Happy Tuesday, traders…

Jeff here.

Last week, we got a big post-election curveball in the markets…

Crypto miners, which had been on a tear, suddenly got hit with a wave of profit-taking.

Small caps, the stars of recent weeks, started to fade after outperforming everything else.

And tech, after surging for several days after the election, suddenly took a big hit on Friday.

There are a lot of confounding moves happening right now. This is the kind of market that throws conflicting indicators in every direction.

But you must figure out how to sort the signal from the noise…

Instead of getting caught in the weeds of tiny individual moves, focus on the big money flows. Listen to what the inside of the market is telling you.

Those initial moves in small caps? They’re not over. I think the recent pullback is just a fake-out (but more on that later)…

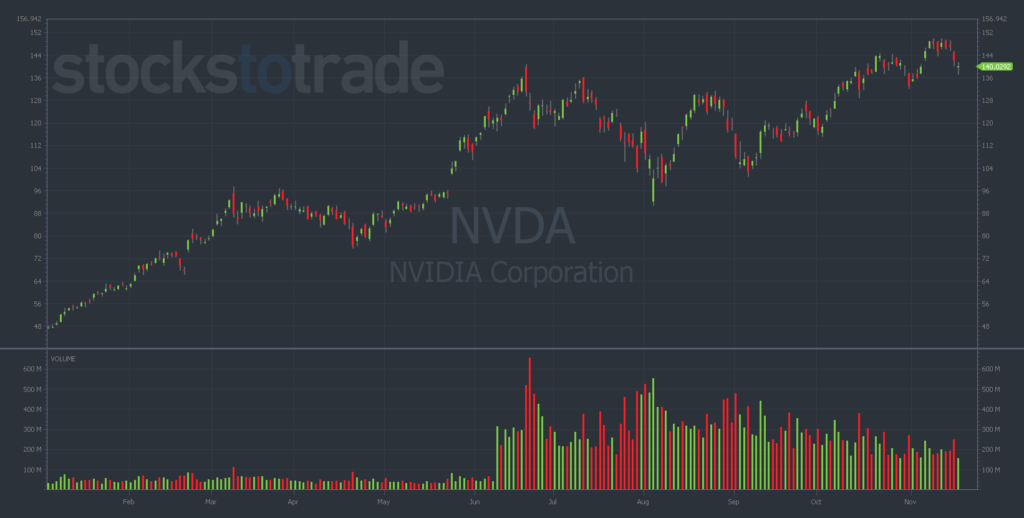

The wildcard this week is Nvidia Corporation (NASDAQ: NVDA). With earnings on Wednesday, it’s setting up to either confirm the tech rally — or put a serious dent in it.

Moreover, another major semiconductor name is about to get de-listed, adding to a long list of headwinds for tech stocks.

Saying there’s plenty to unpack would be an understatement, so let’s get to my Tuesday Market Outlook for this week…

Small Caps: My Favorite Setup for 2025

Last week’s pullback in the iShares Russell 2000 ETF (NYSEARCA: IWM) doesn’t mean the run is over — it’s just taking a breather.

Capital doesn’t flow in a straight line, but when it starts piling into one area, it usually keeps going.

Considering how much IWM has lagged behind the other major indexes, I think there’s plenty of room for small caps to continue catching up.

Additionally, President-Elect Trump has promised to cut taxes for small businesses…

And then there’s the tariff angle. If Trump does put wide-ranging tariffs on foreign goods, the small caps could benefit most.

Why? Unlike big multinational corporations, many small-cap businesses manufacture their products onshore. Tariffs would make imported goods more expensive, giving these companies a built-in pricing advantage.

Meanwhile, the NASDAQ looks tired. Big tech has carried the market on its back for over two years now, and leadership doesn’t stay in one place forever.

With small caps still drawing inflows and policy potentially tilting in their favor, they’ve got a real shot at outperforming tech in 2025 and beyond.

How to Trade Nvidia Earnings

Earnings season always brings fireworks, and NVIDIA’s report on Wednesday is the most important print of the season.

With so much attention on this stock, the stakes couldn’t be higher…

This company has posted seven straight quarters of triple-digit earnings growth. Unsurprisingly, expectations are through-the-roof for this report.

That’s a dangerous setup because it leaves no margin for error. If NVIDIA misses — or even just delivers “good but not great” guidance — we could see a significant pullback.

That’s why I’m cautious here. Instead of playing NVIDIA outright, I like hedging exposure with other semiconductor stocks. This way, you’re not tied to just one name in an industry that’s been red-hot all year.

Meanwhile, Thanksgiving week has historically given the market a boost, particularly in years where stocks have been trending higher.

That leans bullish for the broader market, even if individual names like NVIDIA falter.

And speaking of tech names that are faltering…

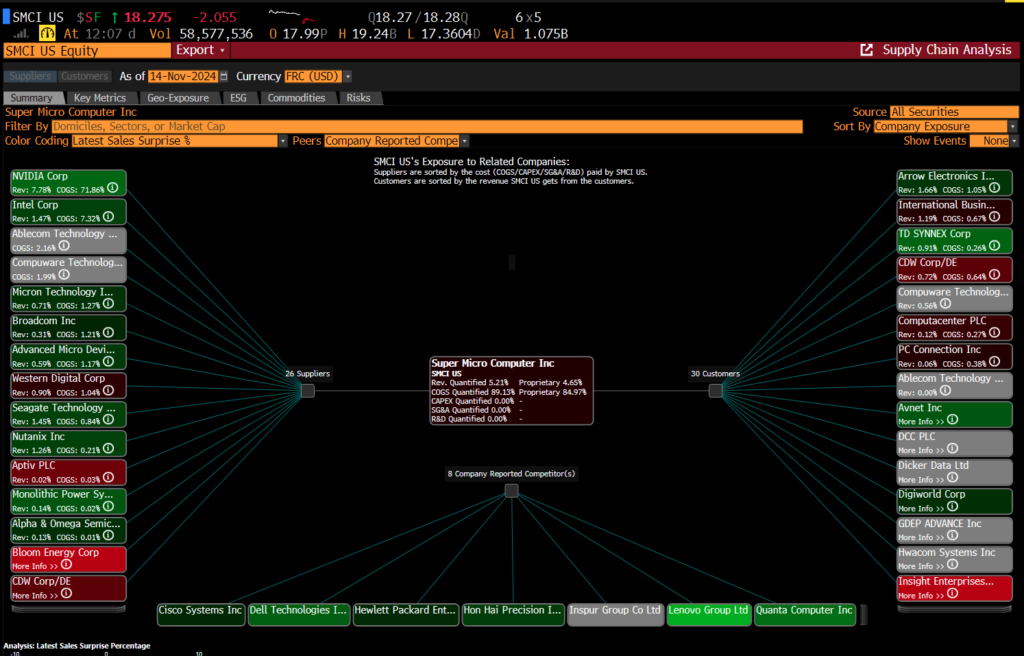

SMCI: A Semiconductor Crisis in the Making

If you’re not watching Super Micro Computer Inc. (NASDAQ: SMCI) … it’s time to start now.

This company is unraveling in real-time, telling us a crucial story about the under-the-hood health of the semiconductor space…

After losing 80% of its value ($55 billion in market cap) in eight months — not a typo — SMCI has stopped reporting earnings entirely, and is now set to get delisted from the NASDAQ.

If we were talking about a penny stock, this wouldn’t be notable. But we’re not talking about some random penny stock…

SMCI is a major player in semiconductors, with deep ties across the sector:

That’s what makes this story so alarming. Nearly every big name in the chip business does business with SMCI.

At the very least, it’s a concern for companies like NVIDIA. At worst, it could be the first sign of something much larger lurking in the sector.

For me, this is another reason to be cautious about semiconductors. Even without SMCI’s implosion, valuations in this space have been stretched thin.

Add this disaster into the equation, and the sector looks vulnerable heading into next year…

My broader outlook? Bearish on semis for 2024, with the QQQ likely to underperform the IWM. This SMCI situation could be the first domino to fall.

My #1 Strategy to Crush This Market

With overall volatility at elevated levels, you need a strategy that keeps you ahead of the market’s moves.

That’s where my overnight setup — the Burn Notice — comes in.

If I had to start my entire trading journey again with a small account, I would exclusively trade this strategy.

Don’t believe me? Take a look at my October track record for my Burn Notice trades:

78% on DELL*

33% on DAL*

84% on DAL*

7% on DUK*

-12% on UBER*

25% on CCL*

11% on NRG*

27% on NRG*

89% on ARM*

7% on FSLR*

35% on UHS*

-4.7% on HMY*

76% on FSLR*

85% on MSFT*

-3.5% on MMM*

19% on TMUS*

6% on AU*

52% on ARM*

84% on AFRM*

19 trades. 16 wins with just 3 losses. All of these moves happened in 24 hours or less.*

If you want to start positioning yourself for wins like this, here’s how this strategy works:

- Identify setups likely to gap overnight…

- Position before the close…

- Exit before the market gives the move back…

This week, NVDA’s earnings report is setting up some great Burn Notice opportunities — not in NVDA options themselves — but in related “earnings sympathy plays.”

I’ll break down my Nvidia earnings strategy step-by-step, including exactly what contracts I’m trading…

TODAY, November 19 at 12:00 p.m. EST during my LIVE BURN NOTICE WORKSHOP — Click here to reserve your seat!

See you there,

Jeff Zananiri

P.S. The election just triggered the most epic 90-day trading window of the decade…

By identifying 1,500 stocks over the last 20 years that delivered average gains of 3,700% within 90 days of election day* — our $3 million AI has already selected its “Top 5 Plays”…

Get all the details from Tim Bohen on Wednesday, November 20th at 8 p.m. EST — Save your seat now!

*Past performance does not indicate future results