link works…

Choose two stocks that historically move in relationship to one another. They could generally trade inversely to each other, or maybe they follow each other.

These pairs are often in the same industry or sector, as they are likely to be influenced by similar economic factors.

The stocks should have a high correlation, meaning they exist in similar sectors/industries and/or move in tandem under similar market conditions.

This is why The Money Link is so crucial right now…

As I’ve mentioned recently, I believe the market is currently rebalancing to prepare for a Donald Trump win in November.

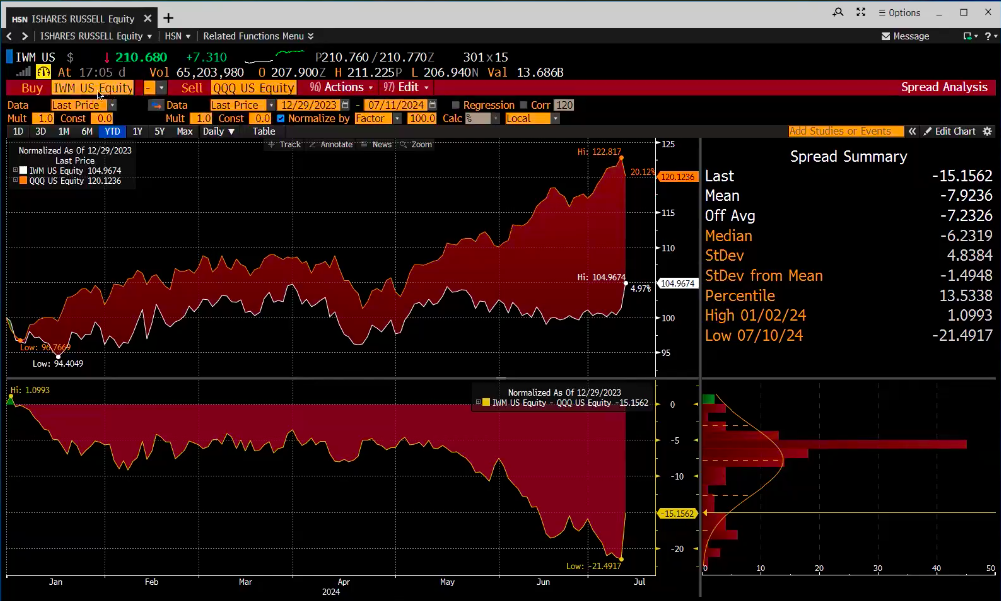

This has been evidenced by a recent rotation out of tech and into small caps, which tracks with a potential Trump victory…

Trump has said he will put tariffs on China, which could create serious headwinds for the Invesco QQQ Trust (NASDAQ: QQQ).

Simultaneously, Trump is all about bolstering Main Street U.S.A., which could create tailwinds for smaller companies in the iShares Russell 2000 ETF (NYSEARCA: IWM).

With that in mind, I recently entered a brand-new Money Link trade — long IWM, short QQQ.

When volatility spikes, it’s often best to trade indexes, and I think the spread between these two could widen considerably over the next four months.

Adjusting to Volatility

My advice in such volatile times is to avoid getting overly aggressive with buying discounted stocks.

Don’t try to be a hero or catch a falling knife.

Shrink the game. Focus on short-term trades, keep your positions smaller, and trade around earnings announcements.

This strategy helps keep your portfolio dynamic and responsive to market changes.

Avoid letting your positions become stale — keep them fresh by constantly turning over your books.

Make smaller bets on single stocks, particularly around earnings.

Happy trading,

Jeff Zananiri

P.S. Want access to an earnings loophole, unlike anything you’ve ever seen before? Click here to see what I’m talking about!