Good morning, traders…

Ben here.

You’ve probably heard the saying, “A rising tide lifts all boats.” But you might not realize that it fits the market perfectly…

When the overall market is trending higher, it creates tailwinds that help individual stocks rise right along with it.

But the opposite is also true — when the market pulls back, even the strongest names can struggle to push higher.

Stocks don’t exist in a vacuum, they’re influenced by broader market trends. Trying to trade against those trends is like running a treadmill at the highest setting: possible, sure, but exhausting and unnecessary.

That’s why trading with the trend is so important. When you align your trades with the overall direction, you’re not just relying on the strength of a single stock — you’re leveraging the market’s momentum to make your job easier.

The trend is your friend.

Today, I’ll show you how to spot those trends, use options to capitalize on them, and run a quick “friendship test” to make sure the trend is real…

Spotting the Trend

There are two main types of trends…

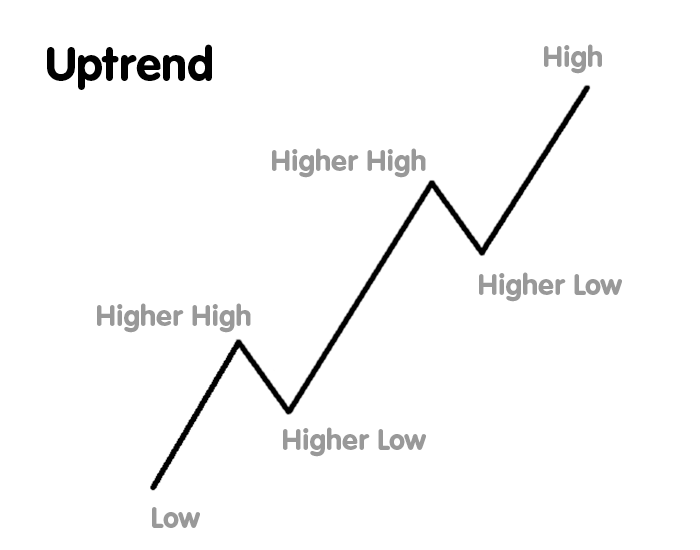

Uptrends:

- A stock’s price consistently moves higher over time.

- Marked by a pattern of higher highs (each peak is above the last) and higher lows (each pullback doesn’t drop as far as the previous one).

- Indicates strong buying momentum, often supported by increasing volume during price advances.

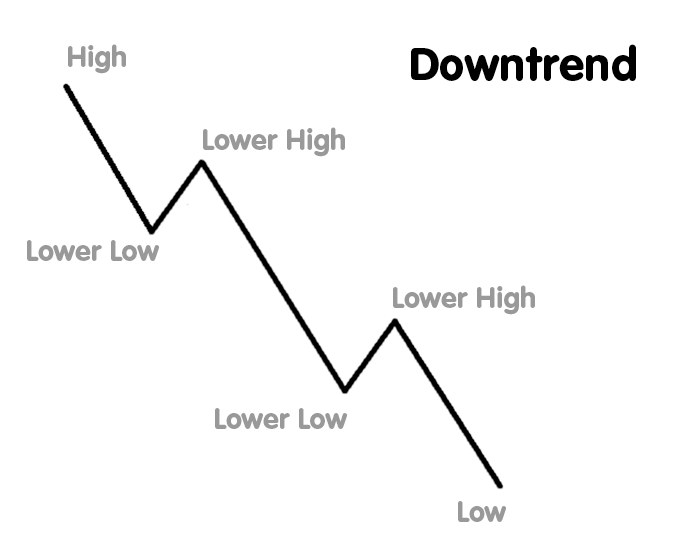

Downtrends:

- A stock’s price consistently declines over time.

2. Marked by a pattern of lower highs (each peak is below the last) and lower lows (each drop breaks past the previous one).

3. Reflects sustained selling pressure, which can intensify if critical support levels are broken.

But simply looking at a chart and seeing the direction isn’t enough.

You need confirmation…

Confirming the Trend

- Moving Averages: These are like roadmaps for a stock’s direction. The 50-day and 200-day moving averages are some of the most popular ones traders use. If the price is consistently above these levels, it’s likely in an uptrend. If it’s below, you’re probably looking at a downtrend. The space between short-term and long-term moving averages can also reveal how strong the trend is. For instance, when the 50-day average is pulling away from the 200-day average, it often signals solid momentum. (And don’t sleep on my favorite: the 21-day moving average.)

- Higher Highs and Higher Lows: Trends don’t form in a straight line. Instead, they move in waves. In an uptrend, you’ll notice that each pullback stops at a higher price than the last one, and every rally pushes to a new high. Downtrends show the opposite: lower highs and lower lows. Drawing a simple trendline on a chart can help you visualize this pattern and confirm if the trend is holding steady.

- Volume Confirmation: Think of volume as the backbone of a trend. When a stock moves with significantly higher trading volume than usual, it’s a sign the trend has solid backing from the market. On the flip side, weak volume on a price move might mean it’s more of a flash-in-the-pan fakeout than a consistent, reliable trend.

When you combine these trading tools, you don’t just rely on what the individual price is doing — you get a sense of whether the market is truly behind the move.

Using Options to Trade Trends

Once you’ve spotted a trend, options allow you to trade it with flexibility and leverage:

- Call Options in Uptrends: When a stock is climbing and showing strength, calls can give you a way to profit without needing to buy the stock outright. Let’s say you find a stock breaking above a key resistance level with strong volume — that’s a sign the uptrend might be gaining steam. By buying a call, you can benefit from the stock’s rise without committing the full amount of capital you’d need to buy shares.

- Put Options in Downtrends: Trends work both ways, and downtrends can offer some of the fastest profits in trading. When a stock consistently breaks support levels and makes lower lows, it’s often a sign the sellers are in control. Buying puts allows you to take advantage of this momentum while keeping your risk defined. I tend to focus on trading calls in uptrends, but that doesn’t mean puts won’t work for you. Being able to play both sides of a chart is a huge advantage.

- Bullish or Bearish Spreads: If you prefer to manage your risks a bit more tightly, spreads can be a great option (excuse the pun). In an uptrend, a bull call spread lets you cap your risk while still participating in the move. In a downtrend, a bear put spread works similarly. And in specific earnings scenarios, iron condors can work beautifully. These strategies can be especially useful when you’re confident about the trend (but want to limit exposure to sudden reversals).

WARNING: Don’t buy puts into uptrends, and don’t buy calls in a downtrend.

The “Friendship Test”

You can’t trade every chart that looks promising. Certain “trends” can be deceptive, weak, and short-lived.

That’s why it pays to give every trend a quick “friendship test” before entering:

- Is the move strong enough? Look for decisive breakouts or pullbacks near key levels of support or resistance. A stock that inches above resistance only to stall out might not have enough momentum to sustain an uptrend. On the other hand, a breakout accompanied by a big volume spike is a sign the trend has real legs.

- Are there obstacles in the way? Even a strong trend can run into trouble if there’s a big resistance level nearby. For example, if a stock is trending up but approaching its 52-week high or a key psychological level like $100, the move might hit a wall before it continues. Be cautious about jumping into trades where the trend has limited room to run. Wait for the level to break, then enter.

- Does it fit the bigger picture? Take a step back and look at the broader market. Is the overall index trending in the same direction? Are other stocks in the same sector showing similar patterns? Trends that align with these larger forces tend to have more staying power.

When you combine these checks with the tools for spotting trends, you set yourself up to trade with confidence.

You don’t have to be the first to spot a move or guess when it will reverse. You simply need to be patient, let the market show its hand, and take advantage of opportunities when they align with the broader momentum.

Next time you open a chart, ask yourself: “Where’s the trend?”

If you can answer that clearly and follow it, the market will do the heavy lifting — and that’s a priceless advantage in the options market.

And speaking of priceless advantages…

Before we go, let’s look at:

💰The Biggest Smart-Money Bets of the Day💰

- $2.8 million bullish bet on X 12/20/2024 $45 calls @ $2.80 avg. (seen on 11/20)

- $2 million bullish bet on PLTR 02/21/2025 $70 calls @ $5.25 avg. (seen on 11/20)

- $1.6 million bullish bet on WFC 01/17/2025 $75 calls @ $2.86 avg. (seen on 11/20)

Happy trading,

Ben Sturgill

P.S. Don’t miss Jeff Zananiri’s Burn Notice Workshop — TODAY, November 21 at 12:00 p.m. EST.

Click here to reserve your seat!

*Past performance does not indicate future results