Good morning, traders…

Ben here.

If you have Super Micro Computer Inc. (NASDAQ: SMCI) on your watchlist, you’ve probably noticed the stock has been on a parabolic run over the past few weeks.

After crashing more than 60% in early November due to delisting fears, the stock has surged 110% in just 15 days.

Sounds like a garden variety short squeeze, right?

Well, not quite…

Traditional short squeezing is only half the story. Many don’t realize that option contracts play a vital role in this specific kind of squeeze mechanic.

It’s much more extreme and rare than a normal short squeeze — it’s a gamma squeeze, a short squeeze on steroids.

In a gamma squeeze, bulls target short-dated, low-delta option contracts and buy them up furiously — sending implied volatility (IV) and gamma to astronomical highs. The squeeze rallies the price of the targeted contract (and all of its surrounding strikes).

And because options contracts provide leverage to traders, gamma squeezes can spark a much larger price increase than a normal common-share short squeeze.

Today, I’ll show you:

- How options can move the entire market via gamma squeezes

- Why these moves are happening now

- And how you can potentially identify gamma squeezes early in their cycles

With that in mind, let’s break down the biggest squeeze of the year (so far)…

The SMCI Downturn

SMCI is a company that specializes in high-performance computing, AI infrastructure, and enterprise server solutions…

It designs and manufactures a wide range of servers, storage systems, and networking hardware, catering to industries that require powerful computing, like cloud computing, artificial intelligence (AI), machine learning, data centers, and enterprise IT.

In the first three months of 2024, SMCI was one of the biggest darlings of the “AI trade.” The stock went from $28 on January 1 to $122 by March 8 — a 330%+ move.

But that was the top. The chart entered a downtrend for the second half of 2024, shedding a whopping 85% over the next nine months.

This downside momentum culminated during the first two weeks of November 2024, SMCI shares collapsed by more than half after the company announced it was at risk of being delisted from the Nasdaq.

The stock plummeted as investors reacted to the news that SMCI had delayed filing its annual report, putting it in non-compliance with listing rules.

The situation worsened when its auditor, Ernst & Young, resigned, citing concerns about internal controls and accounting practices.

The stock, which remember, had been trading above $120 in March, dropped below $18 by mid-November:

At this point, most traders had written this company off.

But little did they know, it was about to come roaring back — with a vengeance…

The SMCI Comeback

After weeks of uncertainty, SMCI released a statement saying it expected to file the delayed reports by February 25, 2025, in an effort to regain compliance and avoid delisting.

The company also projected a staggering $40 billion in revenue for fiscal 2026, a number that caught the market off guard.

The market responded enthusiastically as traders piled into short-dated call options, fueling a gamma squeeze.

The influx of call buying forced market makers to hedge by purchasing shares, creating a feedback loop that drove the stock price higher. In just over two weeks, SMCI has rocketed back up, gaining 110% from its lows:

Meanwhile, the Feb 21 $54 and $55 calls have surged over 1000% in the same period…

…and the Smart Money is still hammering away…

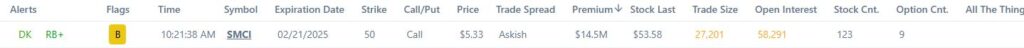

Just this morning, the SPYDER Scanner caught a staggering $14.5 million bet on the Feb 21 $50 calls:

Parallels to GME and AMC

This type of move isn’t new. In early 2021, GameStop Corp. (NYSE: GME) and AMC Entertainment Holdings Inc. (NYSE: AMC) saw similar price action in a historic moment for “meme stocks.”

They even made a Hollywood movie about it called “Dumb Money.”

Heavy call option buying triggered gamma squeezes, forcing market makers to buy more shares, which sent prices soaring.

GME ran from $20 to nearly $500, and AMC spiked from $2 to over $70.

Sound familiar? It should. Because the mechanics behind SMCI’s current move are exactly the same as those legendary squeezes.

But why are these crazy moves happening right now, when historically, they’re extremely rare?

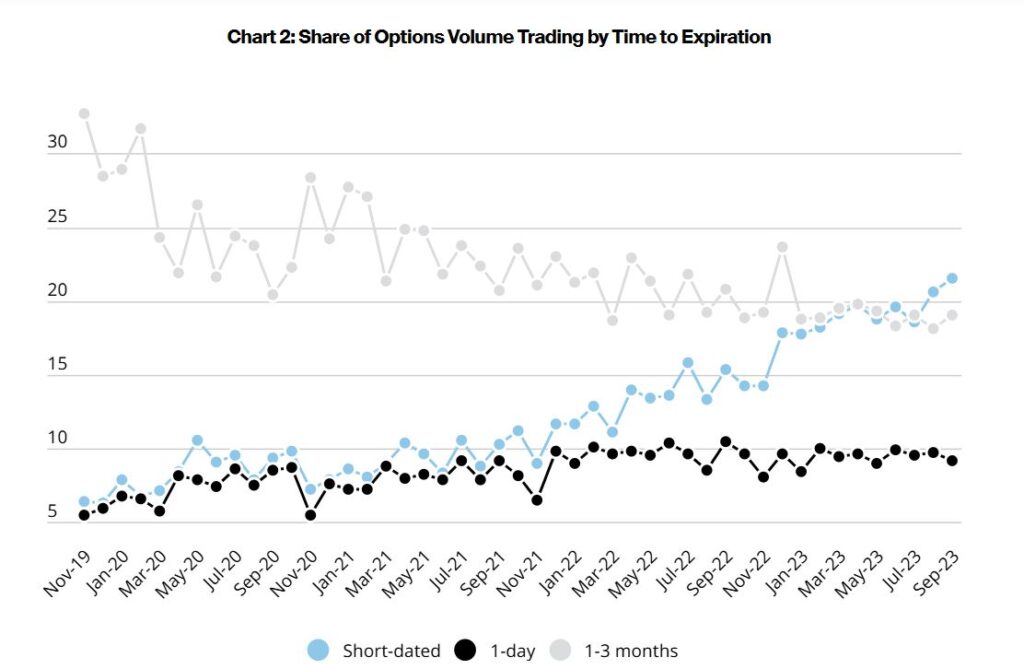

A big part of this comes down to the surge in short-dated options trading volume, which has nearly more than quadrupled since 2020:

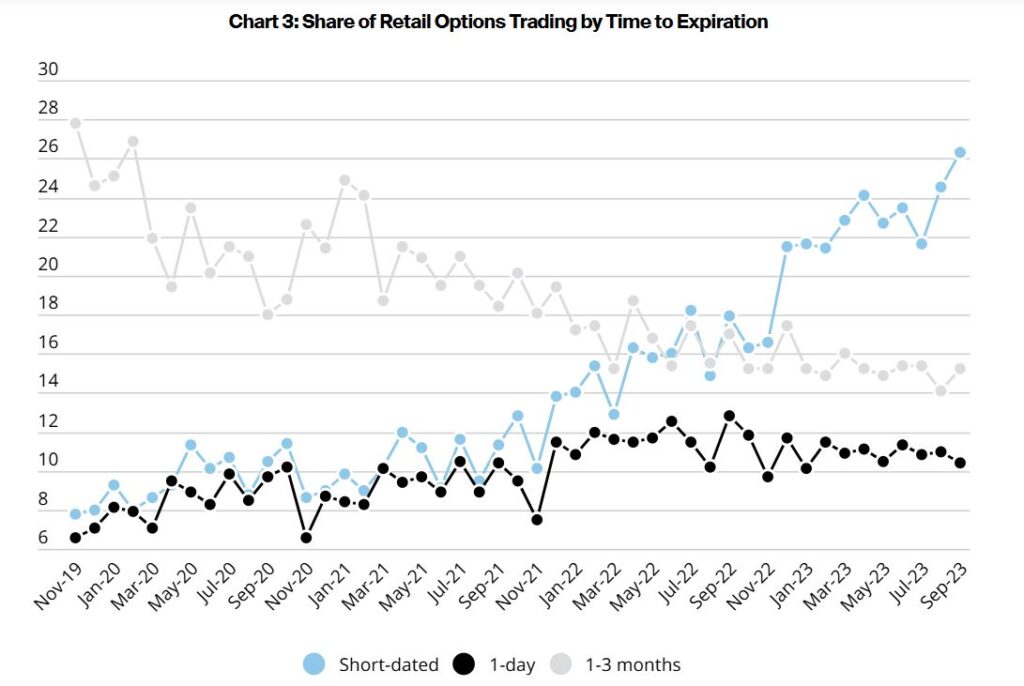

Furthermore, the vast majority of these short-dated options are being purchased by retail traders, not the Smart Money:

That doesn’t mean Smart Money traders won’t get in on these squeezes (as evidenced by the multi-million-dollar sweep mentioned earlier), but the momentum is driven by retail.

It’s important to remember how these squeezes end. It’s always the same — a blow-off top leads to a huge 50%-70% dump.

Where’s the top of these moves? No one knows. But trying to enter in the middle of a gamma squeeze is a recipe for disaster.

If you aren’t in these moves during the first three to five days, it’s extremely dangerous to try and chase the squeeze.

But if you really want to get in on one of these gamma squeezes after it’s already taken off — please, wait for a pullback to a key support level before entering.

3 Crucial Points About Gamma Squeezes

- Gamma squeezes create explosive short-term moves, but they don’t last forever. When the demand for call options fades, the buying pressure disappears, and stocks can drop just as fast as they climbed.

- Short-term options can be a double-edged sword. Early traders who are positioned correctly can make massive gains, but those who chase too late often end up with worthless contracts (and big losses).

- Market mechanics, not fundamentals, often drive these kinds of moves. These surges aren’t about valuation or business strength. They’re about the way options and market makers interact under extreme conditions.

- Sentiment can shift on a dime. In the span of two weeks, this stock went from “no one wants to buy it” to one of the most in-demand names in the tech sector. This is a lesson about trend reversals — you must always be ready for sentiment in a name to shift on a dime.

SMCI’s run has been fueled by speculation and options activity, not fundamental strength.

The company’s future remains uncertain, and if options volume slows down, the stock could see sharp pullbacks.

Gamma-squeezed names don’t follow normal trends. The moves are fast, and the reversals are even more violent.

To be clear: I’m not writing about this gamma squeeze as a suggestion to enter. It’s too overextended here.

But I hope this showed you how paying close attention to options volume and open interest might tip you off to some crazy trades in the future.

Before we go, let’s look at:

💰The Biggest Smart Money Bets of the Day💰

- $3.2 million bullish bet on DLTR 05/16/2025 $95 calls @ $2.25 avg. (seen on 2/18)

- $2.3 million bullish bet on AMD 02/28/2025 $111 calls @ $4.90 avg. (seen on 2/18)

- $2 million bullish bet on C 03/07/2025 $81 calls @ $4.05 avg. (seen on 2/18)

Happy trading,

Ben Sturgill

P.S. You don’t have to trade alone. Let’s figure out what the Smart Money is betting on together.

TODAY, February 19 at 4:00 p.m. EST, I’m hosting a LIVE WORKSHOP to break down the biggest institutional bets of the week.

Stop trading blindly — Click here to reserve yours now!

*Past performance does not indicate future results